Insight Focus

- Favorable weather in the US hits grains markets.

- Wheat harvest selling pressure may have contributed.

- Black Sea exports remain heavily disrupted.

Forecast

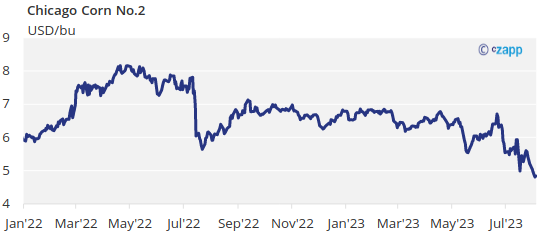

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,42 USD/bu.

Market Commentary

All grains plummeted in all geographies on the back of favorable weather and ignoring the export disruptions out of the Black Sea.

Grains plummeted starting last Monday and the fall intensified through Thursday even after Russia attacked grain infrastructure in the Danube. Favorable weather was confirmed in the US and weighed more than the Russian blockade of Ukrainian exports as Putin also said last Wednesday he is ready to go back to the grain deal once his demands are covered. Only Friday we had positive day in most markets.

The initial weather forecast for last week in the US was hot and dry in the Midwest, but instead milder temperatures and rains arrived and erased fears of another downgrade in yields and the market sold off.

We are also in the middle of the Wheat harvest so it does make sense to have harvest selling pressure as the market -and us- may have been too much focused on the Black Sea export flows.

US Corn condition worsened 2 pts to 55% good or excellent vs. 61% last year. Corn area under drought is 57% down from 59% the previous week. Corn condition in France was unchanged at 81% good or excellent vs. 62% last year.

In Brazil, Safrinha Corn is 54,7% harvested vs. 71,1% last year. The USDA local office in Argentina forecasted 23/24 production at 55 mill ton which will be most likely reflected in the August WASDE this week and is well above the 34 mill ton projected for the actual drought-damaged crop.

Wheat plummeted as well in all geographies on harvest pressure and pulled down by Corn too. The sell off triggered good tender activity form Bangladesh, Tunisia, Egypt, Algeria, all jumping in the market to take advantage of cheap prices ultimately giving some support.

US winter Wheat is 80% harvested now having fully caught up with the 81% harvested last year. Spring Wheat condition plummeted 7 points week on week and is now 42% good or excellent vs. 70% last year. The area of US winter Wheat under drought was 49% up from the previous week. French Wheat condition was unchanged at 78% good or excellent vs. 63% last year, and is 87% harvested vs. 99% last year. Russian Wheat is 31% harvested above the 19% harvested las year.

In the weather front, hot and dry weather is not threatening the US anymore and cooler temps are expected during this week together with rains. In Brazil a cold wave with rains is forecast but staying in the south of the country and reaching just the south of Sao Paulo. In Europe milder temp and rains are expected in the north.

The trade flow out of the Black Sea continues to be an issue as not only Russia has attacked export infrastructure in Ukraine, but Ukraine also attacked the main Russian port for agricultural exports. The Russian port continued operating after a few hours closed, but the bottom line is that exports out of the Black Sea are getting riskier. The first stats after the Russian attack shows -30% week on week exports out of Ukraine.

Is really difficult to predict market direction given opposite signals: supply disruption out of the Black Sea but also very tight old crop availability (US Corn basis is around 70-90 cent/bu in Chicago) vs. a bumper US and Brazil crop around the corner. And then the big doubt of how much winter Wheat will Ukraine plant given the worsening export picture. To add more uncertainty this week we have the August WASDE on Friday , but we expect no major changes to the July report. The weather premium we had in the market is disappearing, but we still have the war premium that should not disappear.

We wouldn’t be surprised to see the market higher as we have enough supply disruptions in the short term and the fall last week may have been exaggerated. In any case the environment is for volatility to continue while the market figures out what is the real supply picture mostly out of the Black Sea.

All grains plummeted in all geographies on favorable weather and ignoring the export disruptions out of the Black Sea. Is really difficult to predict market direction given opposite signals: supply disruption out of the Black Sea but also very tight old crop availability vs. a bumper US and Brazil crop around the corner. We wouldn’t be surprised to see the market higher as we have enough supply disruptions in the short term and the fall last week may have been exaggerated. In any case the environment is for volatility to continue while the market figures out what is the real supply picture mostly out of the Black Sea No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,42 USD/bu.