Insight Focus

Grains survived the macro storm and closed the week positively. The EU meets this week to decide about tariffs on US goods. Fundamentally the market should be well supported at actual levels, but the trade war will dictate market direction and volatility in the very short term.

Grains Weather Tariff Storm

It was a volatile week for all grains, starting with the USDA quarterly stock report, the planting intentions report, Trump imposing new tariffs across the board last Wednesday and China retaliating by applying the same level of 34% on all US imports by the end of the week.

The grains complex held up relatively well last week despite a generally negative week for commodities. Only soybeans plummeted, as they are a significant part of Chinese imports, but corn and wheat managed to close the week positive, with only corn in Euronext experiencing small weekly losses.

The EU will meet this week to decide on measures to address the US tariffs announced last week, which is likely to bring volatility to the market. On the US side, Trump appears to already be exploring ways to bail out US farmers, who will be affected by losing market share in export markets. This is not the first time this has occurred, as during his first term he approved a USD 23 billion subsidy package to farmers.

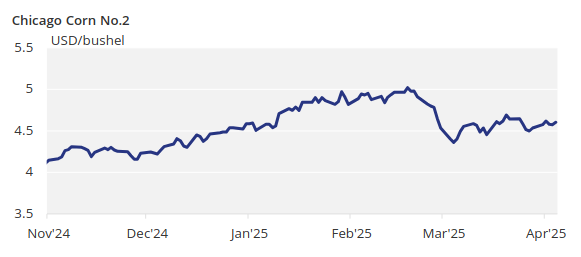

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 4.55/bushel, with some downside risk depending on the trade war. The average price since September 1 has been USD 4.40/bushel.

Corn Acreage Higher than Expected

The start of the week was positive, with lower US stocks as of March 1, despite higher-than-expected corn acreage.

US corn stocks as of March 1 came in at 8.15 billion bushels, in line with expectations, and corn acreage for the new crop was 95.3 million acres, compared to the expected 94.4 million acres, and much higher than the 94 million acres estimated in the USDA forum in February.

In Brazil, Safrinha planting was 97.9% complete, compared to 98.7% last year. The summer corn harvest was 53.3% complete, compared to 48% last year.

Lower Acreage Drives Wheat Market

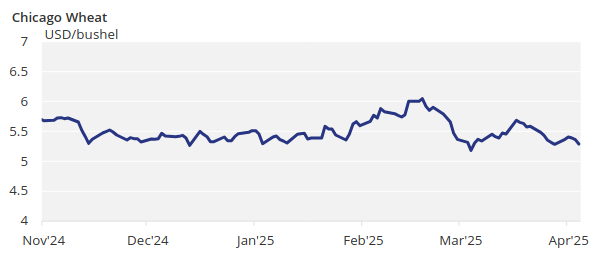

On the wheat front, the market was strong during the first half of the week, following lower-than-expected US wheat acreage, which would be the second-lowest acreage since 1919.

Wheat acreage was estimated at 45.4 million acres, down 2% year-on-year. This would be the second-lowest wheat planted area since 1919. US wheat stocks as of March 1 were 1.24 billion bushels, higher than the 1.2 billion expected by the market.

The condition of French wheat was 76% good or excellent, up two points from last week, and compared to 65% last year.

On the weather front, a late cold storm with heavy rains will hit the US Midwest. Rainy weather is also expected in Brazil’s centre-south, while there is a risk of frost in Argentina. Western Europe is expected to receive rains again, while the Black Sea region is expected to experience just some showers.

In addition to tariff volatility this week, we have late frost in Argentina, which could potentially damage corn, and stormy weather in the US, which could delay the start of the planting season. Fundamentally, the market should be well-supported at current levels, but the trade war will dictate market direction and volatility in the very short term.