Insight Focus

The tariff saga rolls on, and now more countries are getting involved. India seems to be in a privileged position as it forges trade relationships with both the US and Canada, while China is pushing ahead with strategic investments in South America. Meanwhile, potential US fees on Chinese ships could put huge pressure on the shipping industry.

US Tariffs Rumble On

As has been the case for several months now, US trade tariffs are the biggest topic of conversation among those in the agri-supply chain. There is still no more clarity as the April 2 “Liberation Day” approaches. So far, 25% blanket tariffs have been imposed on steel and aluminium imports from all countries – a measure that went into effect several weeks ago. A 20% tariff on all imports from China also went into force.

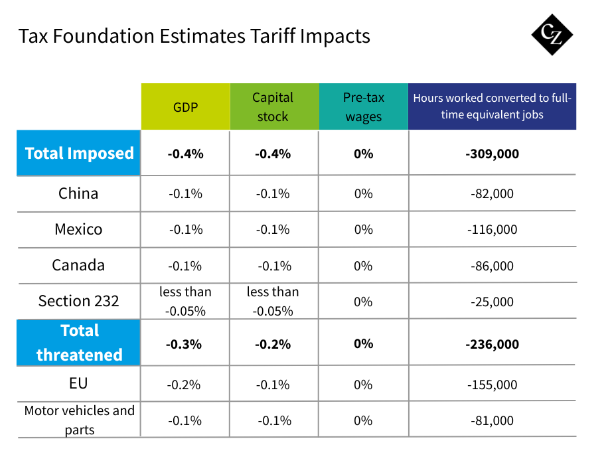

The Tax Foundation has compiled a comprehensive list of all tariffs imposed or threatened so far, which can be found here. It has also estimated the economic impact of the tariffs.

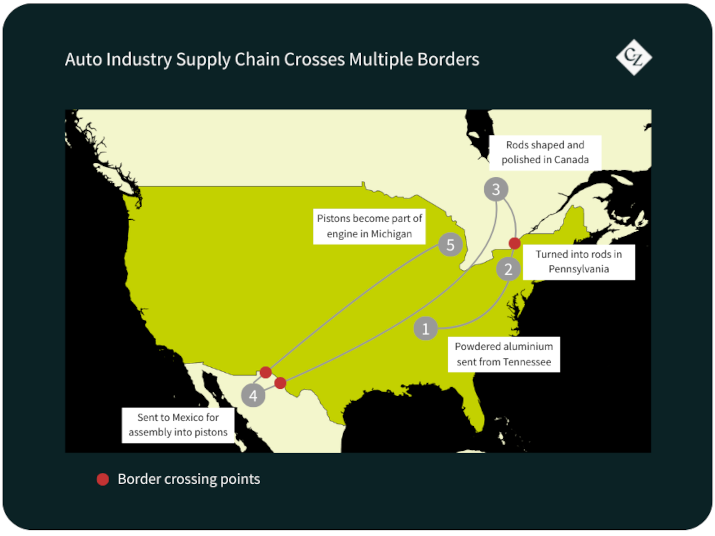

On April 2, a 25% tariff on copper imports is expected to be added and the President also announced last Tuesday that cars and car parts imported to the country would also be subject to 25% fees. This is a cautionary tale of how supply chains may be hugely reshaped by the tariff measures. Much like agricultural production, auto manufacturing often involves multiple border crossings.

Canada has so far responded with identical tariffs on US steel and aluminium and many US agricultural products are being boycotted in Canada. Blanket tariffs on Canada and Mexico are expected to generate retaliation and create huge disruption across the agricultural supply chain.

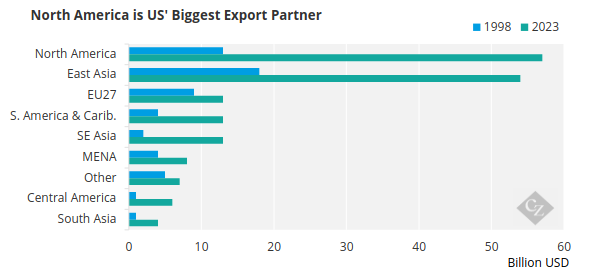

Source: USDA

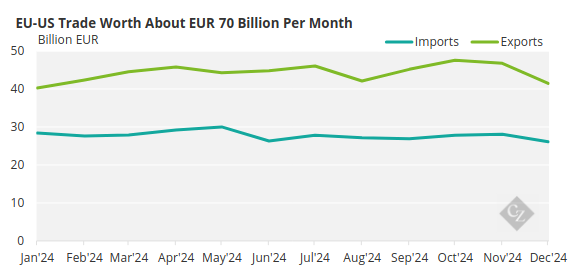

US wine sellers and importers are halting shipments in anticipation of potential 200% tariffs on European alcohol, as threatened by the President on social media. The EU has already announced retaliatory tariffs on US grains, a measure that the European Feed Manufacturers’ Federation says will hurt the bloc’s livestock sector, which relies on imports to meet most of its feed needs. A 25% tariff on US corn, if it goes into effect, could rule it out for major importers such as Spain.

Source: Eurostat

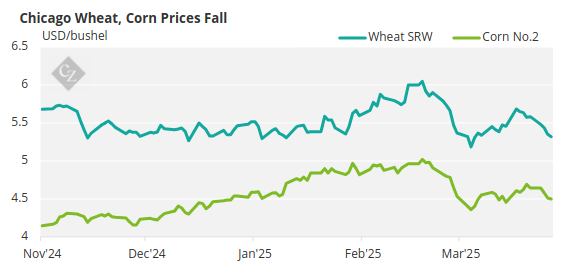

Both Chicago corn and wheat were down at the end of last week, losing about 10% and 11%, respectively, since February 18.

ING has analysed the potential impact on the EU of an escalation in the trade dispute with the US.

US Farmers Under Pressure

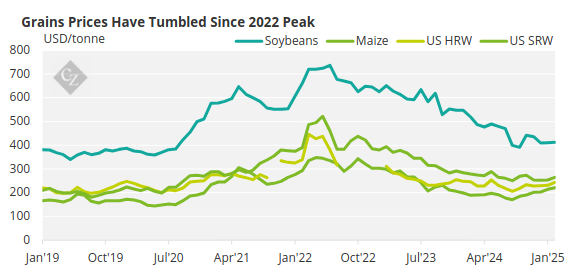

All of these measures not only impact trade partners but they also have major unintended consequences for US farmers. The trade war so far has put at risk about 12 million tonnes of US crop sales to these major markets. Loss of access to these markets could lead to an oversupply domestically and drive down prices.

At the same time, farmers are grappling with increased costs of inputs for essentials such as fuel, feed and equipment. A drop in crop prices has meant that US farmers have faced squeezed margins in the past few years, and this situation is likely to exacerbate the issues.

Source: World Bank

The 2025 federal budget has also disappointed farmers. The 2025 House Budget Plan released by President Trump and Speaker Mike Johnson in February increases spending for border security, the military and tax but requires agriculture funding cuts of USD 230 billion.

US Targets Chinese Shipping

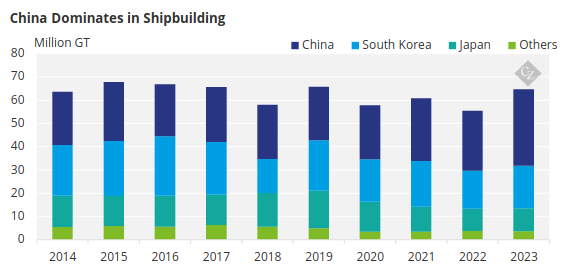

In addition to its host of tariffs, the Trump administration has proposed a million-dollar charge for commercial Chinese vessels visiting US ports. In February, the US Department of Defense added Chinese shipper COSCO to a blacklist but stopped short of imposing any charges at that point.

Critics of the measures say that the fees will in fact hit US ship operators and impact US ports by creating unnecessary congestion. US operator Seaboard, for instance, has 16 Chinese-built ships in its fleet. In fact, given that China’s share in the shipbuilding market grew to over 50% in 2023, this is likely to cause headaches for all operators.

Source: UNCTAD

This comes after the US President laid claim to Greenland and the Panama Canal as it wrestles the Asian powerhouse for control over key shipping channels. This led to the sale of some of the port assets of Hong Kong-based CK Hutchison Holdings, including those that operate the Canal, earlier this month. CK Hutchison Holding operates ports at the Atlantic Ocean and Pacific Ocean entrances to the canal but will now sell these assets to a group of investors led by BlackRock in a deal worth USD 22.8 billion.

US Trade Representative Jamieson Greer is expected to hold his first phone call with his Chinese counterpart next week. US Senator Steve Daines stressed his belief in “constructive dialogue” during a meeting with Chinese Vice Premier He Lifeng in Beijing.

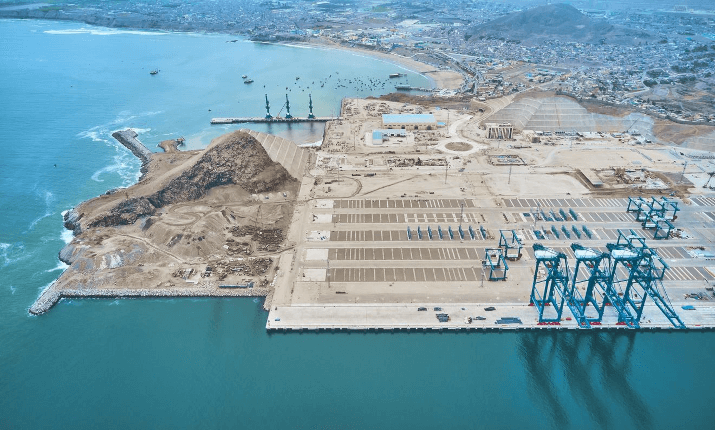

For its part, Chinese-owned COSCO Shipping has been investing heavily in South American ports in anticipation of potential tensions with the Trump administration. Last November, it inaugurated the Chancay Port in Peru, which will allow it greater access to the South American market for goods such as mineral resources, fruits, soybeans, timber and frozen fish.

Chancay Port, Peru

Reshaping Trade Alliances

In the midst of US uncertainty, other countries have been strengthening ties. For several years now – since the first Trump administration — China has purchased more and more agricultural products from Brazil and made investments in the country’s infrastructure.

Canada and India have faced a rocky year of political tensions that centred on Canadian outrage over alleged assassination of a Sikh separatist on Canadian soil in 2023. The fallout resulted in the expulsion of top diplomats from each country. However, it seems that both are now looking to put their tensions behind them amid the global trade uncertainty.

With new Prime Minister Mark Carney at the helm of the North American nation, he has openly addressed the potential to repair ties with India. Although the countries are not major trade partners, Canada does supply some agriculture critical products in the form of fertiliser potash.

At the same time, it seems that India may be one of the only nations to escape the US administration’s wrath in relation to tariffs. The two nations are currently engaged in trade talks with no threats so far of tariffs on April 2 for the Asian country.

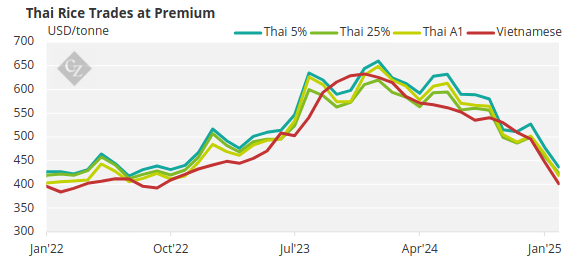

And despite denials from President Trump’s camp that tariffs would be imposed on Thai rice, the country is choosing to keep its options open. Thai Hom Mali rice sells at an average of USD 900/tonne – at a premium to Vietnamese and Cambodian rice. Thailand supplied over 786,000 tonnes of rice to the US in 2024, up from almost 730,000 tonnes in 2023.

Source: World Bank

Vietnam is eager to stay on Trump’s good side, however, and has already moved to cut US tariffs on several of its products, including LNG, cars and ethanol. The country plans to halve duties on US ethanol imports to 5% from 10%.

In Other News…

- The first signs of peace are emerging from the Black Sea region after the US said a ceasefire agreement has been reached between Russia and Ukraine. Under the agreement, Ukraine maintains control of the eastern part of the Black Sea and both parties agreed to ban strikes on energy facilities. However, the process is not all smooth sailing as already the countries have not been able to agree on the timing and all the conditions. In the meantime, President Trump says if he finds the delays to be Russia’s fault, he’ll impose secondary tariffs on Russian oil. But this came after he said he is “looking into” lifting Russian sanctions.

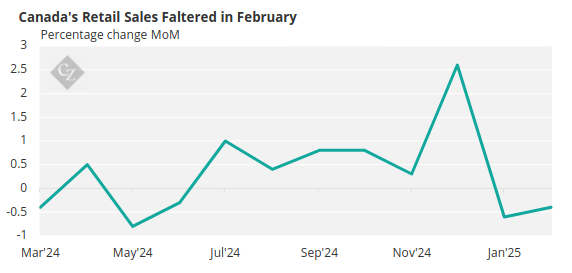

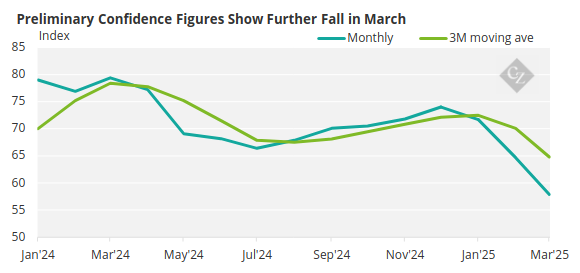

- As the trade war rages, both the US and Canadian economies are taking a hit. Retail sales in Canada weakened month over month in February and US consumer confidence slumped.

Source: Statistics Canada

Source: University of Michigan

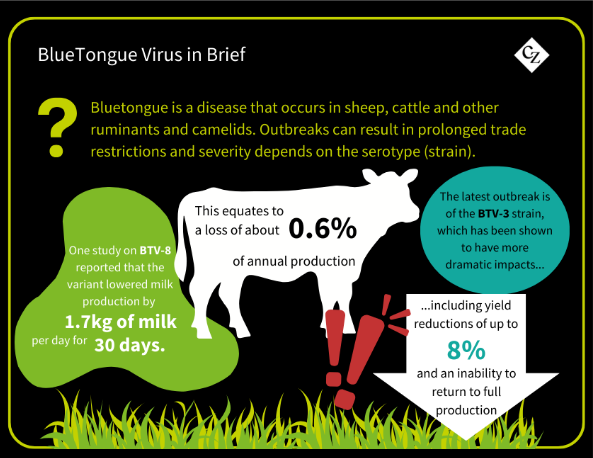

- It seems like livestock in Europe can’t quite catch a break. Last year, ruminants in Germany were hit by an outbreak of Bluetongue virus. Now, foot and mouth disease has been detected near Berlin. In March, Hungary and Slovakia also confirmed cases, leading to the latter declaring a state of emergency as culling measures are being put in place.