Fruit juices in the USA special report from Zenith Global, takes a look at what’s happening with traditional juice sales and consumer trends.

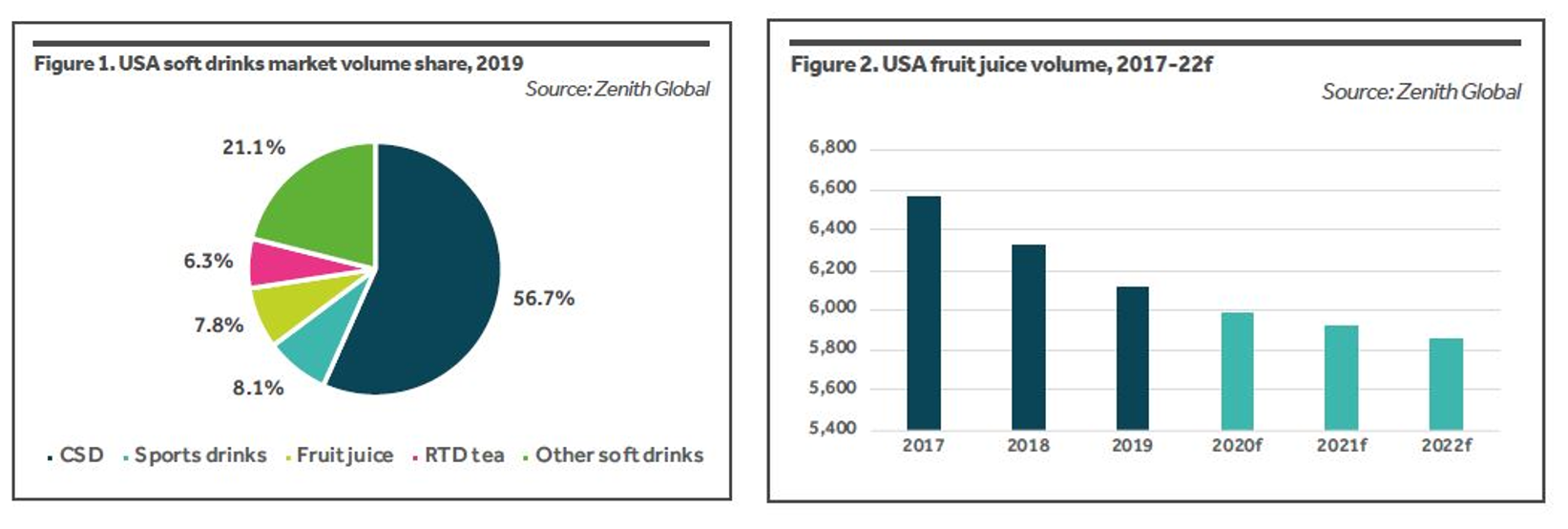

According to the latest data from food and beverage consultancy Zenith Global, fruit juice accounted for 7.8% of total soft drinks market in the US in 2019, the third-largest category behind carbonated soft drinks (CSDs) and sports drinks. The volume fell in 2019 by 3.3% to reach 6.1 billion litres.

Traditional orange juice in particular has suffered as a result of changing consumer habits. Household consumption of orange juice has fallen over the last 20 years, from three quarters of all American households to just two thirds purchasing often or sometimes in 2019.

In value terms, fruit juice occupied second place in the soft drinks market at USD15.8 billion by the end of 2019, a decline of -2.9% on previous year performance.

Decline of traditional juice sales

Whilst both volume and value have been in decline for a number of years, this began to slow in 2019, thanks, in part, to a shift towards premiumisation in the chilled 100% juice segment. American consumers do like their juice and, where the offer is fresh, clean, chilled, with innovative flavour combinations, they are willing to pay a premium price.

Mature market with premium products holding up

At the premium end of the category, smaller convenience packaged brandsare positioned at an average price of USD6.20 per litre. This positioning is not the exception, as there are many innovative 100% juice brands – from global manufacturers to small batch start ups – that are succeeding in the fresh/premium/organic/natural juice space. Examples of premium brands include Suja, Evolution and Vive.

Within fruit juice the mainstream segment is dominant with the highest number of brands occupying this space. It is a mature market where, in some cases, there is little differentiation across mainstream brands in terms of innovation and relatively low consumer loyalty. The market leaders remain those of the big soda brands, Tropicana, Naked (both PepsiCo) and Minute Maid (Coca-Cola).

Private label is also significant in the US, for example in Walmart it is branded under the Great Value label and retails at around USD1.25 per litre. This is significantly lower than other economy brands such as Welch’s at an average of USD1.69 per litre.

New innovations driving interest

Back in 2015, Cold Press and High- Pressure Processing (HPP) juices began growing in popularity, driving interest in a category in freefall and bringing new consumers to the chilled juice aisle. 100% chilled fruit juice is the observed ‘sweet spot’ in the wider fruit juice, nectars and fruit drinks (FJNFD) market, all of which are forecasted to post a slow decline in consumption towards 2022.

Despite the last few years of decline, fruit juice is showing signs of slow recovery, however, brands have been slow to respond to consumers concerns about the sugar content in fruit juice, although in most cases this is natural sugar rather than added sugar.

Health concerns and changing consumer habits

A number of other factors have led to falling sales in the US. Consumers reported purchasing less fruit juice for a variety of reasons: juice is no longer part of the breakfast occasion, with modern families foregoing traditional at-home breakfasts; the extensive functional and healthful beverage choices available; price rises on raw orange juice; traditional juice consumers changing with rapidly evolving dietary needs. These cited reasons could post an opportunity, as American consumers like the functional benefits of juice and there are multiple consumption occasions to tap into outside of breakfast.

Americans like juice but they want innovation

The volume losses seen in fruit juice over recent years are forecast to slow, with the percentage of decline contracting year on year as the category starts to address the issues around its negative image. Zenith Global identified that flavours (including taste fusions, experimental ingredients and superfruits), functionality, organic credentials and premium positioning are all key trends to explore for producers looking to gain ground.