Insight Focus

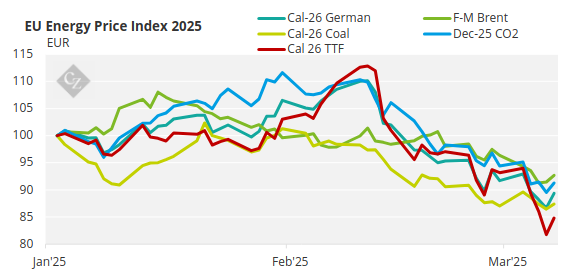

Natural gas has dropped 30% in one month. At the same time, EUAs are down 21%. Markets sold off as gas supply worries eased and speculators cut long positions. The carbon market is still waiting to detach from gas and revert to its own fundamentals.

EU Carbon Prices Fall

EU carbon allowance prices are now at their lowest levels in four months as a plunge in natural gas prices has encouraged widespread selling across the European energy complex.

Source: ICE

The weakness stems from a variety of geopolitical factors that are combining to raise the prospect of a relaxation in the supply tightness in natural gas. As recently as February 11, front-month TTF natural gas futures were nearing EUR 60/MWh, but last week they fell to a low of EUR 38/MWh, a drop of more than 30%.

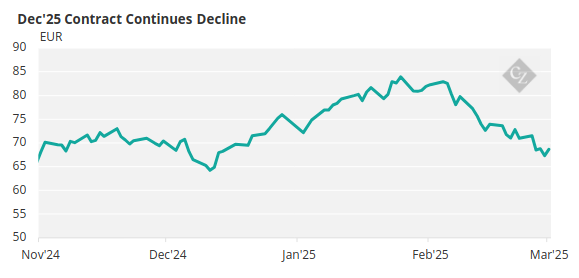

This in turn has brought December 2025 EUA futures down by 21% in just five weeks. The benchmark contract set a new four-month low of EUR 66.78/tonne on Friday.

Source: ICE

The primary factor depressing gas and carbon prices has been a shift by US president Donald Trump away from supporting Ukraine’s defence against the invasion by Russia, to now calling for both parties to negotiate a peace deal.

The prospect of peace has raised speculation that with an end to the war in Ukraine, flows of Russian gas to Europe may resume, bringing to an end a period of abnormally high prices and potentially triggering a revival in industrial output and economic growth.

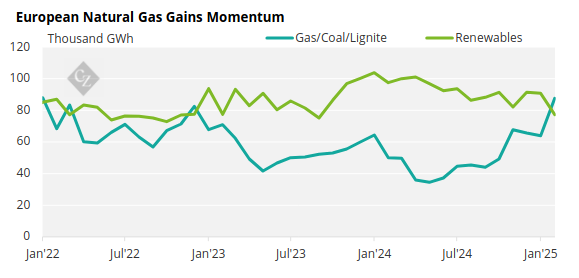

European Renewables Decline, Gas Rises

Another factor is that renewable energy output has declined sharply in the last four months. According to data from the European grid authority ENTSO-E, generation from wind, solar and other renewables sources in November and December 2024 was down by 42% compared with the same two months in 2023.

In the first two months of 2025, renewables output fell by 16% year-on-year, while natural gas generation rose more than 17%. Because of the high price of natural gas in 2024, the drop in renewables was made up largely by increasing the use of coal-fired power. Using coal to produce electricity emits twice as much carbon dioxide as gas and has been inherently bullish for EUA demand and prices.

Source: ENTSO-E

However, falling gas prices are now diminishing the cost advantage that coal-fired power generation has had over gas for many months. Further falls in gas prices may encourage more utilities to despatch gas-fired power than coal, reducing EUA demand going forward.

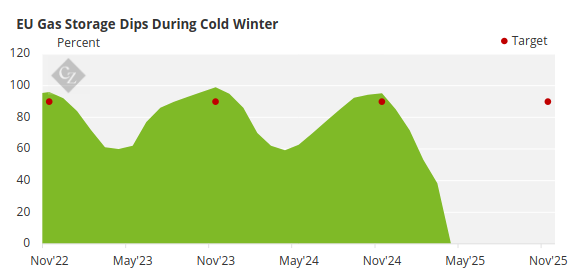

EU Gas Storage Plans Pressure Carbon Prices

A third factor is that in early march, EU member states agreed to maintain the annual gas storage target of 90% for November 1 each year, but agreed to relax interim goals.

This means that while countries must still meet the November deadline, they are not required to achieve specific milestones in the preceding months. Additionally, nations that fail to reach the 90% target on time will be granted extra time to comply.

Source: AGSI

A further delay to 2027 in the bloc’s aim to completely cut off supplies of Russian gas also forced prices lower. The collective impact of these measures has been to calm a market that was pricing in the need to fill storage at a faster rate, with prices for summer delivery gas climbing above those for the coming winter.

EU gas prices have also fallen as demand from Asia – which competes with the EU for LNG cargoes from the US and elsewhere – has fallen, along with prices in the region. According to IEA analysis, Chinese demand for gas has fallen for four successive months, the longest decline since 2022.

Additionally, a strengthening euro is making gas cheaper for European buyers in the international market, coinciding with the transition from winter to the spring “shoulder season,” which naturally reduces heating demand.

What Does This Mean for Carbon?

Recent price action has demonstrated that the carbon-gas price correlation remains very strong. Short-term correlations have frequently fluctuated around the +0.9 level, but now even longer-term correlations are at +0.75 and above.

The correlation underlines the significant position of speculative traders in the market at present, who have been taking advantage of the historic positive correlation between the two markets to build very large long positions, and the recent sell-off in both markets amply underlines the continued strategy.

However, analysts continue to emphasise that the EUA market is headed towards a major adjustment.

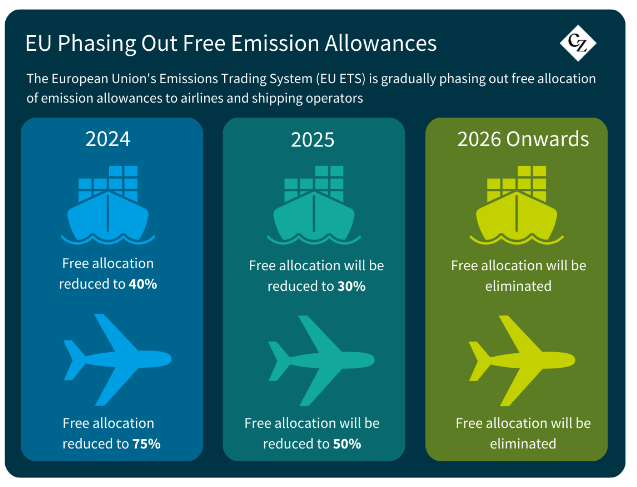

With the end of the REPowerEU sales programme in mid-2026 supply of allowances is set to drop sharply, while changes to free allocation benchmarks and the looming prospect of the CBAM cutting free EUA handouts even further mean that the market is about to enter a period of net annual shortfalls in supply.

The addition of maritime transport to the market last year and an end to free allocation for the aviation sector by next year are also cited as bullish factors.

Analyst forecasts still call for prices to breach EUR 100/tonne by as soon as 2027, with levels expected to reach the EUR 140s/tonne by 2030.