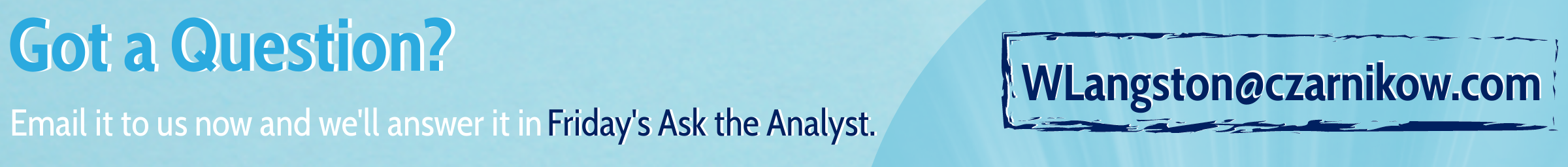

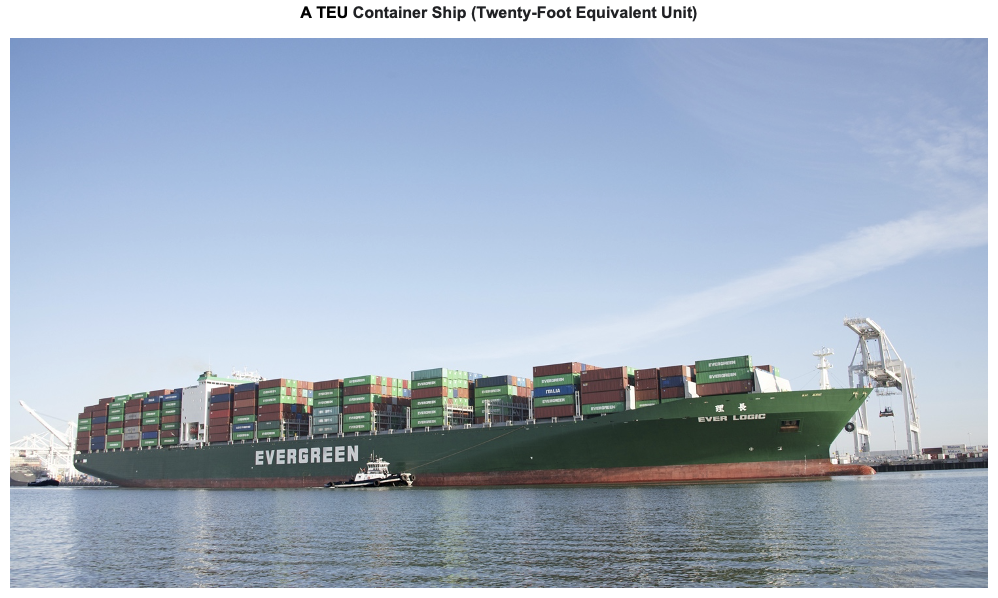

- The global container shortage continues to wreak havoc across the globe.

- COVID-induced port congestion and labour shortages are further complicating matters.

- Freight rates could hold strong until 2023 in response.

Container Issues Persist

- Over the last 12 months, a dysfunctional and chaotic container freight market has severely impacted global supply chains.

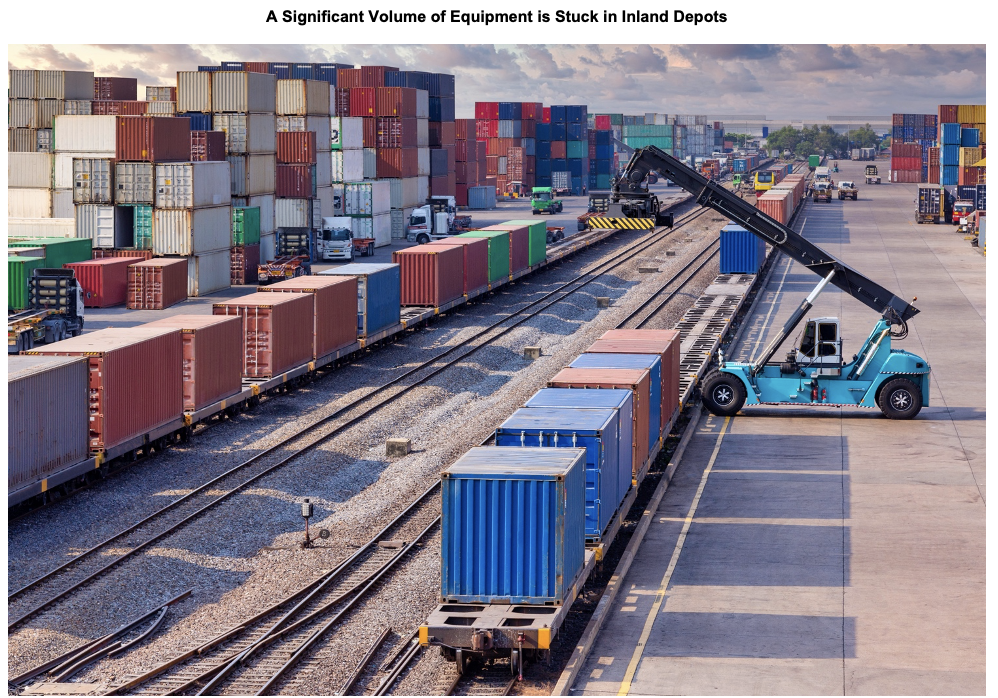

- As a result, freight rates have soared to eyewatering highs.

- Global container trade has now recovered and surpassed pre-COVID levels.

- Extremes in freight demand across the various regions are distorting container supply.

- Increased demand, combined with supply chain bottlenecks, have led to extended container cycle times, reducing capacity, and increasing rates.

- Whilst global trade volumes are mostly stagnant, the Indian subcontinent and Middle East have seen a significant decline in trade versus 2019.

- On the other hand, North America is experiencing a boom in demand, with import volumes showing extraordinary growth.

- North American imports are up 40% year-on-year and up 10% over the last two years, driven by surging demand for high volume consumer goods.

- The result of this misalignment has created massive bottlenecks, absorbing container capacity and putting not only ports but inland logistics under immense pressure.

- North America is supposedly responsible for around 55-60% of the structural deficit of equipment in the Far East.

- This is largely due to increased demand, chassis shortages, port congestion and supply chain bottlenecks in the US.

- High levels of rollover and transhipments are leading to extended transit times.

- Schedule reliability is also at an all-time low, with space/equipment going to highest bidder and many long-term contracts not being fulfilled by lines.

Port Congestion and Labour Shortages Cause Further Trouble

- Port congestion and labour shortages have made it more difficult to reposition empty container.

- After a month-long cut in productivity due to COVID, Yantian port in Shenzhen (Southern China) resumed normal operations on the 24th June.

- Although operational capacity at Yantian had steadily recovered through June, we think it’ll still take more than two months to clear the backlog of more than 700,000 TEU.

- The probability for further localised disruption remains high across many areas in Asia.

- Borders between Myanmar and China have recently tightened due to another wave of COVID cases, although little impact is expected on legitimate trade flows.

The Threat of Increased Regulation

- The container shipping sector has consolidated over the past few years.

- A drive to consolidate saw the formation of key shipping alliances encompassing more than 80% of the market.

- APM-Maersk and Mediterranean Shipping Company, or MSC, joined the 2M pact; CMA CGM, Cosco and Evergreen formed the Ocean Alliance, whilst others including Hapag Lloyd, ONE and Yang Ming created THE alliance.

- Financial reports show all major carriers posting record profits in Q1’21, with operating profits ranging from 500-970 USD/TEU.

- Incredibly, HMM recorded the highest operating profit of nearly 1000 USD/TEU shipped.

- Whilst lines continue to implement blank sailings in an effort to restore services, blank sailings further reduce capacity, pushing up rates.

- On the 9th July, President Biden issued an executive order calling on regulators to tackle the issue of high shipping costs and unreasonable surcharges.

- Transportation bottlenecks and sky-high costs are severely impacting US exporters and have driven US inflation to a 13-year high.

- Across the US, prices of food items and consumer goods have soared, and stock shortages are already occurring in some sectors.

- Other nations, including China, Vietnam and South Korea, have also attempted to tackle high shipping costs over the past year with little to no impact.

Market Outlook

- The fight for Trans-Pacific vessel space should intensify through July and August as we enter peak shipping season and US retail activity surges.

- The backlog in US-bound cargo built up during the recent COVID-19 outbreak in China should also arrive on the US West Coast, exacerbating port congestion.

- Freight rates could remain strong until 2023, with pricing unlikely returning to 2011-2019 levels in that time, if ever again.

- Lines should continue to use capacity management to maintain strong rate levels, but the current supply chain challenges/demands have supported their strategies.

- As lines return to profitability, they’ve invested heavily in their new vessel order books.

- However, new vessel deployment won’t be until 2024 at the earliest.

- We ultimately think rates find a middle ground between current and 2018/19 levels in that near-term period.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…