Insight Focus

- Unrest is brewing as the cost of living rises alongside fuel prices.

- The knock-on effects along the supply chain are putting pressure on producers.

- High input costs will jeopardise long-term food security as farmers feel pressure.

Rising fuel prices are causing widescale disruption around the world. Whilst this doesn’t seem like an immediate threat to food security, fuel plays a key role in agricultural production from the farm to the fork. Unsustainable fuel price rises could lead to long-term food insecurity as farmers battle high input costs, which could compromise future harvests.

Fuel Prices Bite as Ukraine Crisis Continues

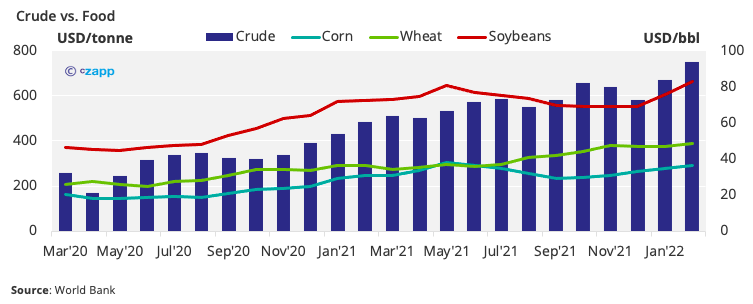

As war in Ukraine escalates, fuel costs continue to rise, lifting food prices. The relationship between food prices and fuel prices is much more interlinked than it would at first appear.

The first impacts of the fuel price rises were felt directly at the pumps. This meant hauliers, food delivery companies and truckers transporting food were hit hard. For the past three weeks, truckers in Spain have been striking in protest of high fuel prices.

These protests have now extended elsewhere. Irish truckers organised a protest in Dublin on the 11th April, putting the city into “lockdown”. And across Asia, anger and frustration is growing over high fuel prices and the lack of government support.

In more extreme situations, fuel and cost of living crises threaten to uproot governments. In Sri Lanka, rising prices have made a bad situation worse, with the ruling government facing rebellion from its own lawmakers during the country’s worst economic crisis in decades. In Kenya, long queues are forming at gas stations as the government delays a KES 13 billion (USD 113 million) subsidy to oil producers that would prevent further price rises.

Farmers Feel the Knock-On Effects

It’s not just truckers. The impact of these protests are already being felt throughout the food supply chain, from producer to consumer.

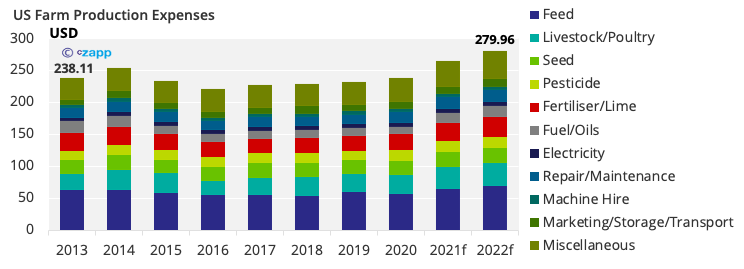

Farmer organisations are now getting involved in the protests as the high fuel costs push up fertiliser prices. According to the USDA, US input costs are forecasted to total USD 280 billion in 2022, up by around 6% on the year and 17% since 2013.

The Spanish government issued a decree last Wednesday recognising the pressure from fuel costs and the risk of food insecurity. “The energy price rise is particularly affecting energy intensive sectors that have little capacity to pass on the price increases, such as highway transport, fishing, agriculture and livestock farming.”

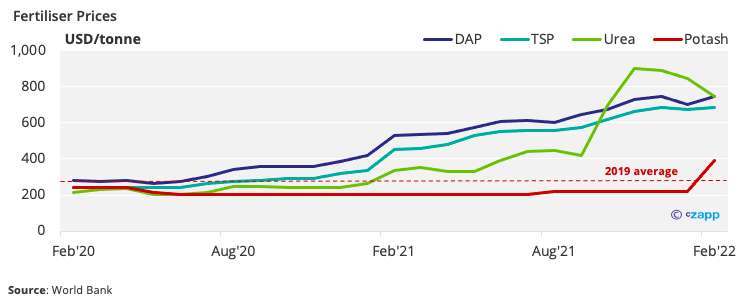

The situation is exacerbated for farmers when considering the double whammy of fuel and fertilisers. The cost of fertilisers has skyrocketed as Russia is a major global producer.

Germany is particularly exposed to the impact of the Russian invasion, with 55% of its gas coming from Russia. The German Farmers’ Association warns that interrupted gas supply in Germany could compromise fertiliser availability to mean “significantly lower harvests would be inevitable from 2023.”

This threat extends through Europe as prices of the EU’s own fertiliser have also risen, causing Italian farmers to make do with 40% less fertiliser for the upcoming spring sowing. These high fuel costs are compromising crop productivity and will have significant knock-on effects in future harvests.

Food Suppliers React with Price Hikes, Rationing

If farmers pass on these costs, there are bigger implications for retailers, wholesalers and consumers. For many, the only option is to pass on the added costs to the end users.

The UK’s Federation of Wholesale Distributors said its members intend to raise prices to reflect higher costs. Meanwhile, the German Farmers’ Association has said German consumers should expect food price rises of between 20% and 40%.

Uber Eats, the global food delivery service spun off from ride-sharing company Uber, has announced that it’ll start charging a new fuel fee of up to 45 cents per delivery in the US. The company has said the measure will be in place for two months, with the additional fees going directly to the drivers.

In Spain, the government is intervening to ensure rising fuel costs don’t lead to food scarcity. In its decree issued on Wednesday, the government is allowing supermarkets to limit the number of items that can be purchased by each customer.

Households Bear the Brunt of Price Rises

So, what does all this mean? With the supply chain, the consumer will ultimately bear the brunt of the rising fuel and fertiliser costs.

Indian fuel consumers experienced their twelfth price hike in two weeks on the 4th April. The Indian government has led a drive to formalise access to liquefied petroleum gas (LPG) in the past few years, but 50% of households still rely on solid fuels such as firewood.

LPG emits less CO2 than burning and LPG stoves have been found to be more efficient than wood burning stoves. Unsustainable rises in LPG prices could compromise India’s move away from firewood and progress towards a more environmentally friendly fuel.

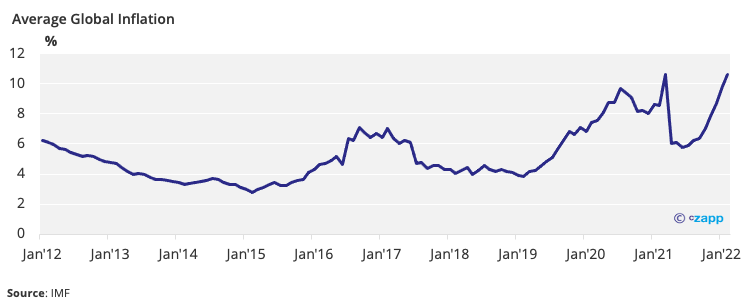

And as global inflation rises to levels not seen since the Great Recession, consumers face the double whammy of higher fuel costs and inflation, pushing up the prices of products on the supermarket shelves.

Opportunity to Reorder Trade

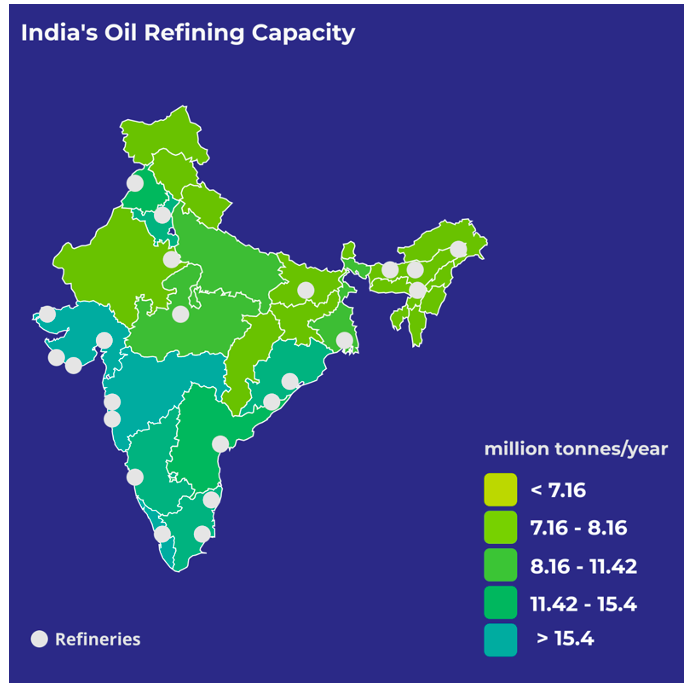

For some countries, there could be opportunity in the fuel price rise. India is in a potentially very good position. The South Asian country has built up oil refining capacity of 5m barrels/day, even though it’s not a major global producer.

India built this capacity to refine Iranian crude specifically, since it is sour, and therefore relatively cheap. While Iran is a major producer of oil, its refining capacity has been declining and now stands at about 2.1m barrels/day. Iran has reserves totalling about 150b barrels but lacks the refining infrastructure.

Iran cannot quickly ramp up its refining capacity. For every 100k barrels/day of capacity, an investment of between USD 2.5 billion and USD 3 billion is required. Depending on the size of the refinery, it can take between five and seven years to complete.

Crucially, the US and Iran are close to a nuclear deal, which would remove the burden of US sanctions from the Middle Eastern country. If Iran can take advantage of Indian refining capacity, it could be possible to plug some – although not all – of the global shortfall suffered from Russian oil, allowing prices of agricultural inputs to stabilise.

Additionally, Russia has already approached the neutral India about selling crude oil at a steep discount. According to Reuters, Indian refiners have already bought at least 16m barrels of Russian oil, similar to their purchases for the whole of 2021. Indian refineries have reportedly shunned the more expensive Saudi oil and increased purchases of cheap Russian crude to take advantage of the current situation.

Solutions Not Available Overnight

It’s clear the agricultural industry needs additional aid to withstand the pressure on margins and consumers will be hit hard if increased costs are passed on, especially in an environment of already high inflation.

Some of the solutions could include finding alternative fuel sources. Germany has already been motivated to sign an LNG deal with Qatar to alleviate some pressure from Russia, although this will not counteract price rises. Instead, some farmers in Germany are turning to organic farming and “methanisation” to create gas from manure, corn and grass. Read more here about how going organic can curb fertiliser price rises.

For some experts, the pressure on the food and beverage industry can be alleviated by government revision of all policies likely to add a burden to manufacturers, such as sugar taxes and packaging legislation.

In the UK, the hospitality industry is calling for an extension of the lower 12.5% VAT rate imposed to aid post-pandemic recovery. And in the EU, a package of measures has been put in place to support farmers, including moving forward an annual subsidy payment and temporarily easing state aid laws. A crisis fund worth EUR 500 million (USD 547 million) is pending approval by member states, but this process could take several weeks.

Concluding Thoughts

The impacts from increasing fuel costs are being felt all along the agricultural supply chain. From high costs to power farm vehicles, to the hefty price of delivering food to the supermarkets, everyone is feeling the pinch.

With the high price environment, the National Farmers’ Union of England and Wales warned that farmers should be vigilant of fuel theft. The union advised that farmers consider constructing a cage around their fuel tanks and install audio deterrents such as gravel or even alarm systems – another cost for farmers to bear.

Given the extensive global unrest over rising prices combined with high levels of inflation, it seems now is the time for governments to step in to halt price rises and maintain profit margins for farmers. Otherwise, there’s a real risk of political unrest and long-term food insecurity as crop harvests are compromised by high costs of inputs.

Other Insights That May Be of Interest…

Going Organic Could Curb Fertiliser Price Rise

Brazil and USA to Boost Fertiliser Output on Russian Invasion

Explainers That May Be of Interest…