Insight Focus

Brazil has approved legislation for green hydrogen that creates tax incentives. The product can be used to manufacture fertilizer, which encourages agribusiness.

Agribusiness Welcomes Green Hydrogen Law

The approval of the green hydrogen regulatory framework in August, which defined everything from certifications to tax incentives, has been encouraging one of the most important sectors of the Brazilian economy.

Responsible for a quarter of Brazilian GDP, agribusiness welcomed the creation of the legal framework for hydrogen production, especially due to the potential for its use to make fertilizer.

Obtained from the electrolysis of water using renewable sources, such as solar and wind energy, green hydrogen can be combined with nitrogen to form ammonia, one of the main bases of fertilizers, in a sustainable process.

“Brazil’s dependence on the import of fertilizers, whose prices are expected to continue rising in the long term, is one of the main attractions for the production of green hydrogen in the country,” said Leandro Borgo, president of the Brazilian Green and Ammonia Association.

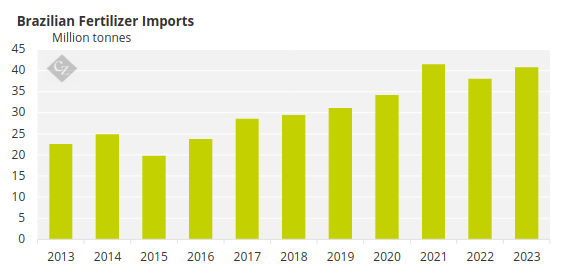

Source: Comex

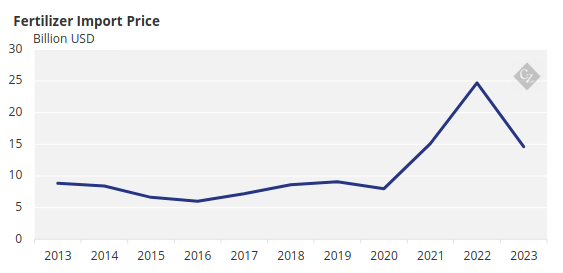

Today, Brazil imports around 90% of the fertilizers it uses. Two years ago, there was a spike in prices due to the war against Ukraine and sanctions against Russia, which supplied almost a third of fertilizers to Brazil.

Even with the search for new international suppliers, the expectation is that global prices will rise until the end of the decade, with an increase in demand due to the expansion of agriculture and productivity.

Source: Comex

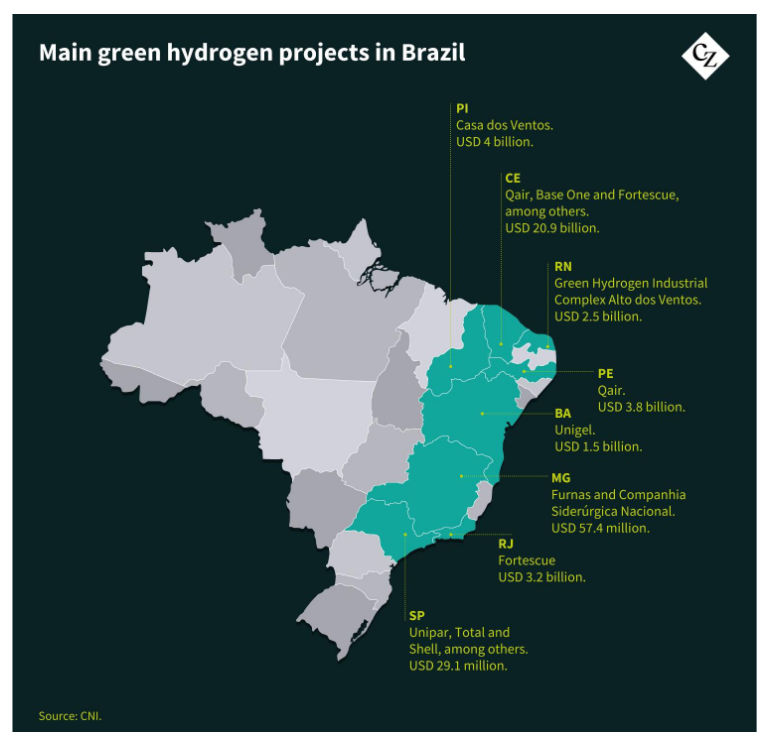

In this scenario, it is not surprising that large companies are interested in manufacturing green hydrogen. “There is already interest from companies and the regulatory framework should serve as an additional stimulus for the development of the market,” said Felipe Diniz, partner at the consultancy Mirow & Co, who carried out a study on the green hydrogen market.

In Brazil, green hydrogen production projects already total around USD 50 billion, led by companies such as Qair, Fortescue and Unigel.

At the same time, the port of Suape, in Pernambuco, is preparing to launch a green hydrogen innovation center focused on new technologies in November. One of the biggest objectives of the initiative, which includes the participation of Senai and companies like Cz, is to create solutions to reduce production, storage and transportation costs.

Other Sectors to Benefit

Although initially much of the production may be directed to the fertilizer industry, other sectors are already looking at the decarbonization potential of green hydrogen. This is the case, for example, of the steel industry. The idea is for hydrogen to replace the mineral coal used in steel manufacturing.

Globally, the expectation is that green hydrogen will also be used as a fuel, to replace fossil fuels in the transport sector and in energy generation.

In Europe, green hydrogen auctions have been moving the market. In April, the European Commission selected seven green hydrogen projects that are expected to receive EUR 720 million. Another initiative of this type should be carried out by the end of the year.

New Development Moves the Needle

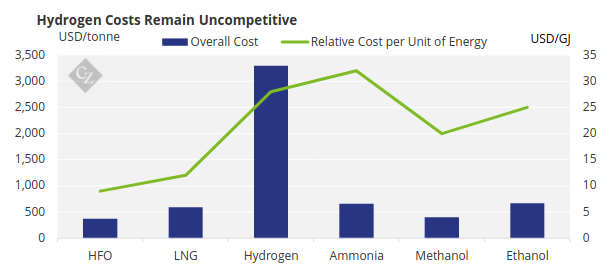

The expectation is that the development of new technologies and gains in scale will allow for a reduction in costs. Today, the production of green hydrogen costs around USD 6/kg, twice as much as ordinary hydrogen obtained from fossil fuels.

Source: IMO

The intention is to reach a production cost of around USD 2/kg by 2030. “With this, it would be possible to use green hydrogen not only to decarbonize the industry, but also to generate energy on a larger scale,” says Borgo.