Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

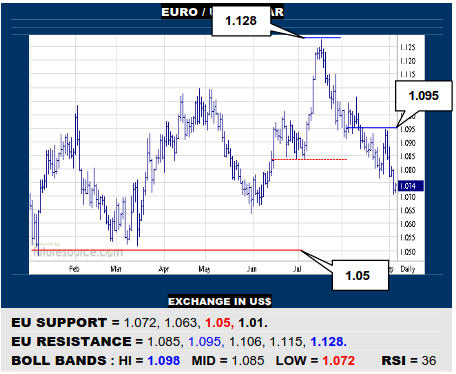

EURO / US DOLLAR

The EU has resumed south from a brief corrective hop but is being tempered by the lower Bollinger band (1.072). Must cater for a bumpy ride then but still leaning towards 1.05 in due course, which marks a sharper cliff edge on down to 1.01. Only a reflex over 1.095 would really make an impact to dispel the generally toppy mid year action.

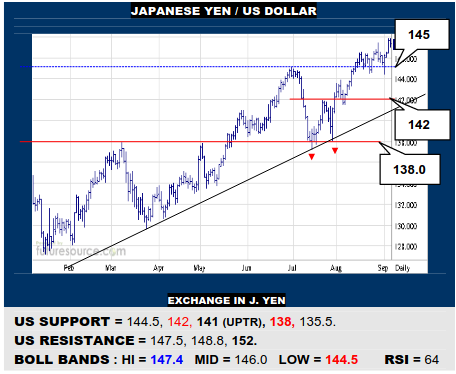

JAPANESE YEN / US DOLLAR

The US is seeking to progress from a nervous spell of consolidation in late Aug that did still largely sustain the 145 escape. Thus continuing to eye the path on up to ‘22’s crest at 152. Only falling through 144.5 would reverse the upside getaway and turn focus back onto the 142 Jly base rim and the uptrend steadily working towards it (141).

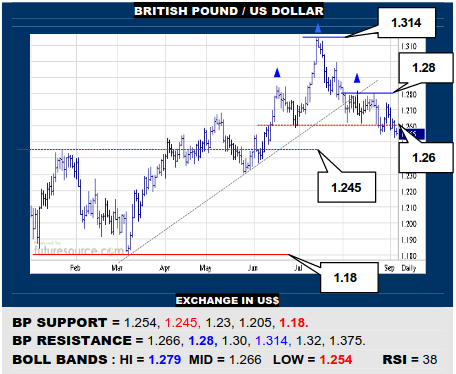

BRITISH POUND / US DOLLAR

Very scruffy action but the BP is currently slipping after breaking 1.26 to propose a summer H&S. Would just seek a confirming break of 1.245 due to its prior relevance to then point on down to a 1.205 top projection. Meantime it would take a reflex over 1.28 to really shake off the top formation and instead suggest new inroads to the 1.30’s.

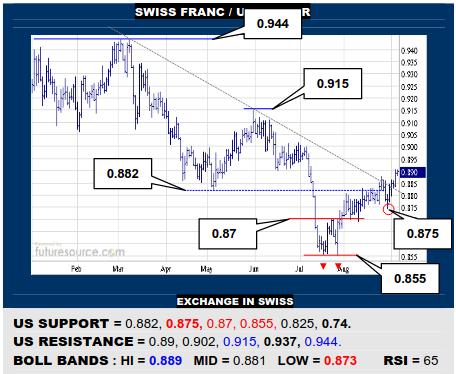

SWISS FRANC / US DOLLAR

The US has gradually gnawed away the mid term downtrend hailing from a large ’22 double top above 0.937 to reveal the next stage of a path back up there, 0.915 the prospective interim rest stop. Awkward action nonetheless so minding the latest 0.875 trough as a key pivot where the rug could be pulled out to provoke a new delve to 0.855.

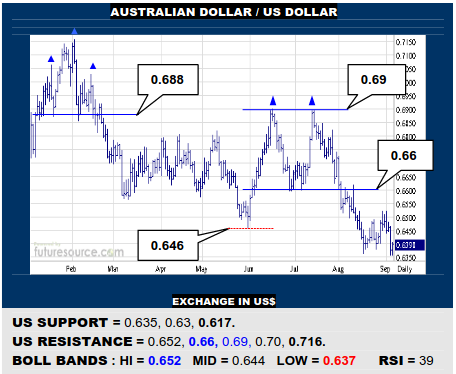

AUSTRALIAN DOLLAR / US DOLLAR

A late Aug corrective swell failed well shy of the mid year double top (0.66) and the AD is dicing with the 0.635 area again, giving a bear flaggish gist and threatening a further snap down to 0.617. Only staunch defence of 0.635 again and a rebound over 0.652 could alter the weak vibe and infer a real chance to dispel the double top.

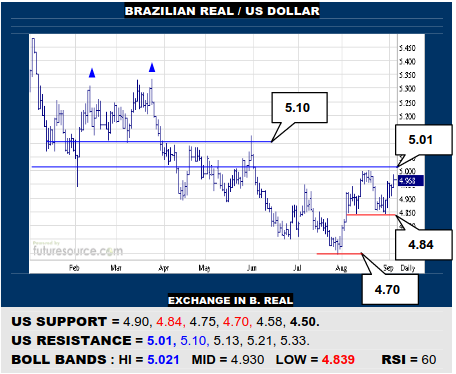

BRAZILIAN REAL / US DOLLAR

The US has shrugged off interim downtrends in Q3 but still needs a decisive thrust back into the 5’s to really disperse the pre-Q2 toppy clutter and thus claim a more reliable turn back onto the upside path. Alas, if still blunted at 5.01, keep a watch over 4.84 as the trapdoor to turn south again and make for the decade long uptrend (4.50) after all.

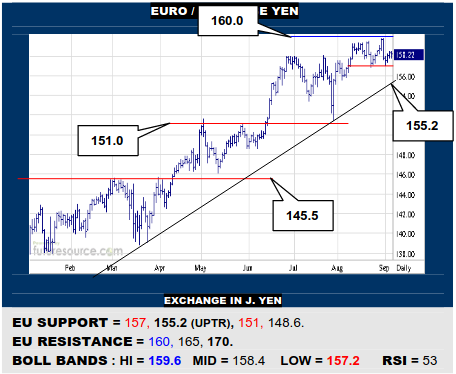

EURO / JAPANESE YEN

Barring one brisk pick-up from the 151’s, Q3 has proven an arduous slog for the EU but graduation into the 160’s could provide a new spark, nothing actually apparent in the way then until 170. Cautious of the rather toppy feel of recent weeks however so do mind 157 as a pivot back down to instead engage the ’23 uptrend (155.2).

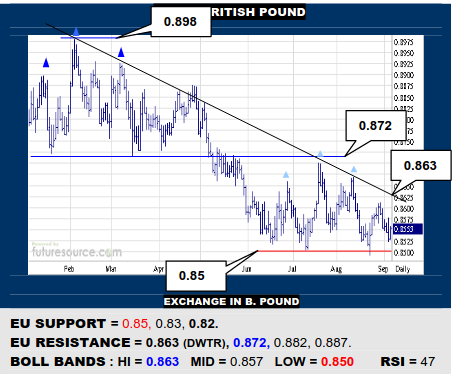

EURO / BRITISH POUND

Summer spikes have all floundered shy of the 0.872 prior H&S rim and a downtrend has become better defined (0.863). At the very least the EU must pierce that trend to perk up for another challenge to the top. Otherwise keenly eying 0.85 as the tripwire to instead resolve a new H&S as a trigger on down to the 0.82 precipice.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.