Insight Focus

Grains failed to sustain last week’s gains due to ample supply. Short-term price action will be influenced by US and European corn harvesting. More downside than upside risk is expected, with the Chicago corn forecast maintained at USD 3.90 per bushel.

Last week, grains attempted to sustain gains from the previous week but ultimately closed negatively due to ample supply. Short-term price action is likely to be influenced by the pace of corn harvesting in the US and Europe, particularly as wheat harvesting concludes with only pockets of spring wheat left.

Additionally, planting rates in Argentina and Brazil will be critical to monitor, especially in Brazil, where prolonged dry conditions have left soil moisture levels low, although the rainy season is approaching. Overall, we expect more downside than upside risk in the market.

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August) to average USD 3.90/bushel. The average price since September 1 has been USD 3.96/bushel.

Corn Supported by Price Stability

The December Chicago corn futures contract maintained its spread after the expiry of the September futures the prior Friday. However, by midweek, the market experienced a sell-off, likely aimed at closing the gap following the September expiry. Despite this, corn prices held above USD 4/bushel.

There was a notable lack of bullish news to support the previous week’s gains. A strong harvest pace in the US contributed to the negative sentiment, alongside disappointing export sales.

Chinese import statistics also weighed heavily, with August corn imports at 430,000 tonnes—down 64% year-on-year and 61% month-on-month, marking the lowest volume since March 2020.

Eastern Europe faced heavy rains and flooding over the weekend. Despite initial concerns about crop damage, the outcome was positive; fields were quite dry following an extremely hot summer. The heavy rains, although brief, likely improved soil moisture. While it may be too late to impact corn yields significantly this season, late-planted corn could still benefit.

The European Commission’s MARS September bulletin forecasted Ukrainian yields to be 9% lower for wheat and 19% lower for corn, primarily due to the dry summer. This forecast is largely in line with market expectations.

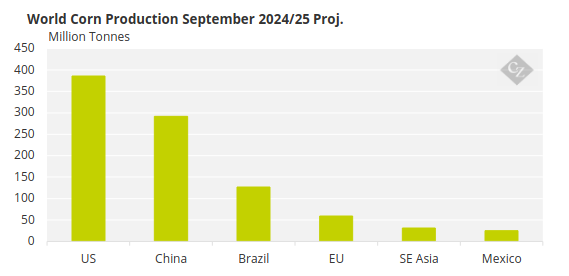

In Brazil, Conab published its first production forecast for 2024/25, estimating corn output at 119.8 million tonnes, up from 115.64 million tonnes produced this year but below the 127 million tonnes projected in the September WASDE report.

Source: WASDE

US corn conditions are reported at 65% good or excellent, up one percentage point week-on-week and compared to 55% last year. The US has harvested 9% of its corn compared to 8% last year and the five-year average of 6%. Areas under drought conditions increased to 26%, up from 18% a week earlier.

In France, corn conditions stand at 80% good or excellent, also up one point week-on-week, with harvesting having commenced.

In Russia, 15% of the corn crop has been harvested with an average yield of 3.38 tonnes/ha, compared to 5.95 tonnes/ha last year. The Ukrainian corn harvest is at 13%, with an average yield of 4.66 tonnes/ha, a 4% increase year-on-year.

Corn planting in Argentina has begun, with 7.1% completed compared to 9.3% last year.

Wheat Pressured by Supplies, Weather Concerns

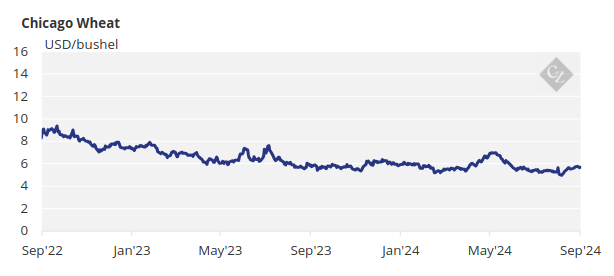

On the wheat front, weekly losses outpaced those of corn, driven by strong supplies from the Black Sea region, despite a reduction in the European crop with no fresh news impacting the market.

Coceral has downgraded its 2024 EU production forecast to 114.9 million tonnes, down from 126.4 million tonnes last year. France and Germany alone are expected to lose 11.7 million tonnes year-on-year, attributed to excessive rainfall during Q4 2023 and the summer of 2024.

The French Ministry of Agriculture forecasts wheat production at 25.8 million tonnes, representing a 26.5% decline year-on-year, and accounting for a loss of 9.25 million tonnes due to excessive rains. The EU wheat production estimate stands at 115 million tonnes, down from 125 million tonnes last year.

In the US, the spring wheat harvest is 92% complete, compared to 91% last year and the five-year average of 90%. Winter wheat planting is 14% complete, slightly ahead of 13% last year and the five-year average.

The Russian wheat harvest is at 78% with a yield of 3.2 tonnes/ha, down from 3.61 tonnes/ha last year. Winter wheat planting in Ukraine is 8% complete compared to 12% last year.

Weather, Harvest Trends Affect Market

Eastern Europe dealt with heavy rains last weekend, but drier conditions throughout the week have alleviated flooding. This dry trend is expected to continue in the Black Sea region. In Northwestern Europe, dry weather is anticipated in France, while light rains are forecasted for Germany.

The US is expected to experience irregular rains, which may delay harvesting operations slightly. Brazil’s southern region will see continued rainfall, while the central part of the country is anticipated to remain dry.