Opinion Focus

- Some major European finished aluminium manufacturers have declined to accept materials of Russian origin.

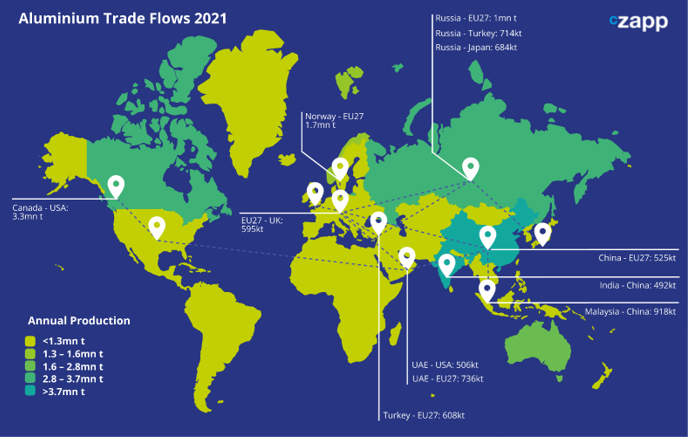

- Russia is the second largest exporter of raw aluminium in the world.

- The food and beverage industry could face significant shortages and price rises.

A European aluminium finished products manufacturer this month announced it was refusing raw aluminium sourced from Russia. Aluminium supply is already being called into question due to plants shuttering as a result of high gas costs. If this move sets the tone for annual contract negotiations, this could have a profound impact on the global packaging market.

Aluminium Production Remains Concentrated

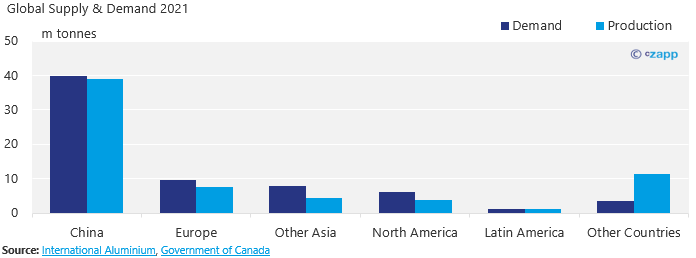

China is by far the largest global consumer of primary aluminium, but much of this demand is satisfied with domestic production.

Almost all of the major aluminium consuming countries operate with an aluminium deficit. Europe – including Russia — produces about 2 million tonnes less than it requires, while North America produces almost 2.5 million tonnes less than requirements.

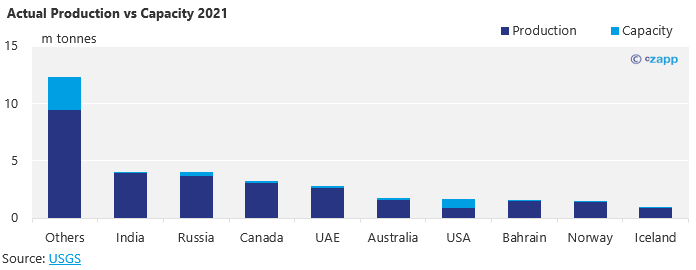

There is very little capacity to ramp up production. The US and Russia have the greatest capacity to bring more capacity online.

Production is concentrated in just a handful of regions. This means that aluminium trade is global.

Decoupling Russia from this landscape is sure to create some supply and demand headaches.

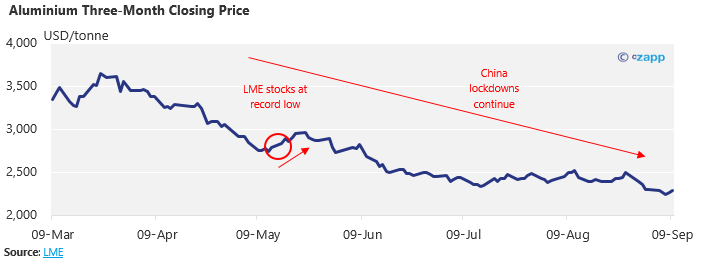

Aluminium Price Tumbles

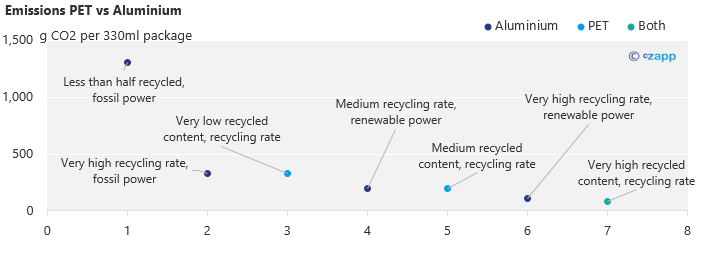

Aluminium is a key packaging material. It is comparable to RPET in terms of its recycling capacity and is generally an inexpensive material.

Throughout 2022, the price of aluminium has been tumbling, mainly due to low demand from top consumer China.

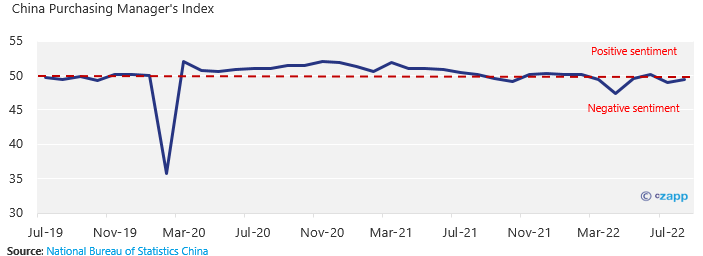

China’s PMI is still struggling to break into positive territory amid continued lockdowns in various regions where Covid-19 outbreaks are detected.

While lockdowns continue in China, manufacturing sentiment is likely to remain negative, which will dent aluminium demand.

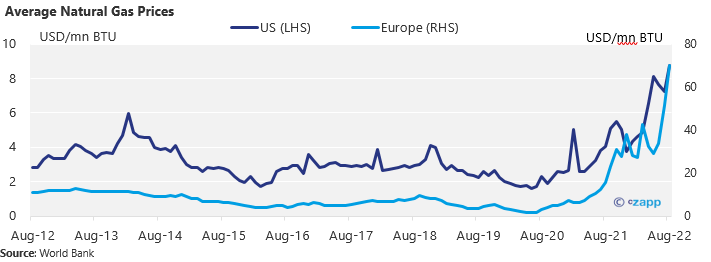

Gas Costs Shutter Capacity

Europe is an especially expensive manufacturing location due to high gas prices.

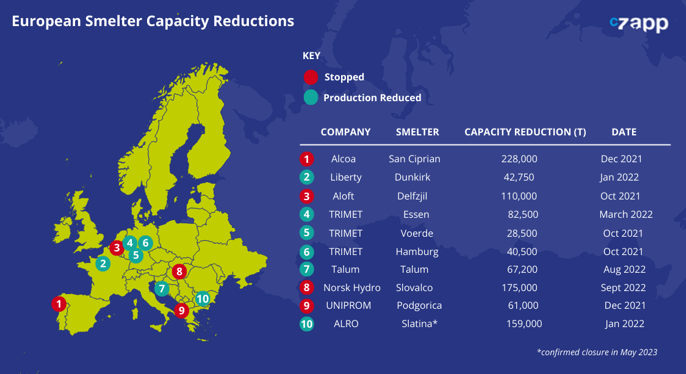

Low aluminium selling prices are combining with rising input costs and forcing many producers to shut down capacity. Already in Europe, just under 1 million tonnes have been taken offline in the past 12 months.

European nonferrous trade body Eurometaux has appealed for EU support and warned that the winter could deliver “a decisive blow” to operations, according to the FT.

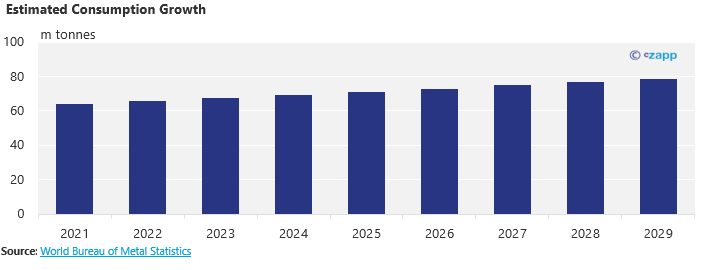

And despite the threat of a global recession, consumption is expected to continue rising to 2030.

Any sharp uptick in demand with so much capacity taken offline is likely to cause a shortage of aluminium, pushing prices up quickly.

Concluding Thoughts

- Recent decisions to reject Russian aluminium could set the tone for annual contract negotiations.

- If this happens, the aluminium market could face huge disruption.

- Europe in particular has a high dependence on Russian primary aluminium.

- Japan also imports significant volumes of Russian aluminium.

- This comes even as smelting production is being shuttered across Europe due to high energy costs.

- Less global supply means a sudden uptick in demand from China could cause the aluminium price to skyrocket.

- Food and beverage packaging manufacturers should keep a close eye on Chinese manufacturing activity.