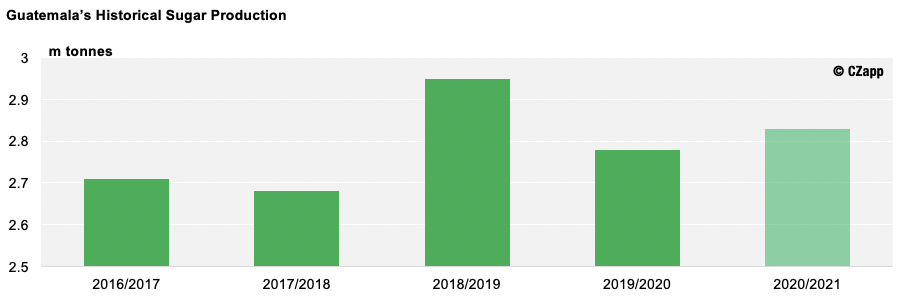

- We think Guatemala will produce 2.8m tonnes of sugar in 2020/21; its highest production in two seasons.

- This comes as the country has been graced with optimal weather for cane development throughout the year.

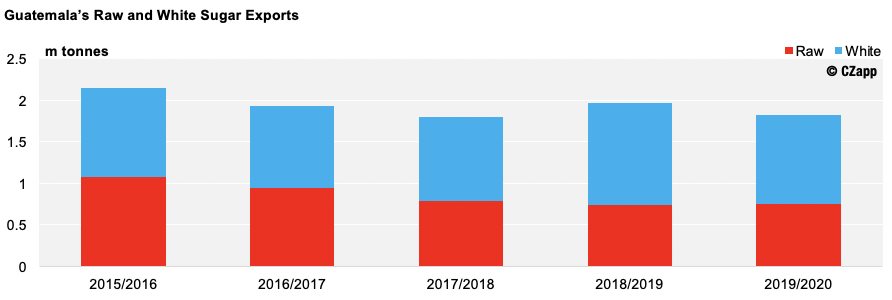

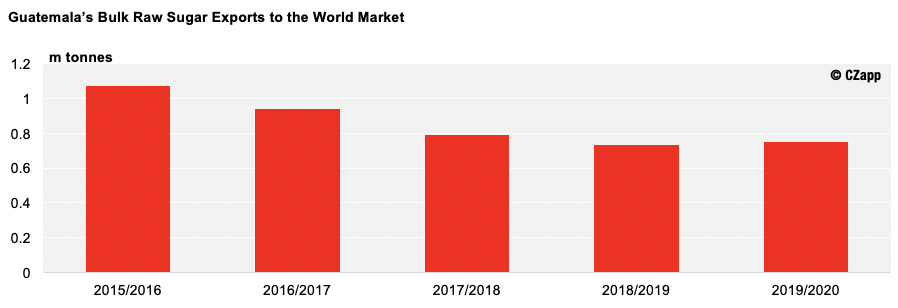

- We think bulk raw sugar exports will continue to reduce as producers prioritise the production of value-added bagged sugar.

Optimal Weather Boosts Guatemalan Sugar Production

- Guatemala should produce 2.83m tonnes of sugar next season, up 50k tonnes year-on-year.

- With this, production sits just 120k tonnes behind the record set in 2018/19.

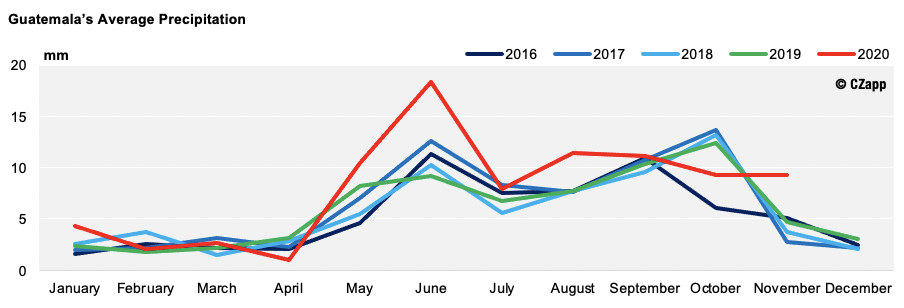

- The year-on-year production increase comes as a result of the increased rainfall seen in Guatemala, particularly between May and September this year.

- Precipitation levels during this period were higher than they have been for the last five years.

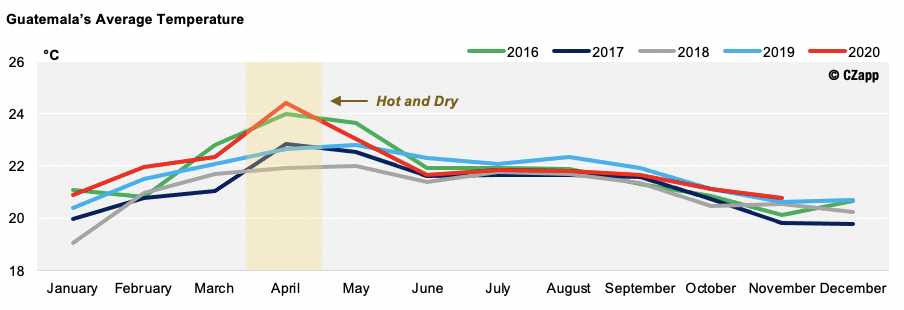

- The only reason we think next season’s production will fail to reach record levels is because it has been hotter than it was in 2018/19.

- This was especially prevalent between January and May, where it was far hotter than it had been in previous years.

- And in April, Guatemala had its hottest and driest April for the last five years.

- This will have hindered the canes’ performance and reduced yields.

Exports Increase with Production

- Guatemala’s increased sugar production means it could export up to 1.9m tonnes in 2020/21, up 7.4k tonnes from this season.

- The majority of this sugar will be shipped in bags and include raws for direct consumption, low quality whites and refined sugar.

- This is something we have seen happening over the last five years, as Guatemalan producers believe it adds value due to its easier handling.

- As such, there has been a steep decline in Guatemala’s bulk raw sugar exports to the world market.

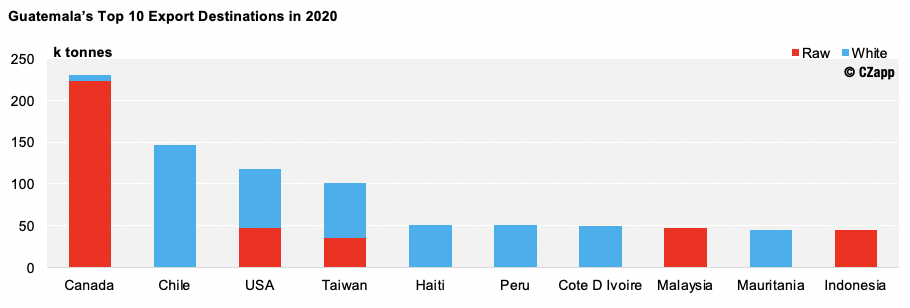

- With this decline, preferential markets have increased in significance.

- The US and Taiwan account for 25% of Guatemala’s sugar exports, as it has access via Free Trade Agreements.

- These countries therefore remain a key source of Guatemala’s returns.

- However, Canada has been Guatemala’s main destination for the last five years due its close proximity allowing easy access.

- This will likely remain the case whilst bulk raw sugar exports stay low.

Other Opinions You May Be Interested In…

- Market Talk: Hurricane ETA Hits Central America

- Central America: Capitalising on Thailand’s Poor Cane Crop

- Guatemala: Steady Crop Start