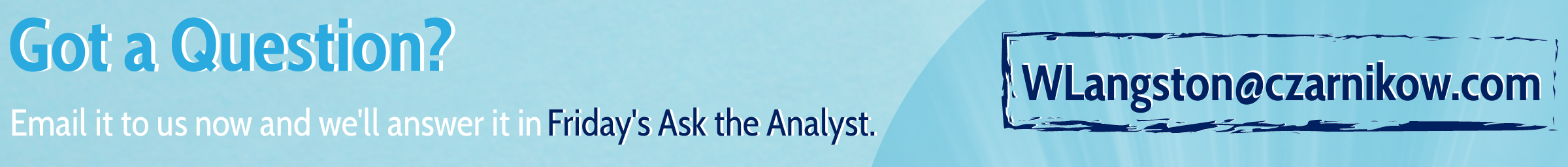

- Thailand’s cost of cane production could hit a record high in 2022/23.

- However, cane returns should also climb to a seven-year high.

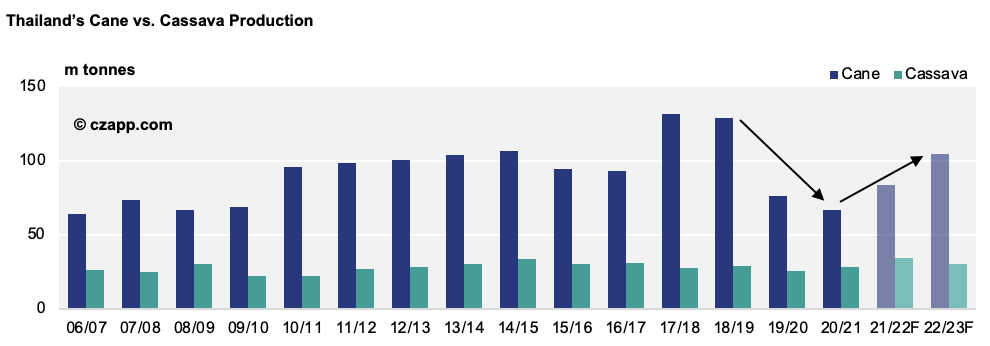

- Farmers should manage to work through the energy crisis and produce between 100-110mmt of cane.

Thai Cost of Cane Production to Hit Record High

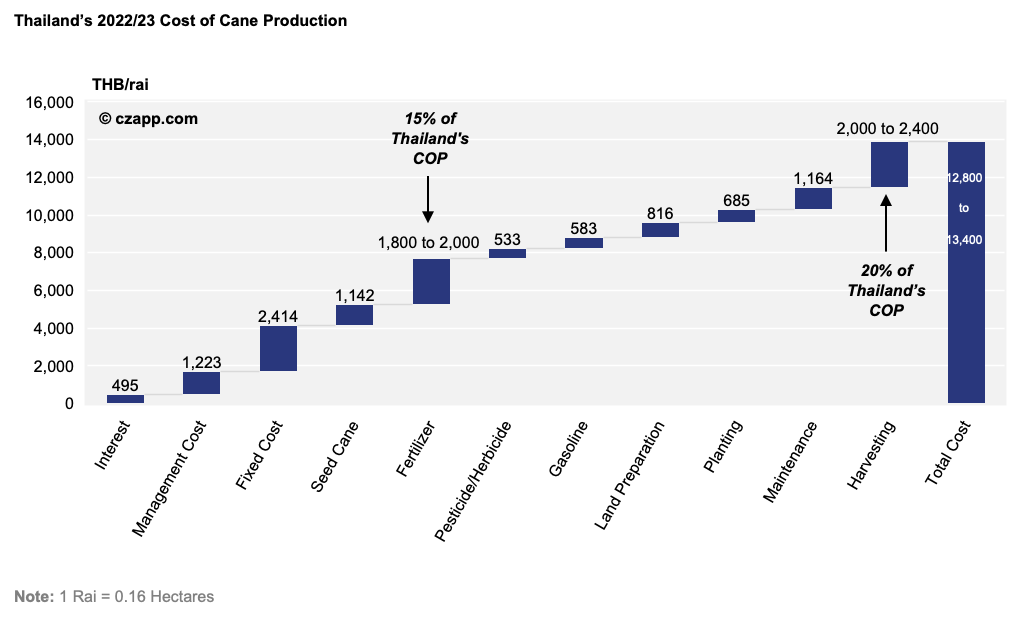

- It could cost Thai farmers a record 12,000 THB/rai to produce cane in 2022/23.

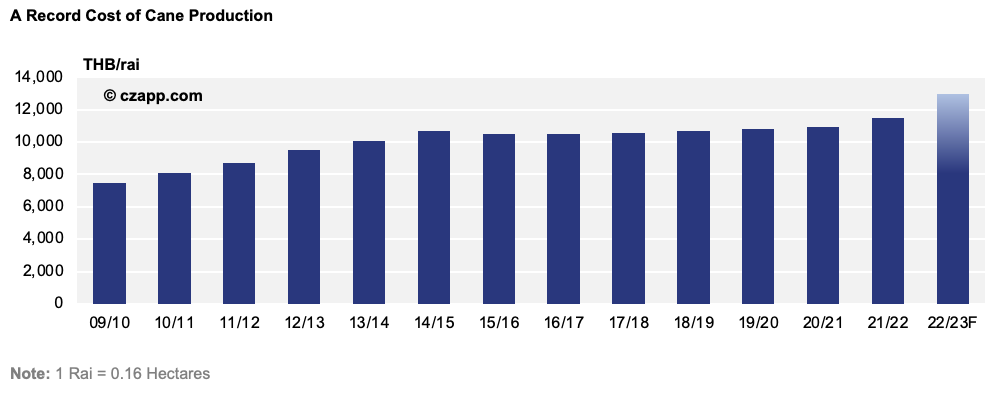

- This is largely because fertilizer prices have rallied, with key suppliers implementing export bans, and natural gas prices climbing amid the energy crisis.

- Demand from has also been high through COVID, as countries have pushed to secure food supply.

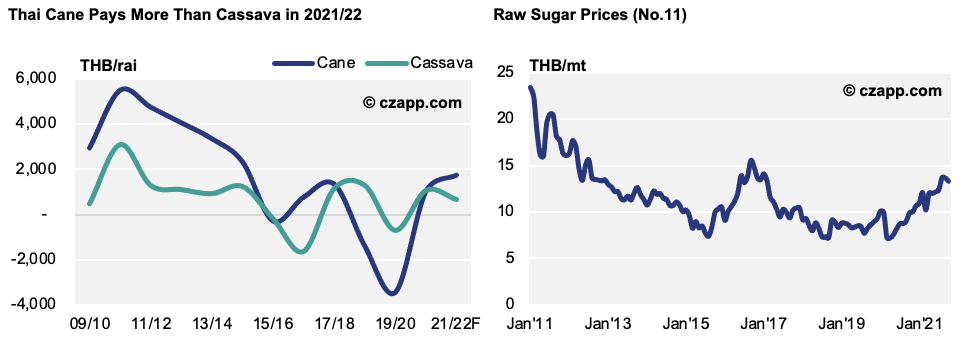

- This could mean more farmers turn to plant cassava next season.

- Cassava only needs to be fertilized twice per crop, whilst cane requires three treatments.

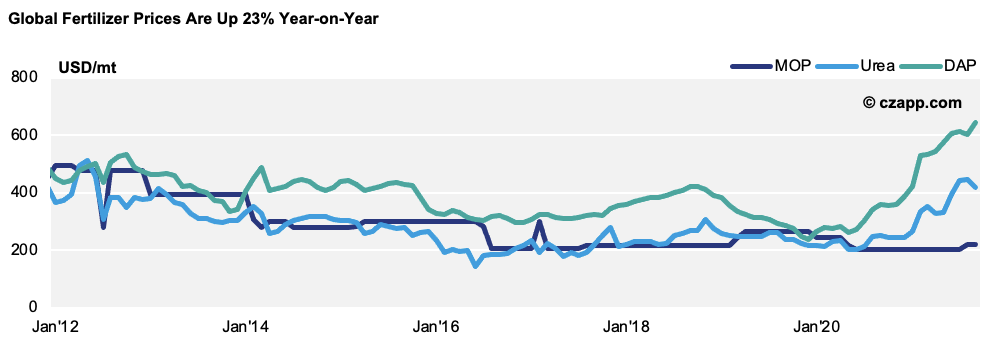

- Cane also demands more machinery, especially now the Government’s pushing for a larger fresh cane harvest.

- For context, Thai farmers used to burn more of their cane as it’s a fast and cost-effective way to remove the tips and leaves prior to cutting, enabling easier handling.

- However, as this is less sustainable than fresh cane harvesting, and sucrose yields tend to be lower, farmers are now being pushed to think of other ways to harvest their cane, which means hiring gasoline-fuelled machinery.

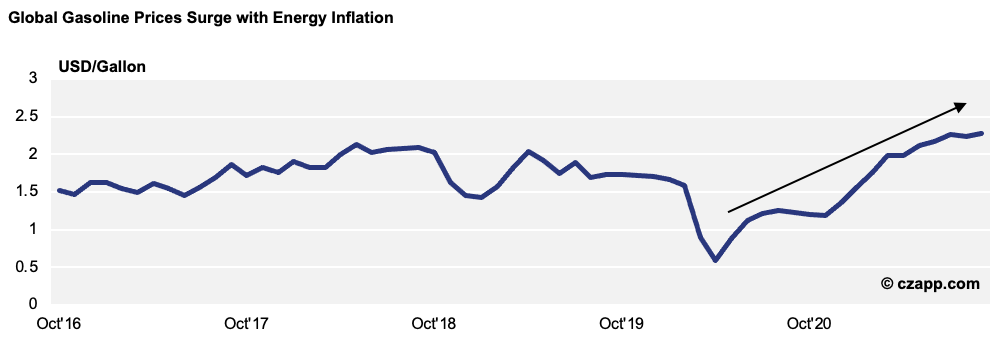

- This machinery is 10% more expensive than it was this time last year, as gasoline prices are also surging at present.

- This adds to Thailand’s already expensive harvesting costs, meaning smaller farmers may have no choice but to turn to cassava.

- Cassava earnings are paid up front, whilst cane payments are only provided once it’s delivered to the mills; cassava therefore offers greater flexibility as it can be harvested more frequently.

Cane Returns Could Also Hit a Seven-Year High, Though

- There’s a silver lining, though; mill payments to cane farmers could be the highest they’ve been for seven years in 2022/23.

- This is partly because raw sugar prices are the highest they’ve been since Mar’17.

- On top of this a 120 THB/mt is paid to those that deliver fresh cane, and the mills could offer a further 50 THB/mt to those that deliver high quality cane.

- If, of course, raw sugar prices drop and the additional payments are discontinued, cassava will likely pay more than cane in 2022/23.

- However, we hold a positive view for the sugar market at present, and therefore think cane will be favoured, with Thailand producing between 100-110m tonnes of cane next season (weather dependent, of course).

Other Opinions You Might Be Interested In…

- Sustainable Agriculture: Responsible Cane Harvesting

- Sustainable Agriculture: Further Cases for Fresh Cane Harvesting

- How Achievable is Thailand’s E20 Ethanol Goal?

- Will Thailand’s Stricter Cane Burning Rules Hit Sugar Production?

Explainers You Might Be Interested In…