Insight Focus

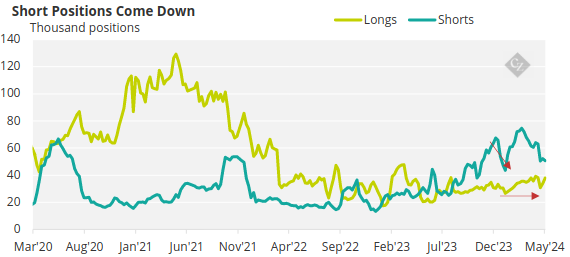

Funds have cut short positions by nearly 50% since February, while long positions remain unchanged. However, there may be a sharp “snap-back” in long positions after REPowerEU sales end.

Bearish Sentiment Declines

Investment funds have reduced their net short position in European carbon by around 50% since late February after EU carbon allowance prices fell to a 30-month low of EUR 51.08.

Source: ICE

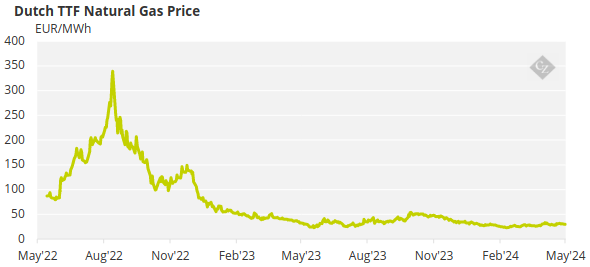

The carbon market has rallied by as much as 45%, benefiting from a 48% rise in natural gas prices as conflict in the Middle East, outages in Europe and the US Gulf and recovering Asian LNG demand have combined to boost concerns that regional supply is not as secure as EU politicians have suggested.

The intraday high on the front-month TTF natural gas contract on April 17 reached EUR 33.98, a rise of 48% compared with the intraday low of EUR 23.24 on February 23.

Data from the two main futures exchanges show that investment funds held gross short positions totalling 74 million tonnes at the end of February, and 35 million tonnes in longs. The net short of 39 million tonnes was the largest bearish bet funds have held since at least 2019.

Since then, the total number of short positions shrunk from 74 million tonnes to just over 50 million tonnes, but the number of long positions held by speculative players has remained more or less unchanged at between 35 and 38 million tonnes. This gives a net short position of nearly 13 million tonnes — the smallest overall bear position since October last year.

What’s Driving This Shift?

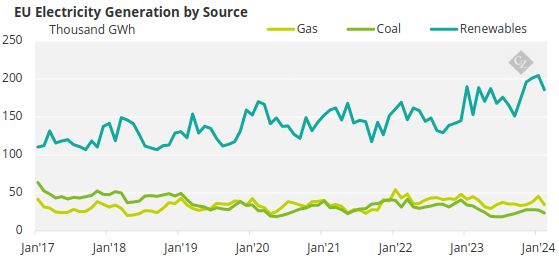

The data suggests that there remains a strong constituency in the market that is focused on the relentlessly poor demand fundamentals. Fossil-fired power generation across the EU continues to decline, with overall coal, lignite and gas output falling 17.5% in Q1, while renewables generation rose 14.5%.

For the year-to-date, overall power generation is flat year-on-year, so the drop in fossil generation represents the increased competitiveness of wind and solar, and perhaps also the slow but steady erosion of coal-fired power in the region.

Source: Eurostat

And industrial output has yet to show signs of a sustained recovery. Data for February showed production fell 5.4% year-on-year in February, and this measure has declined in 10 of the last 12 months. With industrials now accounting for nearly half the total emissions covered by the EU ETS, the sector’s demand is becoming more and more influential to the carbon price.

The supply picture is consequently also bearish, particularly as more than 250 million additional EUAs are coming to market between 2023 and 2026 under the REPowerEU initiative. While these permits represent later supply (after 2027) and their “front-loading” will tighten the market considerably, the impact of that on real-time supply is still at least two years away.

Market Snap Back on the Table

Investment funds are clearly still watching signals from the demand side and maintaining an overall bearish outlook. However, with the market’s rally from the late February low and its subsequent range-bound trading in the EUR 60s, some funds may have decided to liquidate long-standing positions that were put on as early as August 2023 when prices were in the mid- to upper EUR 80s.

But the “front-loading” may also be one of several reasons why investment funds are steadily growing their long positions as well.

Numerous analysts have written about a likely “snap-back” in EUA prices as the REPowerEU programme nears its end. They focus on the annual supply – disregarding the existing historical surplus that’s being slowly absorbed by the Market Stability Reserve – to show that total supply over twelve months is likely to fall considerably short of total annual demand after 2026.

This, many of them say, will lead prices to head back to the EUR 100 level briefly seen in early 2023. So it may be that funds are slowly accumulating long positions with the longer term in mind.

Challenges Remain for Gas Supply

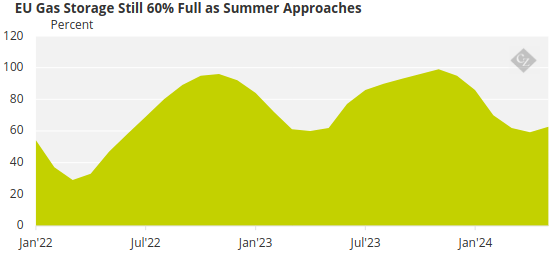

Equally, however, carbon’s correlation with natural gas prices continues to be extremely tight. Gas supply is still comfortable (despite occasional concerns and supply interruptions) and Europe’s storages are over 60% full, well ahead of schedule. So, gas prices are low enough not to encourage any additional use of coal.

Source: AGSI

But when gas prices do rise, so carbon rises in order to help maintain gas’ cost advantage over coal. And this has driven the short-term price correlation between the two markets to well in excess of 0.9.

And Europe’s natural gas market faces a challenging summer. With Asian buyers looking to add to reserves ahead of winter, and Russian pipeline no longer an option for EU buyers, the competition in the LNG cargo market is increasing. And when major exporters in the US Gulf suffer plant outages, the market reacts far quicker than it may have done previously.

European buyers must continue to refill storages to reach 90% by November 1. Between now and then, however, a predicted hotter-than-normal summer would boost demand for power for cooling and likely slow the rate at which gas storages are being refilled.

This in turn could give gas prices a hefty boost starting in the summer, which in turn would lead the carbon price higher. And for this reason, it’s possible that speculative investors are adding to their EUA holdings ahead of any summer rally.

Finally, the annual compliance cycle reaches its peak in September, when more than 11,000 power stations and factories will need to surrender EUAs covering their calendar 2023 emissions. So, there may be a rush of last-minute demand for permits that could also support the market.