Insight Focus

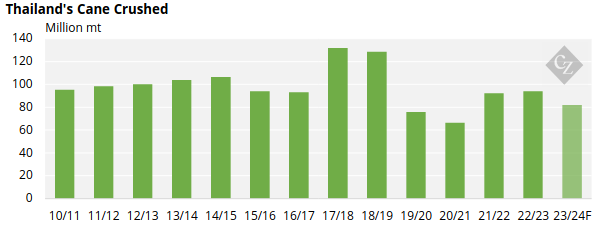

- Thailand should crush 82m tonnes cane this year, in line with previous seasons.

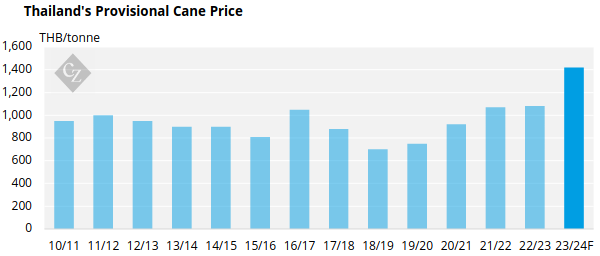

- Farmers are receiving record high prices for their cane.

- 24/25 cane crushing could exceed 100m tonnes.

We had previously expected this year’s Thai cane harvest to be a disaster; the worst in a decade at 66.5m tonnes. This followed extremely dry weather in H1’23, stunting cane development.

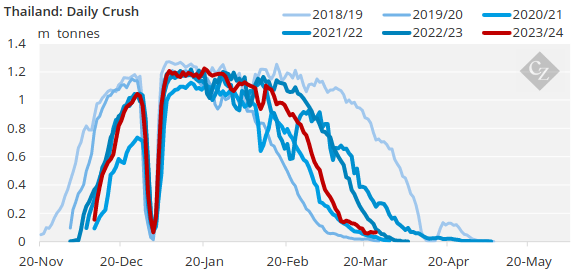

As it turned out, unseasonably high rainfall in September and October saved the crop, allowing the cane to mature later than normal. We’d feared a 23% drop in cane yields, but the eventual fall was just 8%. The 2023/24 cane crush is likely to reach around 82m tonnes, broadly in line with recent years’ output.

This year’s good performance leaves open the possibility of a large cane crop next season, assuming normal weather.

The price that farmers are paid for their cane is linked to world sugar market returns. Sugar futures have strengthened for 4 years now, recently peaking at 12-year highs of 28c/lb. This means that farmers will be paid a high provisional cane price and so will have planned accordingly. For the first time in 5 years, cane will be the best retuning major crop in Thailand, exceeding cassava returns once more.

We therefore expect cane area to increase, and for farmers to pay for better cane maintenance and more field inputs. This should lead to higher cane yields too.

We think the 24/25 cane crush could exceed 100m tonnes for the first time in 6 years. Mills have the capacity to process the cane if this happens; recent daily crushing rates have been below historical peaks.

The future for Thailand looks bright once more.