Insight Focus

Gas is competing with lignite as the main fossil power generation fuel and carbon prices are moving in line with the relative competitiveness of these. The growing role of international gas markets is also playing a part.

Is Carbon Overvalued?

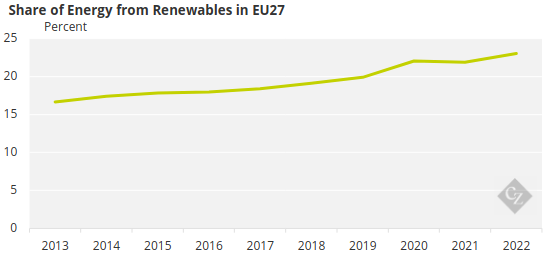

Numerous analysts and traders have been bearish on European carbon throughout the last six months, pointing out that renewable energy is making deep inroads into the share of generation historically occupied by coal and gas, while industrial output has flatlined or even fallen amid the macroeconomic downturn.

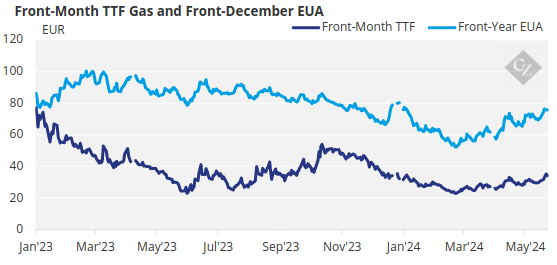

The logic is straightforward enough: less fossil generation – and lower industrial output – mean less CO2 being pumped into the atmosphere and therefore less demand for EU Allowances. Since August last year EUA prices have fallen from the high EUR 80s to as low as EUR 50.

Source: ICE

And while they are back in the EUR 70s today, there are still many market participants who believe that carbon is fundamentally overvalued in the current economy.

Fundamentals Take Steam Out of Market

We’ve written before about how short-term supply is rising as the EU plunders carbon market auctions for EUR 20 billion to pay for the energy transition until 2026. We’ve also explained how the rising tensions and eventual war in Ukraine drove gas prices sky-high and forced utilities to switch from using natural gas to coal for power generation. That brought with it a surge in demand for carbon permits, that culminated in the record price of EUR 101/tonne in early 2023.

And since then, Europe’s success in replacing lost Russian gas has taken the steam out of the gas market and meant that utilities don’t need all those carbon allowances anymore – leading to the sell-off that took the market down to EUR 50 earlier this year.

Since then, little has changed in terms of fundamentals. Power generation is still tilting towards renewables, with hard coal, lignite and gas fired power down between 25% and 28% year-on-year in the four months to April. Wind, solar, and other zero-carbon sourced of electricity are up 22%.

Source: Eurostat

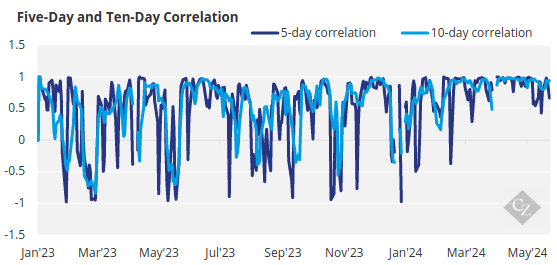

But for that share of the power market that continues to come from fossil fuels, there is still a strong dynamic at play that helps set EUA prices. And that dynamic is presently the strong correlation between natural gas and EUA prices.

Gas Matters for Carbon

As one analyst put it this week, “gas dictates power prices, which dictate fossil profit margins [for utilities], which dictate hedging [demand], which dictate EUA prices.”

Hard coal-fired generation is largely unprofitable, by a considerable margin compared to natural gas. This means that natural gas prices can rise (within limits) without affecting their pole position in the merit order for power generation.

However, by common consensus, power generated from lignite (soft, brown coal) is still frequently profitable, since power plants that use the fuel are located next to lignite mines. Because lignite is less energy-intensive and emits far more CO2 than either hard coal or gas, each megawatt it generates requires more EUAs.

This means that as gas prices rise, lignite becomes comparatively more profitable as a generation source, and so demand for EUAs should increase. However, this is hard to prove except by well-connected analysts since lignite is not traded and costs vary according to mine. But it does represent a continuing explanation for the linkage between EUAs and gas prices.

The below chart shows the outright prices for both front-month TTF natural gas and front-December EUAs.

The next one shows the short-term price correlation between the two.

Both demonstrate a rising correlation since the start of 2024, which coincides with the decline in fossil fuel use but equally, with the continuing competitiveness of lignite.

Gas Provides Back Up

Data from the European grid operators’ association show that lignite has generated 50,800 terawatt-hours (TWh) of power so far this year across the EU. Hard coal has supplied 40,500 TWh, and gas 110,500 TWh. And renewables have provided more than 404,000 TWh of electricity.

Gas remains relevant because in the medium term it will be required to back up the growing fleet of renewable generation across Europe. While coal-fired power plants typically tend to take up to eight hours to reach full steam output, gas-fired boilers can be operational in anywhere from 20 minutes to an hour.

The outlook for the gas market is therefore very relevant for EUA prices. Most analysts are cautiously bullish for TTF, pointing out that there remain considerable geopolitical risks to gas supply – Russia, Ukraine, the Middle East – as well as the regular ebb and flow of supply interruptions due to maintenance.

Prior to the controversy over the Nordstream pipeline and the war in Ukraine, Europe relied heavily on Russian pipeline gas. Now, it must compete with buyers in Asia – and the domestic US market – for liquefied gas cargoes from the US and Persian Gulfs. Add to that the new requirement for EU storages to be full by November 1, and this adds a steady tension to the market that previously did not exist.

As a consequence, EU carbon prices are effectively being driven by the gas market’s evolution. If TTF prices rise, then lignite generation will go up and so will demand for EUAs. If the gas market is relaxed, then carbon prices will ease.