Insight Focus

- Corn prices continue to trend downward due to high supply.

- This was exacerbated this week by projections of higher ending stocks in France.

- The wheat market is also well supplied but high rainfall in Europe poses risk.

The first half of the week was negative for corn, while the second half of the week saw some recovery after the long correction that started during the final days of December. But by the end of the week, European grains, particularly corn, continued to fall. The rally of the dollar put some additional pressure on dollar quoted grains.

Wheat closed positive in Europe and negative in the US. There is a well-supplied market with the only risk coming from lower European wheat production due to excess rains and lower soybean production out of Brazil due to dry weather during November and December. However, Brazilian weather conditions should have been priced in already and good rains during January are reducing concerns.

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop, which remains in the range of USD 4.15/bushel to USD 4.4/bushel. The average price since Sep 1 is running at USD 4.73/bushel.

Ample European Supply Pressures Corn Prices

It was a slightly negative week for corn in Chicago thanks to an end-of-week rally followed by a deeper fall in Europe. The dip was even bigger in Brazil. Corn market participants continued to price in the information supplied by the January WASDE report, which was a confirmation of ample supply.

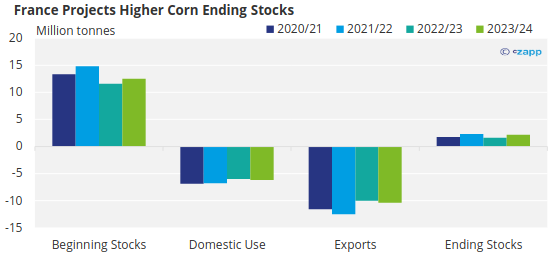

The pressure on European corn came mostly after FranceAgriMer increased its forecast for corn ending stocks to 2.18 million tonnes — a huge increase compared with the 1.65 million tonnes of ending stocks for the 2022/23 harvest. Part of this increase is due to an expected loss of market share in exports.

Source: FranceAgriMer

The second half of the week saw positive data on the demand side. Chinese customs data showed 2023 corn imports of 27.1 million tonnes, which is 31.6% higher than last year. In December, an all-time monthly record amount of 4.95 million tonnes were imported. This was a strong signal from the demand side as Chinese corn production also grew by 4.2%.

Weather in Americas Improves

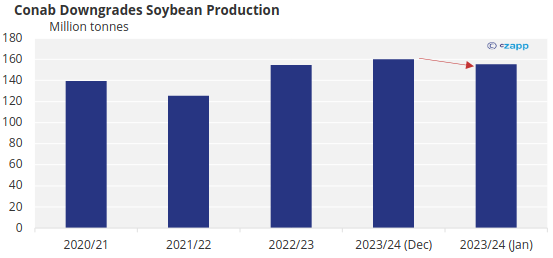

Brazilian soybean production continues to be a concern for the grains market. Two weeks ago, the National Supply Company (Conab) downgraded production to 155.3 million tonnes from 160.3 million tonnes.

Source: Conab

However, some reputable analysts already project that final production will end up in the 150 million tonnes region. We think this has been priced in already. Harvesting is 1.7% complete.

The summer corn crop in Brazil is now 6.8% harvested, up from 3.3% last year. Safrinha planting is 87.7% complete compared with 91.9% last year. Argentinian corn is 92.7% planted, ahead of last year’s 88.6% and its condition improved significantly to 46% good or excellent compared with 36% last week.

Brazil is expected to receive good rains for a second consecutive week, which will help to alleviate low soil moisture and worries for soybeans and corn. These rains will also reach Argentina.

The US also had better soil moisture thanks to snowfall last week, which has resulted in improving drought conditions. Now, 34% of the corn area is under drought conditions, down from 45% last week.

Additionally, 27% of the wheat area is under drought conditions, down from 33% last week. The forecast for this week is for higher temperatures and average rains.

Black Sea Wheat Supply Creates Surplus

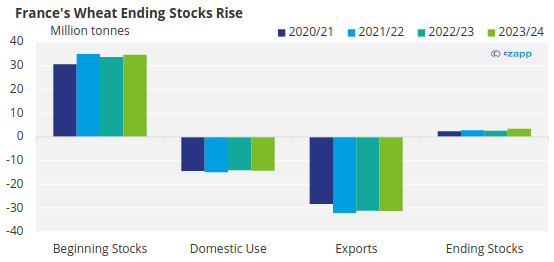

On the wheat front FranceAgriMer increased its forecast for ending stocks due to competition with Black Sea wheat resulting in less exports. Endings stocks are forecast at 3.43 million tonnes, which is a significant increase on the 2.6 million tonnes reported for the last crop.

Source: FranceAgriMer

Argentinian wheat is almost fully harvested with BAGE’s forecast unchanged at 15.1 million tonnes.

The market continues to be well supplied with the only risk coming from less European wheat production due to adverse weather, although this should already be priced in. Europe is expected to have higher temperatures this week after they dipped below freezing last week. Rains are also expected.

A tighter wheat balance is expected to partially offset downside pressure on corn due to ample supply.