Insight Focus

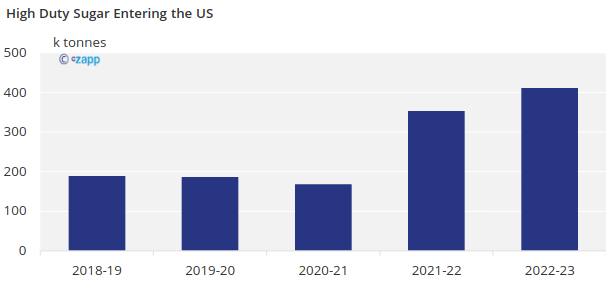

- High Duty Sugar entering the United States has doubled in the past five years.

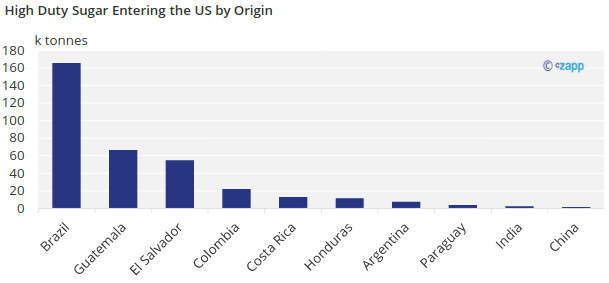

- Brazil and Guatemala are the two largest origins of high duty sugar.

- This means a little less sugar for the world market.

What is High Duty Sugar?

High-duty sugar is any sugar imported into the United States that is not covered by trade deals or treaties. These trade deals can include the TRQ Program, Dominican Republic-Central America FTA (CAFTA-DR), or any World Trade Organization (WTO) agreements. The high-duty sugar entering the United States must pay a duty of 360 dollars per tonne or 16.33 cents per pound. In the past, this high duty discouraged people from exporting sugar into the United States without being covered by a deal or treaty.

The amount of high-duty sugar entering the United States has doubled in the past five years.

High-duty started entering the United States in higher volumes during the 2021-22 harvest when the No.16 (the United States raw sugar price) started to surge.

The high No.16 prices allow people selling sugar into the United States to buy sugar from the world market, at the No.11 prices, pay the duty of 360 dollars per tonne or 16.33 cents per pound (as well as other costs such as freight), and still have enough to make a profit.

Pessimistic US Sugar Outlook

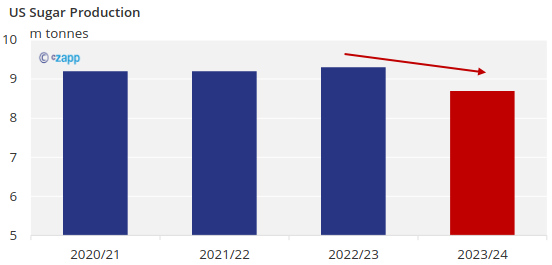

The United States is currently facing a potential crop shortfall. The US Drought Monitor claims that 44% of the Louisiana sugar cane is affected by exceptional drought, while 54% was under extreme drought. The drought has caused experts to lower the state’s forecast by 200k tonnes. Then, in Texas, 100% of the cane crop is experiencing severe drought.

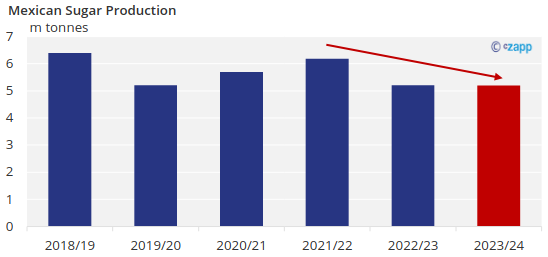

To make matters worse, the United States cannot depend on its largest sugar supplier, Mexico. We don’t expect a recovery from the poor 2022-23 crop due to El Niño. During El Niño, Mexico experiences more rain during the winter, followed by an arid summer. A summer drought could adversely affect cane development in Mexico as the crop needs rainfall through the middle of the year to grow and mature fully. The drought could lead to lower yields as more than 60% of Mexican cane is not irrigated. Rain during the winter could also delay cane harvesting.

Mexico and United States Crop Shortage effect on No.16 Prices

The United States, dealing with a poor crop and unable to depend on its largest trade partner for sugar, Mexico, should maintain the No.16 prices high for the time being. The high No.16 prices mean it will be attractive for countries like Brazil and Guatemala to export sugar to the United States, even if it means paying a duty.

If more countries export sugar to the United States, there will be less sugar for the world market. This increase in exports into the United States will further strain the global sugar deficit. An increase in the worldwide sugar deficit could further push prices in the short term.