Bulk Shipments

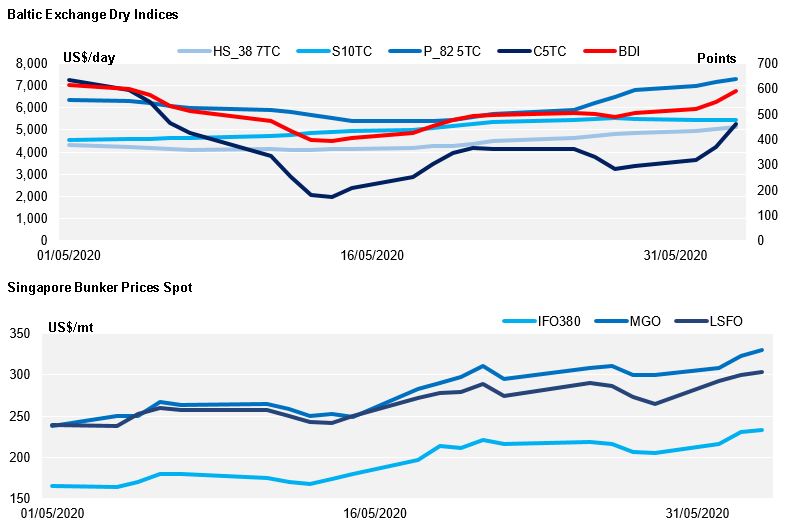

The BDI settled on 504pts at the end of May, recovering much of the ground it had lost during the first half of the month. Since falling below $2000 per day in the middle of the month (a new low for 2020), the Capesize 5TC index now appears to have some real momentum behind it, gaining more than 50% of value in the last few days of trading. The Capesize market is well known for its volatility and reports of increasing ton-mile demand in Ore and Bauxite flow into China from the Atlantic basin will only fan the flames.

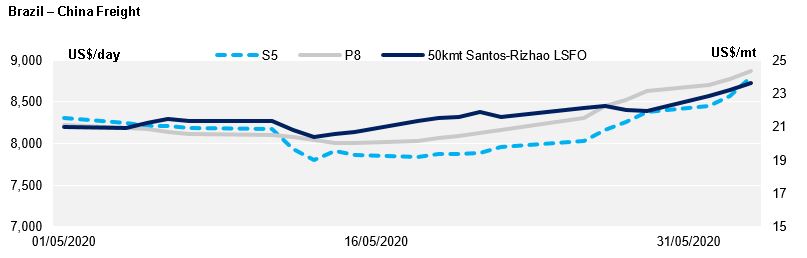

Staying within the Atlantic, the Panamax P8 route, which measures the cost of freighting grains (primarily soybeans) between Brazil and China, recorded a 20% gain in value over the last 2 weeks, also recovering from a new low of $20.02pmt reached on the 14th May. We are seeing a similar gain in the geared Supramax S5 front-haul index

route, with our Santos-Rizhao LSFO 50kmt spot route assessment now approaching $24.00pmt.

Singapore bunker fuel prices continue to track crude higher, adding about $100pmt to its value since the middle of April. With an approximate fuel burn of 1350mts to ship sugar from Santos to Rizhao, this translates into an additional premium of $2.70pmt to freight a 50kmt cargo size.

Containerised Shipments

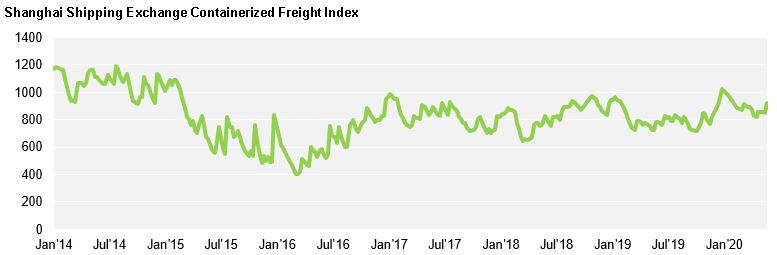

What was initially anticipated to be a V shaped recovery for the container shipping industry is now looking unlikely as the COVID-19 pandemic continues to suppress consumer demand globally.

Shipping lines successful implementation of blank sailings across regions has proven their increased agility in comparison to previous crises. Blank sailings have removed

significant supply from the market, the repercussions of which are being felt by shippers. In addition to schedule interruptions there have also been many changes to routings with increasing pressure being placed on regional feeder lanes, resulting in many shippers facing rollovers at key transhipment hubs.

At the end of May idle container ship capacity reached an all-time high, placing increasing burden not only on shipping lines but also particularly non-operating vessel owners. New container vessel orders have fallen to their lowest level in a decade.

Shipping lines successful capacity management has led to increasing rates as vessel space becomes more and more limited. Spot rates on many lanes seeing increases of 10-25% vs this time last year, on lanes including China to Europe and the US West Coast.