531 words / 3 minute reading time

Bulk Shipments

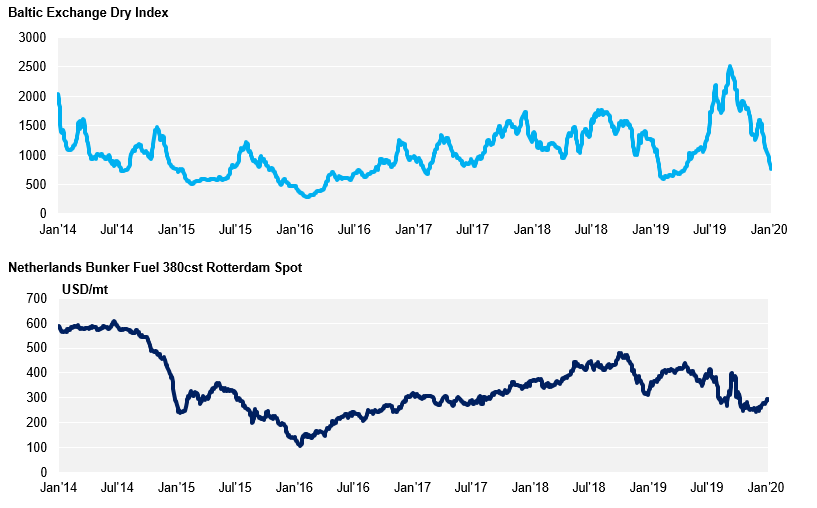

- The BDI has lost almost 50% of its value since our last update, settling at 774pts on Friday.

- All asset classes came under pressure, with Capes leading the way (C5TC – down 58%), followed closely by the Panamax sector (P5TC – down 43%), suggesting the major bulks had taken early leave for the festive season.

- With Chinese New Year falling earlier this year, the year of the rat will be welcomed in on the 25th January. There is anticipation that activity will pick up soon and perhaps some participants in the dry bulk sector will draw positives from the fact that the rat is seen as a sign of wealth and surplus in Chinese culture, as well as representing the beginning of a new day.

- Singapore spot prices of Low Sulphur Fuel Oil (and the Gas Oil alternative) increased by almost $150pmt in the fortnight, leading up to IMO-2020 implementation day. The High-Low Fuel Oil spread widened out to about $350pmt at its peak, however, reducing inventories of the High Sulphur Fuel (which can still be used by scrubber fitted vessels) and tensions in the Middle East helped bring this spread back to around $300pmt by the end of last week.

Containerised Shipments

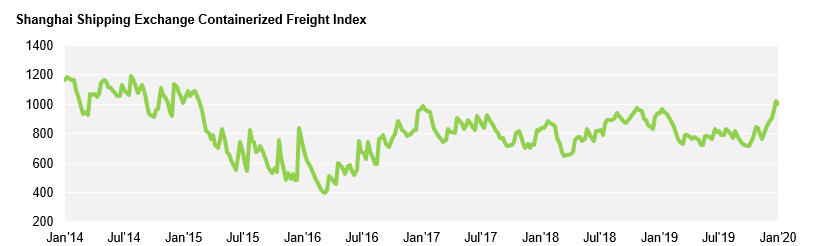

- Most carriers introduced surcharges in effect from the 1st December 2019, as an effort to start recouping the costs incurred to comply with the new IMO 2020 regulations commencing on the 1st January 2020. This has led to sharp increases in rates across most trade lanes, particularly for those rate agreements with validity up to three months.

- With each line taking a different approach to the calculation and terminology being used, shippers have been left having to revisit their contracted rates, leading to concern and confusion across the industry.

- The lack of historical data for Low Sulphur Fuel prices has made it especially difficult to obtain complete transparency and standardisation in the approaches being taken. It is expected that the Low Sulphur Fuel premium will over time fall to a premium of 35-40% of the current higher sulphur standard.

- With the IMO’s sulphur mandate now in effect, the start of this year has seen sharp increases in container spot rates across most routings.

- Approximately 6% of market capacity is said to be idle as vessels wait to be fitted with scrubbers in an effort to become IMO compliant. This combined with an early Chinese New Year is further pushing up rates.

- Carriers are said to be standing strong when it comes to recouping higher fuel costs from shippers in the form of fuel surcharges. While a lack of consistency and transparency still persists, carriers are largely restricted by antitrust laws preventing them from taking a consistent approach to calculating the surcharges being applied. Vessel capacity, utilisation and approach to becoming IMO compliant (scrubbers, 0.5% sulphur content fuel) all impact the approach taken by the lines in calculating the charges levied.

- Many shippers are holding off long term rate negotiations until post Lunar New Year when rates are expected to settle and more transparency is available in terms of fuel surcharge calculations.