Bulk Shipments

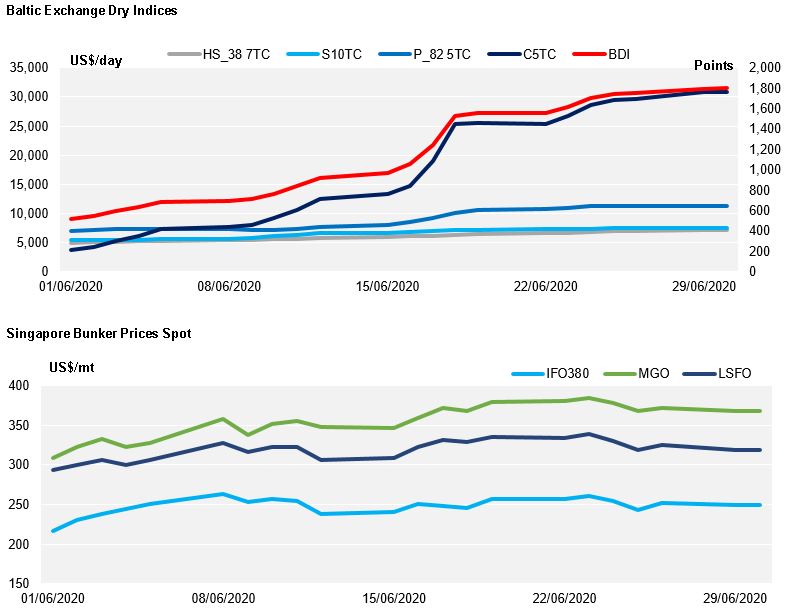

The BDI made some tremendous gains in the last month, capturing further the momentum which had surfaced in the Capesize market at the end of May. Settling at 1,799pts on the 30th June, the BDI recorded a +350% increase in value over the last 30 days. This dramatic return to form for the dry bulk sector has in the main been driven by very strong demand for Capesize vessels shipping ore cargoes to China, witness the 900% gain in value of the Cape 5TC index price over the last month.

An improving demand situation helped boost values in the smaller sizes as well. Whilst not to the same meteoric extent as the Capes, time charter averages in the Panamax sector posted a very decent 67% gain in the last month, with the Supramax 10TC and Handysize 7TC bringing up the rear with respective increases of 36% and 48% in the same period. In the near term, sentiment is likely to remain positive in both the Atlantic and Pacific, aided along by a tightening supply of vessels in some areas due to worsening port congestion.

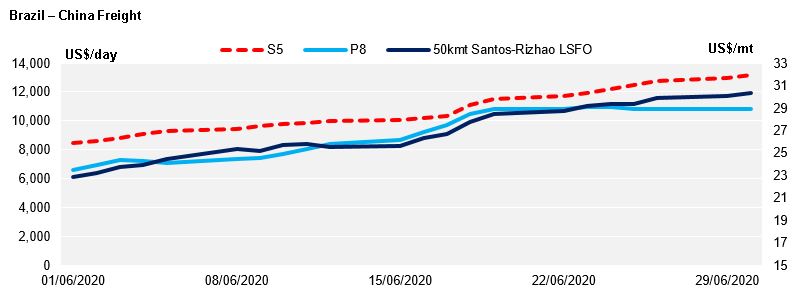

Our 50kmt Santos-Rizhao route assessment is now back above $30pmt on account of the improved S5 index price as well as higher Singapore bunker fuel prices.

Containerised Shipments

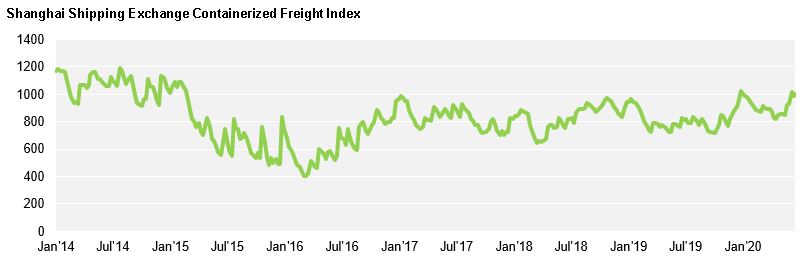

The impacts of the three Alliances on container shipping can be better seen over the last few months than ever before. In previous crises lines have reacted to drops in demand by slashing freight rates to win business. Their response this year however has been very different. To avoid the need to cut rates, lines have implemented record levels of blank sailings, restricting capacity enough to not only support rates but increase rates YOY on most major lanes. According to Container Trade Statistics the global rate level in April was up approximately 12.1% YOY and Sea-Intelligence reported rates basis the CCFI were up approximately 5.7% YOY the first week of June. The success of the blank sailing strategy in supporting rates is particularly surprising given the rapid decline in the price of oil, with bunker fuel being one of the shipping lines highest

operational costs.

As the lockdown in a number ofregions eases, many are wondering what impact this will have on rates going forward as demand recovers. Drewry reported this week that blank sailings planned for July are at the lowest level seen since the COVID-19 outbreak began. With the majority of cancellations being seen on the transpacific and Europe to North America flows. That said as demand recovers, many lines are announcing rate increases and peak season surcharges as capacity remains limited.

With the lines unsure about the timing and extent to which demand will recover as the lockdown eases and shippers facing so much uncertainty surrounding rates and schedules, shippers are being advised that wherever possible to plan and book as far in advance as possible to avoid to rolled shipments.