Insight Focus

Global wheat end stocks are at their lowest in nearly 10 years. The Black Sea, the US and Canada have been exporting at pace since the summer harvests. Harvests from Argentina and Australia could be critical to trade flows and supply volumes in early 2025.

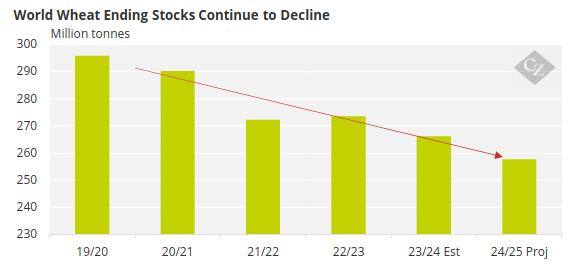

Wheat Ending Stocks Deplete

Global wheat stocks are now at critically low levels. USDA figures show that global ending stocks for 2023/24 are estimated at 266 million tonnes, down 2.5% from 2022/23. Projections for 2024/25 are even lower at 257 million tonnes.

Source: USDA

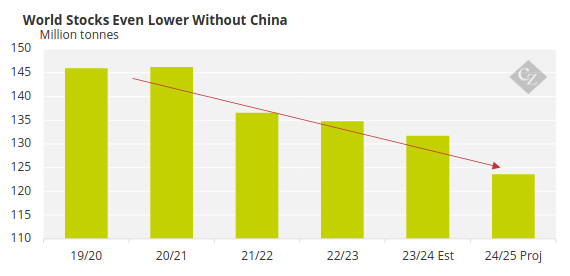

The situation is made even more stark when examining wheat stocks excluding China. China is known to stockpile large amounts of agricultural commodities due largely to its quest for food self-sufficiency.

Source: USDA

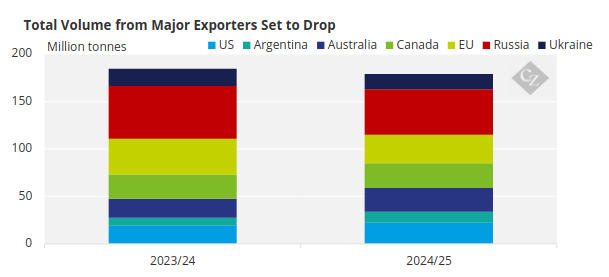

With all the Northern Hemisphere’s major exporters, except the EU, having had a large shipping program so far, it is inevitable that shipping here will slow somewhat into the new year.

Sellers from the Black Sea have been shipping record volumes, especially Russia and Ukraine. Meanwhile, the US and Canada have seen greater tonnages than forecast moving out in the first half of the marketing year.

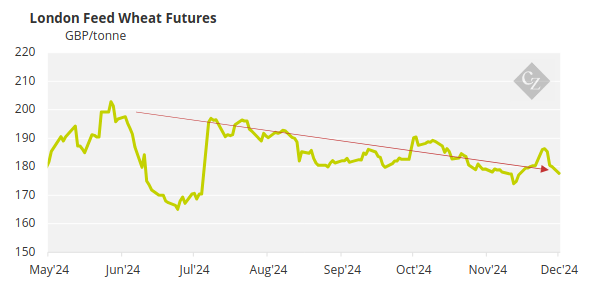

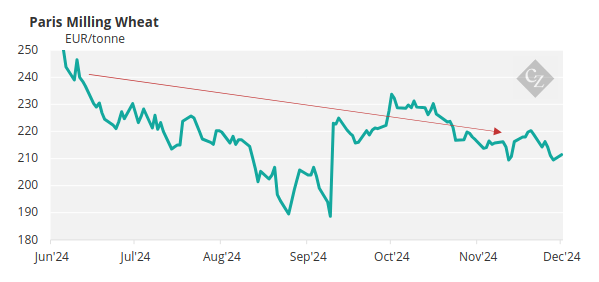

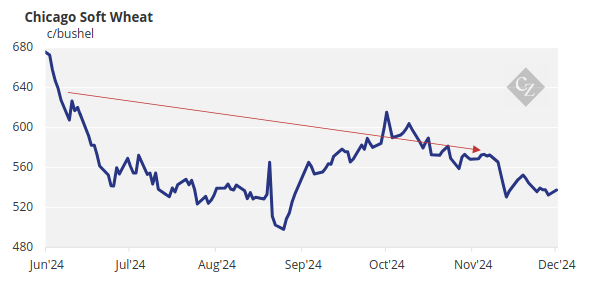

Despite reductions in stocks, high volumes of exports so far this year have created some bearish sentiment in wheat pricing.

Exports Set to Slow

The EU had a very poor harvest in 2024, keeping it generally away from the export markets. The exceptions were the Black Sea countries, such as Bulgaria and Romania, who had much better exportable surpluses and have been competing into the Mediterranean market.

Russia harvested 81-82 million tonnes in 2024 – some 10 million less than in 2023. As a result, export forecasts range from 44 to 48 million tonnes, down from 55 million tonnes last year. Still, exports have been strong, prompting the Russian government to drastically reduce export quotas for the EEU* from February 15 to June 30, 2025, cutting them to 11 million tonnes from 29 million tonnes last year. This will likely bring the final export total closer to 44 million tonnes than the forecasted 48 million tonnes.

*The EEU includes Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia, and coordinates customs and tariff policies for all its members.

Ukraine has harvested 22-23 million tonnes in 2024, with exports expected to reach around 16 million tonnes. However, the exceptional rate of shipments since the harvest has led the government to introduce minimum export prices starting last week.

The US has also been shipping at a rapid rate. Exports are running at over 30% above last year, following a larger crop. With the USDA forecasting an increase of only 17%, it looks as though exports will slow as we head into 2025.

Canada mysteriously found an extra 2.75 million tonnes in store from previous campaigns and has joined the group of rapid exporters this year. It too may need to rein this in the new year to avoid exceeding the 26 million tonne export forecast.

Argentina, with prospects for an improved harvest, is competitively priced to increase export sales from last year by about 3 million tonnes, reaching 11-12 million tonnes.

Australia is also on track for an improved crop as the combines continue to roll. Estimates of a 6 million tonne increase, bringing the total to 32 million tonnes, should enable an additional 5 million tonnes of exports for the new year.

Source: USDA

Will This Prompt a Price Correction?

The fundamental issue for shipments in early- to mid-2025 will likely hinge on Argentina’s and Australia’s ability to reap the size of crops anticipated, helping to make up for the Northern Hemisphere exporters’ shortfall as we await the 2025 harvest.

The question then remains as to whether Argentina can competitively supply any shortfalls into North Africa. Middle Eastern buyers may see prices rise if supplies struggle, despite shipping rates providing access to most major sellers. The Asian market will miss Black Sea wheat less, as possibilities from Australia, Argentina and North America should still be available.

But despite North America’s best efforts, an extra 3 million tonnes of exportable surplus in Argentina and 5 million tonnes in Australia may not be enough to compensate for the 18-20 million tonnes lost this year from the EU and Russia.

With dwindling global stocks at 257 million tonnes, a near 10-year low, the pressure may mount if buyers want to continue to enjoy the abundance of cheap, willing sellers they have benefitted from in recent months.