Brazilian crop forecasts remain relatively unchanged as the market begins to gauge the supply from the 2021/22 crop.

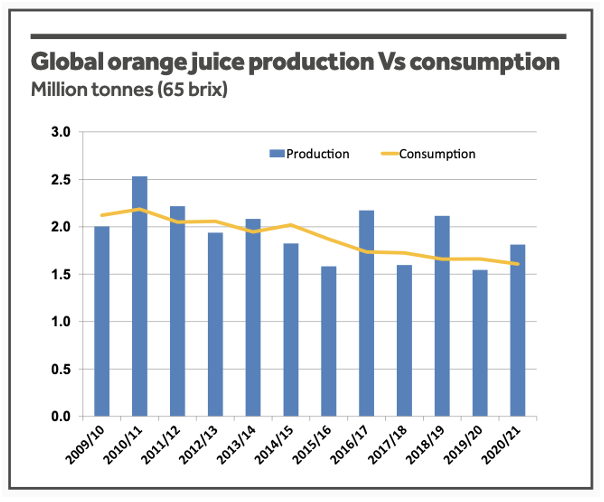

Global Orange Juice Supply in 2020/21

Global orange juice (65 brix) production for 2020/21 is forecast 17% higher than the previous year at 1.8m tonnes. Production in Brazil and Mexico is expected to more than offset the drop in the US. However, global production continues in a general long-term decline. Similarly, consumption should continue its long-term decline, although exports could rise this year with Mexico’s rebound.

Brazil production should climb 20% to 1.2m tonnes on an increase in oranges available for processing. Consumption and stocks are both higher, while exports remain unchanged at present. Brazil remains the largest producer and should account for 75% of global orange juice exports.

US production may drop 16% to 250k tonnes, with fewer oranges available for processing. Consumption and stocks could also be lower, in spite of higher imports.

Mexico production is projected to more than double to 200 000 tonnes after last year’s drought-decimated orange crop. Consumption and exports are expected to climb, keeping stocks unchanged.

EU production might edge up to 88k tonnes. Consumption is up slightly too, but higher production should more than offset lower imports.

Brazil remains the top supplier to the EU.

Florida’s Orange Crop in 2020/21

The USDA currently thinks Florida will produce 55.5m boxes of orange this season, down 500k boxes from its previous forecast. If this materialises, it’d be down 18% from last season’s final production.

The forecast for non-Valencia production has been raised by 500k boxes to 22.5m boxes. The Navel forecast, included in the non-Valencia portion of the forecast, is 600k boxes.

The forecast of Valencia production has been lowered by 1m boxes from the previous report to 33m boxes. Current fruit size is below average and could be below average at harvest. Current droppage is beyond the maximum and should remain so at harvest.

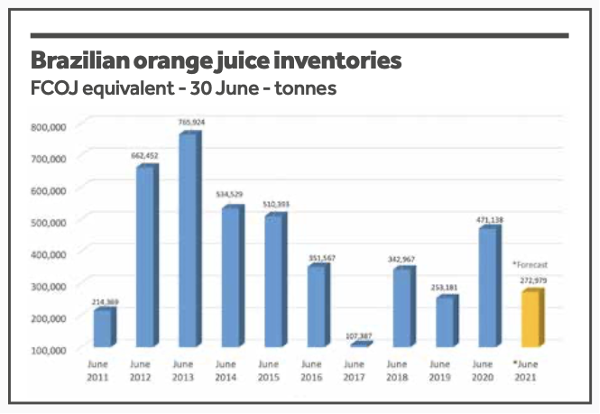

Brazilian Orange Juice Production and Stocks

Orange production in São Paulo and the Minas Gerais triangle in 2019/20 will reach 269.01m boxes (40.8kg), according to Fundecitrus. The estimated volume of oranges used for processing for the 2019/20 season is at 215.64m boxes, of which 198.01m boxes are processed by CitrusBR members.

CitrusBR thinks the total consumption of oranges on the domestic and export fresh markets will be 53.4m boxes. The average juice yield should be 263.7 boxes per tonne of FCOJ.

Considering the above data, total orange juice production during 2020/21 will be 817.7k tonnes (FCOJ 66 brix equivalent).

This is 32% lower than production during the previous season. CitrusBR says global inventories of FCOJ equivalent in the hands of CitrusBR members are estimated to be at 272.9k tonnes on 30th June 2021. If confirmed, this projection will represent a 42% decrease year-on-year.

Brazil’s Orange Crop in 2020/21

The 2020/21 orange crop forecast for São Paulo and Triângulo Mineiro/Southwest Minas Gerais citrus belt now sits at 269.01m boxes (40.8kg). This figure is almost on par with the previous forecast but is down 6.52% from the initial forecast and 30.45% lower year-on-year.

Fundecitrus says the crop withstood the physiological effects of a negative biennial bearing. This crop loss, unprecedented in the history of citriculture, evidences the severity of climatic issues in this season.

Florida’s Grapefruit Crop in 2020/21

The USDA thinks Florida will have 4.6m boxes of grapefruit in 2020/21. The red grapefruit forecast is unchanged at 3.9m boxes, and the white grapefruit forecast is similarly held at 700k boxes. The fruit size and fruit drop are now final.

The final size for white grapefruit is below average, while red grapefruit size is above average. Droppage for both varieties is above average.

Other Opinions You May Be Interested In…