Insight Focus

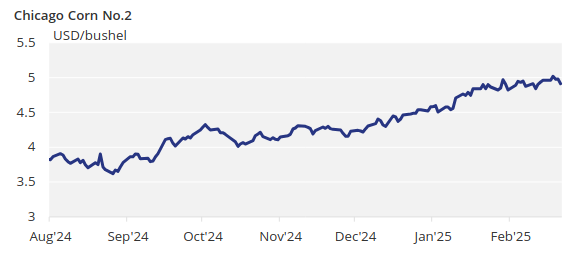

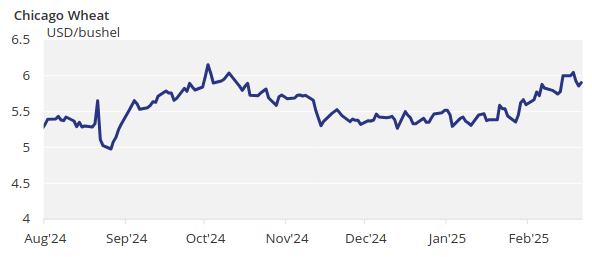

Chicago corn cleared USD 5/bushel last week. Chicago wheat cleared USD 6/bushel. However, both closed the week negative. The focus now shifts to the May futures as the March WASDE report coincides with the expiry of the March contract and talk of higher acreage may lead to long liquidation.

Upcoming WASDE Reports Could Drive Prices

After corn in Chicago cleared USD 5/bushel, the market saw some profit-taking following the rally that began in December. However, higher prices will likely require fresh fundamental news, which could come from tighter stocks in any of the upcoming two WASDE reports.

We believe a lower US carry is justified by higher demand for ethanol and increased exports, while lower world stocks are driven by reduced production in Argentina and Brazil. The focus is also starting to shift toward new crop planting intentions, with improved corn profitability suggesting higher acreage.

The March WASDE report will almost coincide with the expiry of the March futures contract, so the focus will turn to the May futures contract. With a lack of fundamental news until the next WASDE, talk of higher acreage for the new crop, and the large speculator long positions, long liquidation may continue.

However, sooner rather than later, lower US and world stocks should be confirmed, providing good support. We expect the May futures contract to hold above the USD 5/bushel level.

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August) to average 4.55 USD/bushel. The average price since September 1 is running at 4.4 USD/bushel.

Chicago Corn and Wheat End Week on a Downturn

March Corn began the week on a strong note, closing above USD 5/bushel on Tuesday. However, the market saw a pullback on Wednesday and Friday as profit-taking took hold, ending the week at USD 4.9/bushel. The early-week rally was driven by better-than-expected export inspections, which were up 19% week-on-week, well above expectations.

In Brazil, the slow pace of the soybean harvest—25.5% complete vs. 29.4%—continues to delay Safrinha corn planting, which is 35.7% complete vs. 45.3% last year. The first corn crop is 21.1% harvested vs. 21.4% last year. Corn planting in Argentina is complete.

Just like corn, Chicago wheat started strong, closing above USD 6/bushel last Tuesday, but finished the week lower, posting weekly losses of almost 2%. Euronext also saw declines, driven by improving conditions in France.

The cold front in the US last week fuelled the early-week rally, but US wheat inspections then disappointed and prompted the market to sell off.

French wheat conditions, published last Friday, showed 74% in good or excellent condition, up from 73% the previous week and compared to 69% last year.

On the weather front, the US experienced a cold front with freezing temperatures starting last Thursday, increasing the risk of winter kill. South America is expected to receive some rain, both in Brazil and Argentina. Rain and average temperatures are expected in Northwestern Europe, similar to Eastern Europe.