Insight Focus

Grain prices rose last week due to weather concerns. However, further gains for Chicago corn are not expected as the drought in Eastern Europe appears priced in, and only significantly lower yields could drive prices higher. Flat to downside risk is anticipated in the coming weeks.

All grains were up last week across all geographies due to weather concerns. But despite last week’s rally, we do not see any compelling reason for Chicago corn prices to rise further. We believe the drought in Eastern Europe is already factored into prices, and only if yields fall further than the current downgraded estimates would we anticipate additional upside risk.

Chicago corn may face harvest pressure unless rain slows down harvesting this week. We expect flat to downside risk in the coming weeks.

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 3.90/bushel. The average price since September 1 is running at USD 4.02/bushel.

Corn Prices Supported by Lower Production

Corn in Chicago opened last week with a rally on Monday, driven by weather worries. It consolidated the gains throughout the week, adding another rally on Friday and closing 4% up for the week.

In the EU, the MARS bulletin reduced its forecast for corn yield to 6.84 tonnes/ha from the previous estimate of 7.03 tonnes/ha and below the five-year average of 7.35 tonnes/ha. This reduction is a result of the very hot and dry weather Eastern Europe experienced over the summer. Romania, in particular, is a major concern, and reports suggest a large number of contracts have been cancelled.

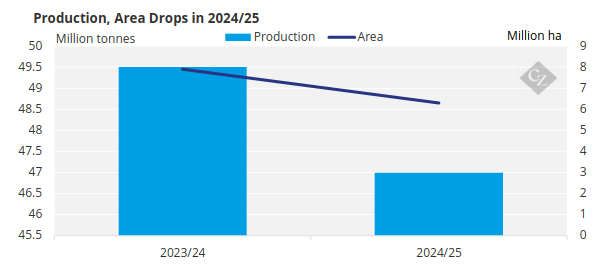

BAGE in Argentina published its first production forecast for 2024/25 at 47 million tonnes, a 5.1% year on year drop, mostly due to reduced planted area.

Source: BAGE

US corn conditions remain 65% good or excellent, unchanged week-on-week and compared to 53% last year. US corn is 14% harvested, slightly ahead of 13% last year and the five-year average of 11%. The area under drought conditions improved marginally to 25%, compared to 26% the previous week.

In France, corn conditions stand at 79% good or excellent, down one point week-on-week and versus 82% last year. The harvest in France has begun, with 1% complete, compared to 10% at the same point last year.

In Russia, 20% of the corn crop has been harvested, while in Ukraine, 23% has been harvested with an average yield of 5.13 tonnes/ha, 5.4% lower year on year.

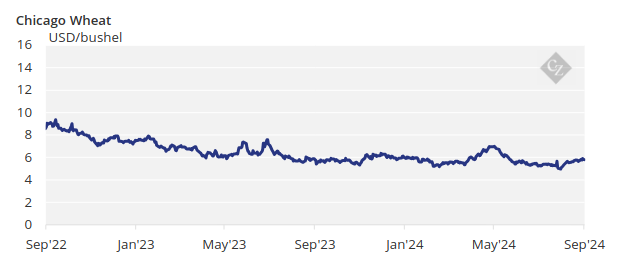

Wheat Experiences Mild Gains

Wheat followed corn but saw milder weekly gains, with no significant new developments impacting supply. In the US, spring wheat is 96% harvested, in line with 95% last year and the five-year average. Winter wheat planting is 25% complete, compared to 23% last year and 24% of the five-year average.

Russian wheat is 83% harvested, with a yield of 3.15 tonnes/ha compared to 3.18 tonnes/ha last year. In France, winter wheat planting has begun, with 1% complete compared to 0% at this time last year.

On the weather front, the US Corn Belt is expected to receive some rain, which could slow the pace of harvesting. In Brazil, southern regions will continue to see rain, while the central part of the country is expected to remain hot and dry. Argentina is expected to have dry and cold conditions.

In Europe, France and Germany are forecasted to have warm and dry weather, which will be beneficial after recent excessive rainfall. Eastern Europe and the entire Black Sea region are expected to remain warm and dry, helping to alleviate the effects of last week’s floods.