Insight Focus

Grain markets experienced a negative week due to continued poor demand and harvest pressures. Supply risks remain from adverse weather conditions and declining yields. We expect ongoing pressure on US grains, while European values may see some support.

It was a negative week for all grains across all geographies, continuing the negative sentiment from the October WASDE report and weak Chinese demand.

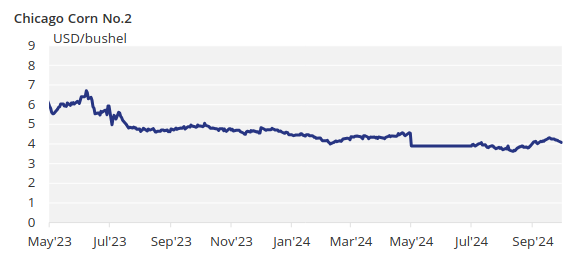

Corn prices in Chicago faced harvest pressure last week, which, coupled with favourable weather in most producing regions, contributed to the negative week. However, supply risks remain from prolonged dry and hot weather in Eastern Europe, declining Russian corn yields and the potential reduction of Russia’s wheat export quota.

Harvesting in France is progressing slowly. We should continue to see more pressure on US grains, while European values may experience less pressure or even support due to tight Eastern European and Russian supply.

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 3.9/bushel. The average price since September 1 is running at USD 4.1/bushel.

Corn Market Faces Decline

Both corn and wheat opened on the defensive last week, still affected by the October WASDE report and favourable weather in South America and the US. However, the market turned around during the second half of the week as concerns about supply from Russia and the Black Sea region resurfaced. Friday was negative again after China reported poor imports during September.

The pace of the US harvest contributed to the negative sentiment, along with a lack of any supportive news.

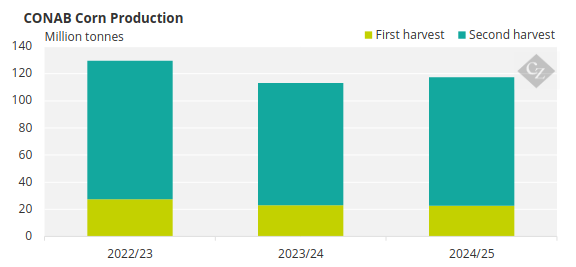

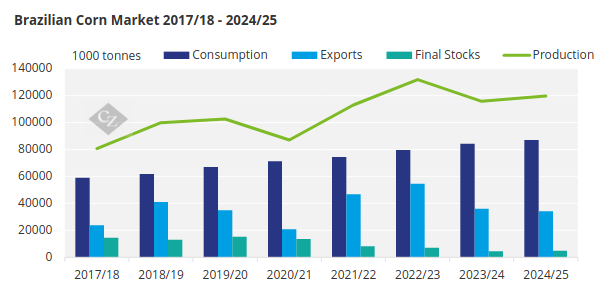

CONAB in Brazil slightly reduced its projection for the summer corn crop (the small first crop) to 22.7 million tonnes, down from 23.4 million tonnes previously. This was partially offset by an upward revision to Safrinha (second crop) production, now at 94.6 million tonnes, compared to 94 million tonnes before. Overall corn production was marginally reduced to 119.7 million tonnes from 119.8 2222million tonnes previously.

Source: CONAB

US corn conditions remain at 64% good or excellent, unchanged week-on-week and compared to 53% last year. Currently, 47% of the US corn crop has been harvested, compared to 42% last year and the five-year average of 39%.

French corn conditions were reported at 78% good or excellent, flat week-on-week and compared to 83% last year. Harvesting in France is 13% complete, a significant slowdown compared to 67% harvested at this time last year and the five-year average of 55%.

Russian corn is 59% harvested with a yield of 4.69 tonnes/ha, down from 6.19 tonnes/ha last year. Ukrainian corn is also 59% harvested, up from 34% last year, with a yield of 5.56 tonnes/ha compared to 6.74 tonnes/ha last year.

In Argentina, corn planting is 24.3% complete. In Brazil, summer corn planting is 28.8% complete, down from 30.4% last year.

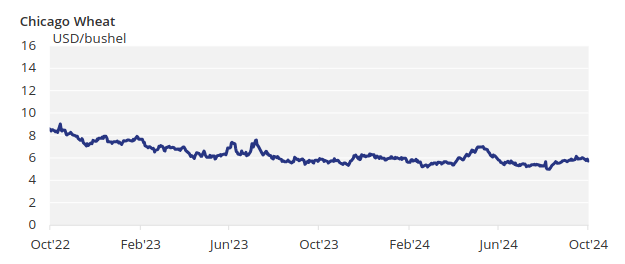

Weak Demand Pressures Wheat Prices

Wheat also had a negative week, with Russia now having harvested 97% of its wheat, collecting 85.8 million tonnes gross weight, which aligns with the government’s projection of 83 million tonnes of clean product. Therefore, no further surprises are expected regarding Russian wheat production, although there may still be limits on their exports, which have yet to be announced.

US spring wheat is now fully harvested. Winter wheat planting is 64% complete, compared to 65% last year and the five-year average of 66%. Russian wheat is 97% harvested with a yield of 2.98 tonnes/ha, down from 3.3 tonnes/ha last year. In Ukraine, winter wheat planting is 75% complete, compared to 69% last year.

In France, winter wheat planting is only 10% complete, down from 32% last year and the five-year average of 27%.

On the weather front, cold and rainy conditions are expected in the US. Brazil is finally expected to receive much-needed rains across the entire central-south region.

In Europe, France is forecast to have mild temperatures and some rain, while ample rain is expected in Germany. Eastern Europe is anticipated to remain dry and hot.