Insight Focus

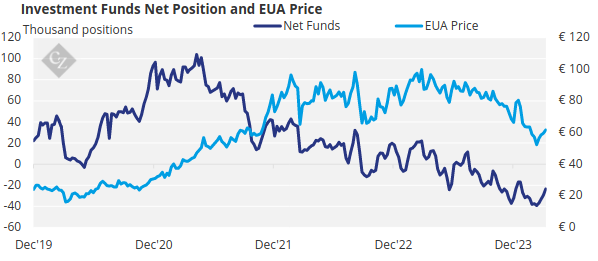

- Investment funds held record net short position at the end of February.

- The net short has shrunk 40% since then as EUAs have rallied EUR 10.

- The market is uncertain whether prices will resume declines after recent gains.

EU Carbon Prices Rise

European carbon prices have climbed by more than EUR 10 since falling to a two and a half year low of EUR 51.08 in late February, a rally that coincides with a steady reduction in investment funds’ net short positioning.

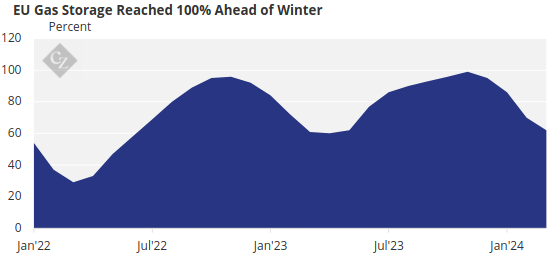

The benchmark December 2024 EU Allowance contract fell to EUR 51.08 on February 23, the lowest intraday price since July 2021. The intervening 31 months saw EUA prices top EUR 100 for the first time as energy prices soared in the wake of Russia’s invasion of Ukraine, before falling back as Europe successfully negotiated its first winter without supplies of Russian pipeline gas.

Source: AGSI

The decline in carbon prices has reflected sharp reductions in consumption as European industry slashed production and domestic use fell amid record high prices. Europe’s response to the invasion, prioritising the transition to renewable energy, has been a significant success, with electricity generation from fossil fuel tumbling by more than 20%.

The result is that analysts believe emissions from all installations covered by the EU ETS fell by as much as 14% in 2023. Verified data will be published by the European Commission this week.

Funds Capitalise on Green Transition

Investment funds were amongst the first to spot the downward trend in fossil fuel use and energy demand and began converting their previous net long holdings into a net short position in EUAs starting in August last year.

Benchmark EUA futures prices were in the high-EUR 80s at the start of August and fell almost without a break to reach the EUR 51 mark in late February. Over the same period, investment funds’ total short holdings grew from around 27 million tonnes to a peak of 74 million at the end of February.

Over the last eight months, long positions have remained steady at an average of 31 million EUAs.

The funds’ net short position of more than 39 million EUAs at that time represented the biggest-ever bearish bet on prices.

As prices reached the low-EUR 50s last month, market participants expressed confidence that the market would likely continue to fall, at least into the EUR 40s, before speculative investors began to take profit.

However, volatility in the natural gas market appears to have halted the decline in the short term. Futures prices for front-month TTF gas halted their four-month decline at the end of February, which prompted a rally in carbon.

As TTF prices have climbed by 20% in the last month, so carbon has recovered by a similar percentage and investment fund short positions have shrunk by around 13 million EUAs.

The last four weeks have seen growing speculation over whether funds are now discreetly closing their net short holdings. The net short has been reduced by around 40% since late February.

Bearish Mood Remains

Some stakeholders are still confident that prices will move back below EUR 50 in the coming weeks, however, citing continuing weak fundamental demand for carbon allowances. This week’s verified emissions data for 2023 is likely to show power generation demand for allowances fell by around 20-25% last year, based on EU generation data.

An additional bearish influence remains the prospect of millions more allowances being auctioned into the market as part of the EU’s REPowerEU plan.

The initiative plans to raise EUR 20 billion from the sale of additional EUAs to help fund the bloc’s energy transition. So far, the EU has sold 55.5 million EUAs and raised EUR 3.9 billion.

The EU initially envisioned selling around 250 million permits to raise the EUR 20 billion, implying an average price of around EUR 75. However, since prices have tumbled below that threshold, it’s likely the Commission will need to sell more than that number. Based on an auction price of EUR 60, the Commission will need to sell another 266 million allowances through to 2026.

Analysts are careful to point out that these additional allowances are not new supply, but simply EUAs that were meant for sale in the period from 2027 to 2030. That means that while supply today is healthy, the market is likely to become very much tighter towards the end of this 10-year phase of the market.

Most traders don’t expect prices to start to reflect that looming shortage until at least 2026, but industrials are being advised to buy permits for future use now, while prices are at two-year lows.