- The 2020 wheat crops have suffered from both drought and flooding.

- However, global stocks are growing, and prices continue to rise.

- Is there any logic behind the market rise?

The Wheat Market Moves

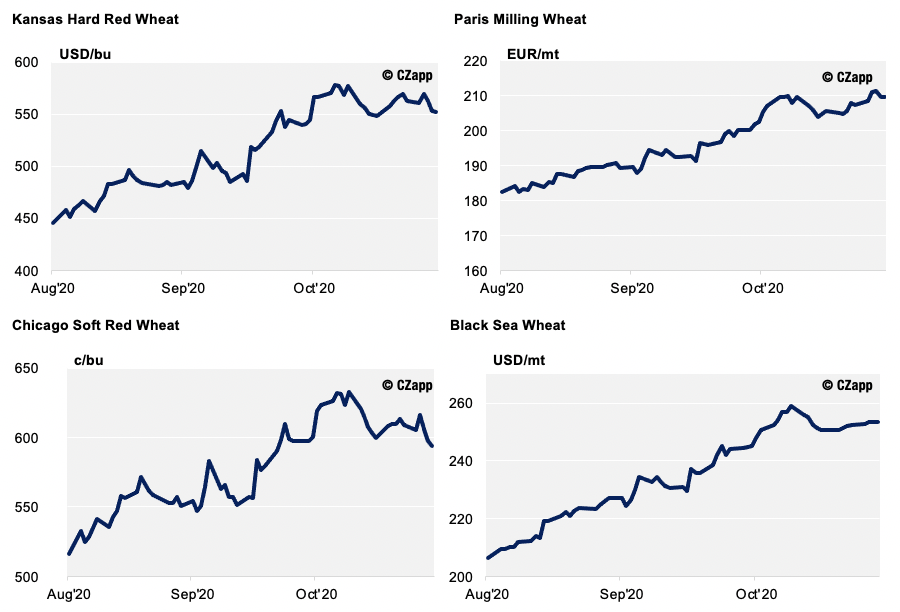

The global markets have been on the up ever since the Northern Hemisphere harvests romped into full swing in July and August.

However, the Northern Hemisphere wheat crops suffered from both drought and flooding this year.

Despite this, the harvest results as the wheat hit the barns have finally given more confidence in the numbers to trade; the consequence of this being higher prices and robust trade around the globe.

Global Wheat Stocks at Record High

Following the US Department of Agriculture’s (USDA) World Agricultural Supply and Demand Estimates (WASDE) over recent months has been interesting.

With the growing difficulties for the 2020 crops, there was a greater degree of uncertainty and scepticism over expected production than normal.

These weather extremes have produced some notable production variations compared with 2019. Despite this, total world production for 2020/21 should total 772.38mmt compared to 764.94mmt in 2019/20.

The most noteworthy differences are:

- On the downside, the EU -18mmt and US -3mmt

- On the upside, Australia +13mmt, Russia +10mmt, India +4mmt and China +2mmt

The resilience of wheat has shone through and the farmers have managed to produce better Northern Hemisphere crops than anticipated. This has been shown in the monthly WASDE from August to November as production figures have climbed for major exporters:

- Russia (November 83.5mmt vs. 78mmt August)

- EU (November 136.55mmt vs. 135.5mmt August)

- Canada (November 35mmt vs. 34mmt August)

This has more than offset the marginal decline for:

- The US (November 49.69mmt vs. 50.01mmt August)

- Ukraine (November 25.5mmt vs. 27mmt August)

The Southern Hemisphere wheat crops in exporters Argentina and Australia are still to be realised, but the ever-growing Australian production numbers (November 28.5mmt vs. 26mmt August) offset the decreasing Argentinian crop (November 18mmt vs. 20.5mmt August)

This all leads to the world exporters projected end stocks, according to the latest WASDE Release, at 61.81mmt in November vs. 61.06mmt in August.

So, Why Are Prices Rising?

If we compare the 2020/21 stock number to the 2018/19 end stocks for the major exporters at 67.89mmt, and consider a 10% drop in marketable grains, we begin to see more plausible answers as to why the markets have risen.

Interestingly, with the world market end stocks in 2020/21 estimated at a record level of 320.45mmt (up 36.34mmt from 2018/19), we must note the disproportionate amount of stock held by China (163.68mmt) and India (31.11mmt). An incredible 60% of global stockpiles in just two countries!

This prompts a thought on food security in China and India, as the most populous countries on earth are understandably nigh-on obsessed with food security for their vast populations.

The lingering coronavirus effect of logistical uncertainty, that we have touched on in previous articles, helps us comprehend the robust buying activity from the big importers, such as Egypt. If shipping is disrupted by coronavirus lockdowns, their food and hence political stability become unstable.

Weather is always a significant player in market movement. We have, yet again, in the autumn of 2020 seen less than ideal planting conditions for the Northern Hemisphere farmers.

Winter sowing has been hampered by excessive moisture in parts of Europe, while dry conditions over areas of Russia and the Ukraine have reduced acreage expectations. The US plains have equally been in the midst of a dry spell, giving concern to the rapidly drilled 2021 crop.

End Results

Simple economics tells us that large supply is more likely to depress prices than raise prices.

Currently, the record world stocks, and recently rising prices defy this logic.

However, consider where the stocks are. In reality, stocks in China and India are unavailable to the wider market. Major exporter stocks less than the recent past years create the simple reduced supply side of the equation to stimulate the rise in value.

Add in a difficult planting season and the ensuing crop uncertainty for 2021 and the future looks far from certain, despite the world being regularly reported as ‘awash with wheat’!

Other Opinions You Might Be Interested In…

- Czapp Explains: Global Wheat Futures

- The World’s Largest Wheat Users and Importers

- The World’s Largest Wheat Producers and Exporters