Global orange production looks slightly more positive in a lot of regions this year. However, Brazil’s bounce back does not look as strong as the industry had hoped.

Brazilian Orange and Orange Juice Production

Fundecitrus thinks Brazil will produce 269m boxes or orange in 2020/21, down 17.4m boxes from the previous projection in September and 18.4m boxes below the initial forecast.

Production was significantly hindered by late rainfall in the spring, coupled with intense heat. If these new projections hold true, it will result in the largest crop loss for the citrus belt (Sao Paulo – Minas Gerais) since at least the 1988/89 season.

The commercial area in Sao Paulo and the western part of Minas Gerais should contribute 315m boxes (12.85m tonnes) next season, up 17% from this season’s current figure (269.4m boxes or 10.99m tonnes).

The lack of rainfall and high temperatures during September and October last year prevented the first blossoming in several citrus growing regions; this will likely reduce the 2021/22 citrus output. However, the second blossoming occurred in October and November and benefited from good rainfall and moderate temperatures. Production from other states should remain stable at 100m boxes (4.08m tonnes). Nevertheless, the USDA thinks it’s still too early to project Brazil’s total orange production for 2020/21, but more accurate numbers will be available soon.

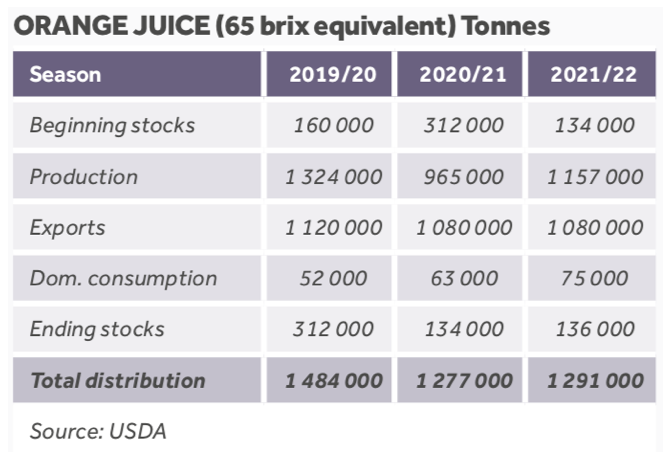

Brazil should produce 1.2m tonnes of Frozen Concentrated Orange Juice FCOJ (65 brix equivalent) in 2021/22, up 192k tonnes from last season.

Sao Paulo should produce 275m boxes of orange juice (190m boxes of FCOJ and 85m boxes of Not From Concentrate), accounting for 1.061m tonnes of juice (730k tonnes of FCOJ and 331k tonnes of NFC converted to an FCOJ equivalent). Other producing states should produce 24m boxes, accounting for 96k tonnes of juice.

Brazil’S FCOJ (65 brix equivalent) production has been revised downward and now sits at 965k tonnes for 2020/21. The USDA thinks Brazil’s FCOJ exports will total 1.08m tonnes in 2021/22, unchanged from this season.

Ending stocks for 2020/21 are forecast at 136k tonnes (65 brix), compared with carryover stocks of 134k tonnes in 2019/20.

The USDA’s stock figures only include stocks in the storage tanks at orange juice facilities (processing plants and port terminals) in Brazil. They don’t include stocks owned by Brazilian companies abroad, e.g. in transit and port terminals in the US, Europe and Japan.

According to CitrusBR, global Brazilian orange juice inventories totalled 471k tonnes (FCOJ equivalent) on the 30th June 2020. This includes orange juice in storage tanks at processing plants and port terminals in Brazil, and stocks abroad (vessels and port facilities worldwide).

Chinese Orange Production

China should produce 7.5m tonnes of orange in 2020/21, up 100k tonnes year-on-year. The USDA thinks its FCOJ production will remain on par with that of 2019/20, at 30.8k tonnes.

China’s FCOJ consumption is forecast up slightly, at 89.9k tonnes, following the anticipated rebound of the Chinese economy and the stronger consumer confidence to spend as COVID restrictions are eased.

China should import 60.8k tonnes of orange juice in 2020/21, up slightly from last season.

Costa Rican Orange Production

Costa Rica’s orange production is set to decrease by 5k tonnes this season and total 285k tonnes. This comes after some of the main growing regions were hit by strong rains during the flowering period.

Costa Rica exports the majority of its orange as FCOJ, but also exports it as NFC too.

According to the Costa Rican Trade Promotion Board (PROCOMER), juice exports 2019 amounted to 32.k tonnes and were valued at USD 50 million, compared to 36.9k tonnes at USD 68 million in 2018. The US remains Costa Rica’s main destination for orange juice exports.

Egyptian Orange Production

The USDA thinks Egypt will produce 3.4m tonnes of orange in 2020/21, up 200k tonnes year-on-year. It should process 350k tonnes of orange, up 15k tonnes from 2019/20.

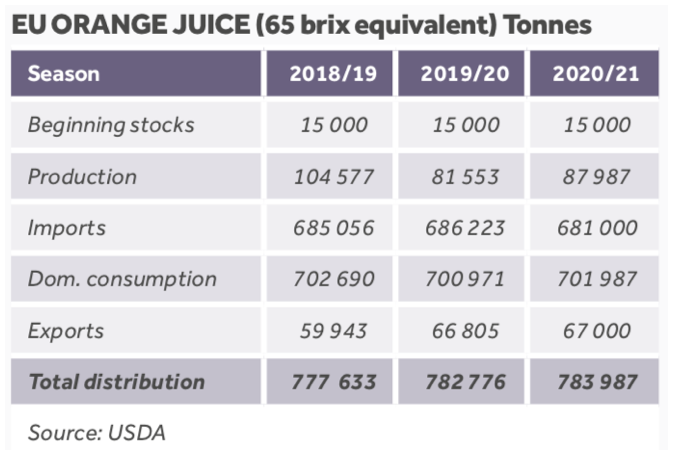

EU Orange Juice Production

The EU should produce 87.9k tonnes of orange juice in 2020/21, up 8% year-on-year. This forecast is aligned with the expected growth in the volume of EU oranges destined for processing this season, particularly from Spain and Italy. Spain is the major orange processor in the EU, followed by Italy. Approximately 20% of Spanish orange production is used for processing purposes.

In 2020/21, the EU’s orange juice consumption should slightly as a result of increased domestic supplies and growing consumer interest for immune-strengthening products following COVID-19.

Despite this, the EU’s orange juice imports in 2020/21 should drop and total 681k tonnes, down 5k tonnes year-on-year.

The EU is a net importer of orange juice. However, during the last decade, its orange juice imports juice have declined by 17% due to the growth in domestic production and the downward trend of orange juice consumption.

The EU’s orange juice exports have reportedly increased by 45% over the past 10 years.

Floridian Orange Production

The USDA now thinks Florida will produce 56m boxes of orange in 2020/21, down 2% from its October projection. If this materialises, it’ll be a 17% drop year-on-year.

The forecast for non-Valencian production has also been lowered by 1m boxes and now sits at 22m boxes. The current fruit size is above average and should remain so

at harvest. The current droppage is also above average and should be above the maximum at harvest.

The Navel forecast, included in the non-Valencia forecast, is unchanged at 700k boxes. The final Navel size and droppage are above the maximum.

The forecast for Valencia production is unchanged from the previous forecast at 34m boxes. The current fruit size and droppage are above average and should remain so at harvest.

Mexican Orange Production

The USDA thinks Mexico’s 2020/21 orange crop will rebound after it was decimated by drought last year and suffered 40% losses. Its output in 2020/21 is set to total 4.01m tonnes, up from 2.53mn tonnes last year.

Its FCOJ production is set to total 200k tonnes, up 122% year-on-year. The majority of this is destined for the world market.

South African Orange Production

South Africa should produce 1.7m tonnes of orange this year, up from 1.65m tonnes in 2020.

The increase is a result of good rainfall in the main growing regions, increased planting, better water management by farmers and new plantings of high yielding and late maturing varieties.

The region should process 302k tonnes in 2021, up 20k tonnes year-on-year.

Other Opinions You May Be Interested In…