Insight Focus

- The USA’s demand for organic products (including sugar) has increased over the past decade.

- This is likely because sustainability and health now rank higher on the consumer agenda.

- Will these trends continue with non-organic food prices climbing around the world?

The USA’s demand for organic products (including sugar) has grown across the past decade, with the market’s revenue hitting an all-time high in 2020. We suspect demand has primarily grown as sustainability and health have ranked higher on the consumer agenda. Whilst we don’t think organic products will account for a large share of the overall food market for the foreseeable future, these products should become increasingly popular.

US Consumers Turn to Organic Produce

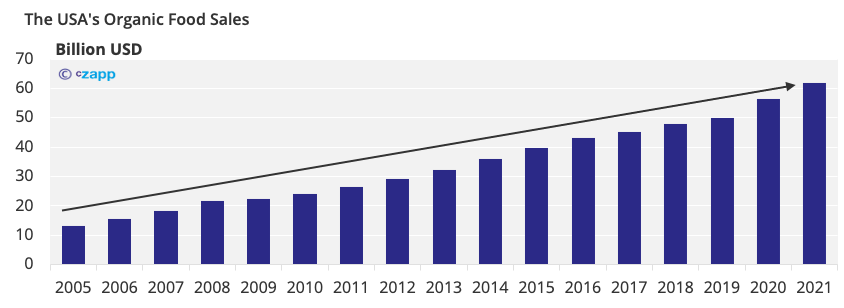

The USA’s sales of organic produce hit a record high last year (USD 61.9 billion).

Today, over 82% of households in USA buy at least some organic products, and the market is showing signs of growth every year.

This is perhaps because, over the past decade, consumers have become more environmentally conscious and the organic production process is free of pesticides, which contaminate soil and water with the synthetic chemicals they contain.

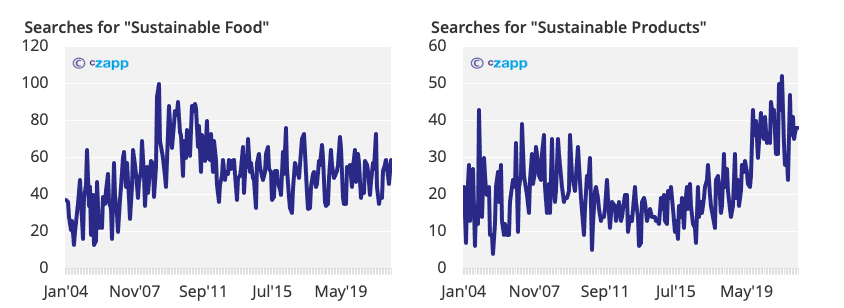

This interest is apparent when looking on Google Trends, as searches for the terms sustainable food and sustainable products have increased in recent years.

Concerns around animal welfare also come into it. Using antibiotics on livestock can provoke a poor immune response in humans. Organically raised animals don’t receive antibiotics or growth hormones, though, and they are not fed any animal by-products.

Health and wellbeing have been placed higher on the consumer agenda in recent years as well, and organic produce doesn’t contain any harmful chemicals that could spark issues here.

Organic Sugar is Increasingly Popular

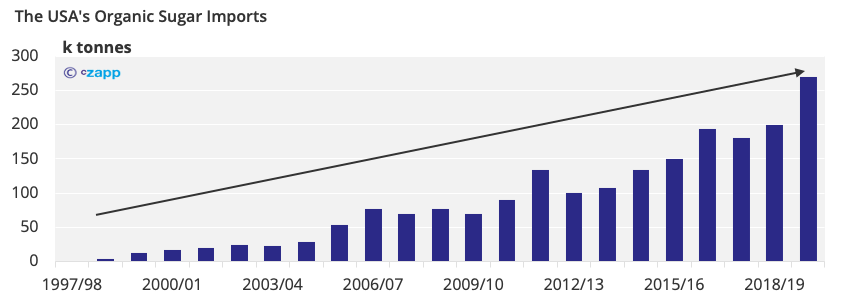

In 2019/20, the USA imported around 270k tonnes of organic sugar, up 269k tonnes from when our dataset began. Organic food and beverage sales grew alongside this.

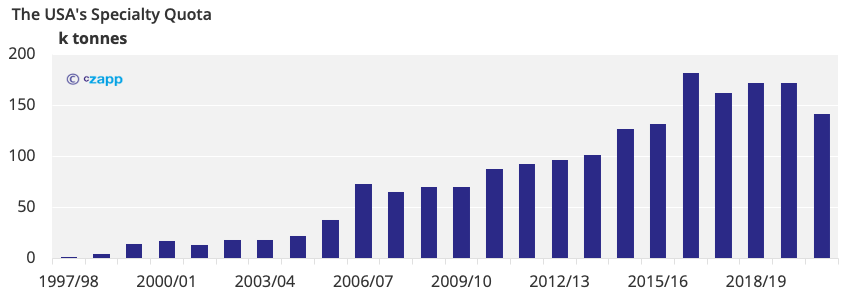

Most of the USA’s organic sugar is imported through the Specialty Quota, which arrived in 1982 and applied to refined sugar from countries that didn’t have a raw sugar allocation (read more on US import polices here).

However, by 2002, organic sugar occupied around 95% of this quota, indicating massive demand growth.

What Does this Mean for the Wider World?

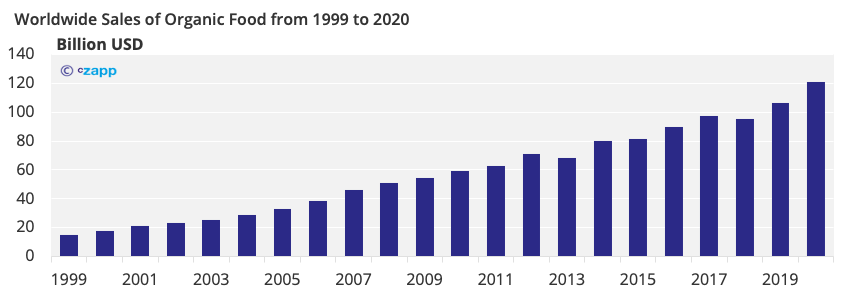

Organic products are becoming increasingly popular all over the world.

And, while we don’t think organic products will occupy a large share of the overall food market for the foreseeable future they should grow in popularity as consumers become more health and environmentally conscious.

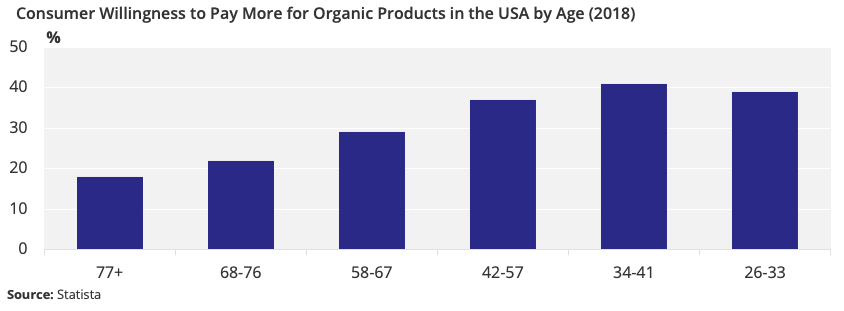

Of course, there’s the drawback that organic products are more expensive than non-organic ones at present, but research shows that consumers are becoming more accepting of this. Seeing younger consumers leading the charge in the US is positive too, as it suggests they may keep buying these products over the course of their life, making the trend more permanent.

Rallying fertiliser prices may also mean the cost difference between organic and non-organic prices narrows going forward, making consumers more willing to pay a little extra for healthier, more sustainable product.

Other Insights That May Be of Interest…

Russia & Ukraine Grain Flows Likely to Be Disrupted into H2’22

What the Ukraine Crisis Means for PET