Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

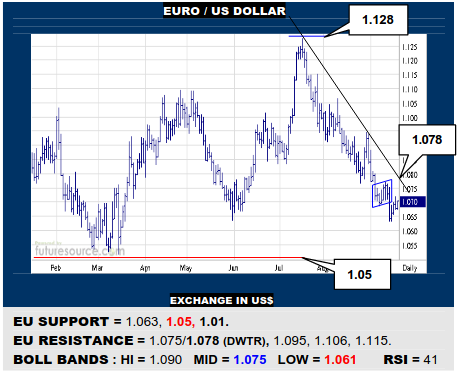

EURO / US DOLLAR

Fed watch day as meantime the EU has quickly contested a recent slip from a bear flag. Even so, it must dispatch the mid band (1.075) and Q3 downtrend (1.078) in order to really score a substantive turn that would offer access back into the 1.10’s. If held in check by that trend, be prepared to still resume south towards the 1.05 shelf.

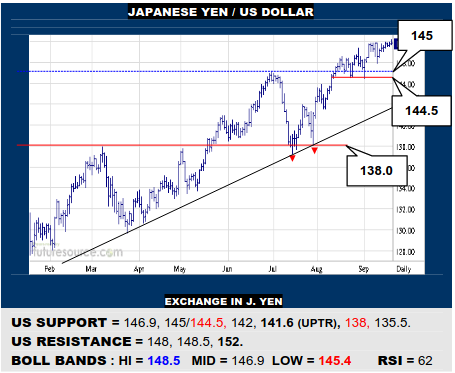

JAPANESE YEN / US DOLLAR

The US has continued to harass the 148 resistance but badly needs a definitive breakthrough to shake off the growing vibe of stagnancy. Keenly aware of the mid bands’ approach meanwhile (146.9) as the Fed rate decision nears, a twist back below threatening the 144.5 ledge where a backlash to the ‘23 uptrend (141.6) could be tripped.

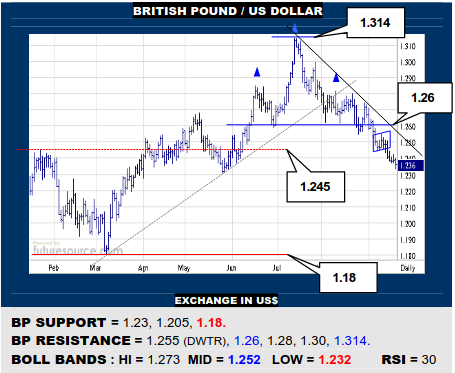

BRITISH POUND / US DOLLAR

On the heels of forming a H&S, the BP has taken a further step down from a subsequent small bear flag and the indicators are responding in endorsement of these ongoing losses. The top projects towards 1.20 so keep making room underneath while it will otherwise take a jolt over the downtrend and 1.26 top border to claim a reliable turn.

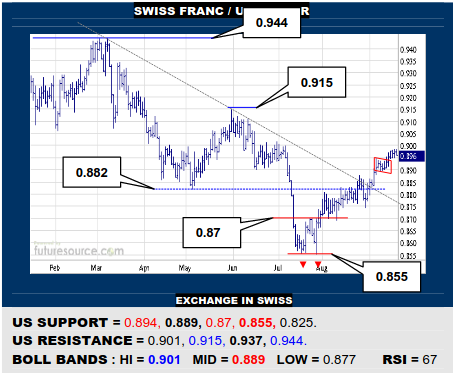

SWISS FRANC / US DOLLAR

The US appeared to progress from a nearby bull flag but isn’t exactly tearing up the tarmac so would watch the mid band closely as the Fed makes its decision (0.889). If soldiering on aboard it, the path to 0.915 will remain open. If the mid band cracked however, be ready for a corrective backlash to the 0.87 border of the small Jly dual bottom.

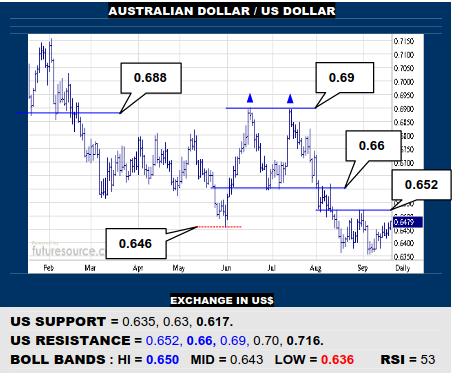

AUSTRALIAN DOLLAR / US DOLLAR

The AD has grappled away from the 0.635 support for a second time but must deliver a break of 0.652 to build its recent resilience into a small new double bottom that could then pose a genuine challenge to the prior dual top above 0.66. While foiled shy of 0.652, this action won’t necessarily rule out a further slide to the 0.617 trough from ’22.

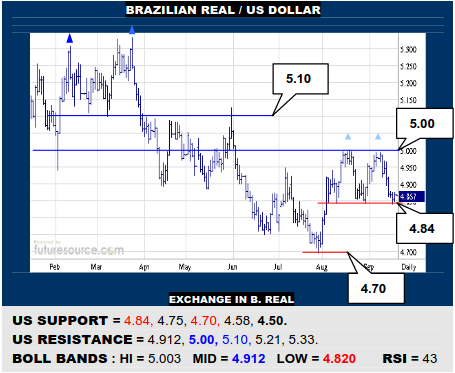

BRAZILIAN REAL / US DOLLAR

Successive rebukes from 5.00 now have the US flirting with the threat of a Q3 double top forming if the 4.84 support were to succumb, in which case wary of pressing on through 4.70 towards the decade uptrend at 4.50. Must clamber back over the mid band (4.912) to temper the top danger and keep that 5.00 hurdle in the mix.

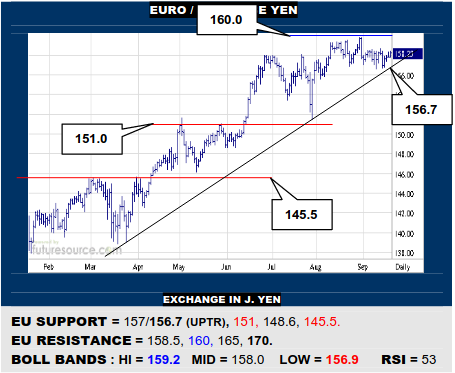

EURO / JAPANESE YEN

The EU is showing signs of trying to perk up again as the ’23 uptrend draws in closer underneath (156.7) so watch 158.5 as a preliminary springboard to spark a fresh swipe at 160, clear air from there up to 170. Only derailing from the trend would inflict greater damage here and warn of taking another delve down to the 151’s.

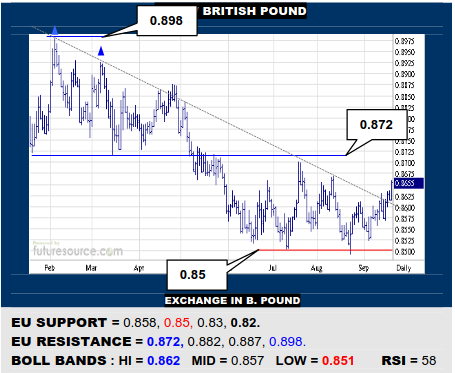

EURO / BRITISH POUND

The Q3 defenses at the 0.85 level have led to the EU shedding its ’23 downtrend. This suggests opportunity to stage an attack on the 0.872 frontier of the preceding H&S top, a further break there really turning the tables as a useful new base would then form. Minding the mid band meantime (0.858) for any sign of the rebellion fading.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.