Insight Focus

Grain markets have lowered across all geographies. A safe passage agreement in the Black Sea, and expected USDA stock forecasts, have weighed on the market. Moving forward, tariff concerns and supply forecasts may continue to drive volatility.

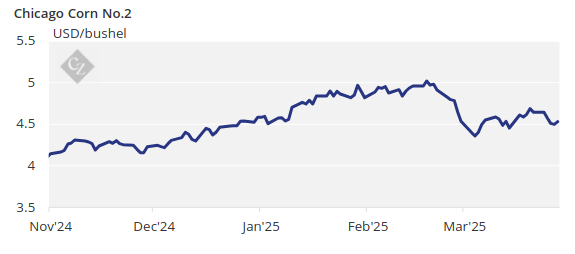

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 4.55/bushel. The average price since September 1 has been running at USD 4.40/bushel.

A safe corridor was agreed upon for the Black Sea, and expectations of higher US wheat quarterly stocks and increased US corn acreage pushed all grains lower across all geographies.

USDA Reports Predicted to Signal Higher Stocks

The USDA quarterly stock report is expected to show corn stocks of 8.15 billion bushels (down 2.4% year-on-year), wheat stocks of 1.2 billion bushels (up 12.1% year-on-year), and soybean stocks of 1.9 billion bushels (up 3.3% year-on-year).

The planting intentions report is expected to show 94.4 million acres for corn, compared to the USDA outlook forum’s 94 million acres at the end of February and 90.6 million acres last year. Wheat acreage is expected at 46.5 million acres, compared to 47 million from the USDA forum and 46.1 million last year.

Last week brought only bearish news, all pointing to higher supply. However, the reality of the safe passage deal in the Black Sea is that vessel flow was already happening, meaning that, in practice, nothing changes from a trade flow perspective. Nonetheless, it added to the bearish sentiment driven by higher wheat quarterly stocks, which were not supported by lower expected acreage.

We expect the quarterly stock report to be supportive for corn. Since the market has already priced in higher corn acreage, we do not anticipate another negative week. However, this is also “tariff week,” with new tariffs on EU products expected this Wednesday and potential European retaliation before the end of the month. Any fundamental support may be overshadowed by tariff-related announcements, leading to expected volatility this week.

Corn Prices Drop on Tariff Concerns

Corn in Chicago opened negatively last Monday and continued trading lower throughout the week due to concerns about import tariffs on US corn and higher acreage in today’s prospective planting report by the USDA.

Wheat also pulled corn lower as it sold off following a ceasefire agreement for the Black Sea and expectations of a significant quarterly stock number.

The estimate for the quarterly stock report and prospective planting report, published March 31, predicts corn acreage to reach 94.5 million acres, exceeding the USDA’s projection of 94 million acres from a month ago.

In Brazil, Safrinha planting was 95.6% complete compared to 96.8% last year. The summer corn harvest was 48% complete versus 42.8% last year.

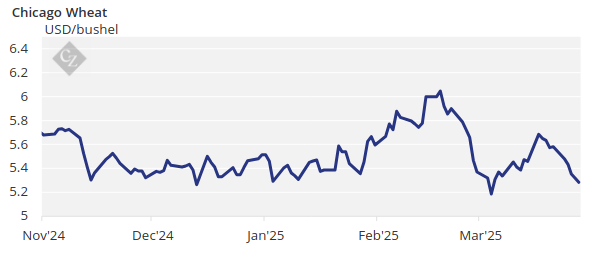

Wheat Prices Slide on Strong Supply

On the wheat front, rains in US growing regions were confirmed at the beginning of last week, further pressuring wheat in Chicago.

Additionally, the US announced a separate agreement with Ukraine and Russia to secure the safe passage of vessels in the Black Sea, leading to further selling in both European and US wheat futures. Ikar in Russia increased its wheat production estimate to 82.5 million tonnes, 1.5 million tonnes higher than its previous estimate.

Better-than-expected weekly inspections of US wheat did not halt the selloff, which continued through the end of the week.

The March MARS bulletin from the EU reported that grain crops are in fairly good condition. The soft wheat yield was forecast at 6 tonnes/ha, up from 5.58 tonnes last year and 5.77 tonnes over the five-year average.

French wheat conditions remained unchanged for the fourth consecutive week at 74% good or excellent, compared to 66% last year.

On the weather front, the US Midwest received fairly good rains last week as expected, with more stormy weather forecasted this week, which will improve soil moisture. Brazil is expected to remain dry in the centre-south, with some showers in the south, while Argentina is forecasted to receive rain. Northwest Europe is expected to remain dry and warm, whereas rain is expected in the Black Sea region.