Insight Focus

Both corn and wheat were bearish this week after the USDA acreage report projected a higher corn growing and harvesting area. This, combined with steady progress in the US and Russia, in turn pulled wheat down.

There was an unexpected jump in US corn acreage and quarterly stocks this week, leaving Chicago closing the week below 4 USD/bushel. European grains only experienced mild losses.USDA

The correction last week was justified, and we will have to wait now for the July WASDE report next week to confirm consumption data will not significantly change the expected carry. The stock-to-use would justify a sub USD 4/bushel market for the average of the new 2024/25 crop.

The doubt now is if there is further downside risk or not. The reality is that on-farm stocks are sizable and harvesting starts in October so farmers will need to get rid of the bulk of that inventory before the new harvest starts. We may see a rebound after last week’s sell off, but we think there is little to no upside risk between now and October – but as always, this is weather dependent.

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop to average USD 4.60/bushel with a downside bias towards USD 4.40/bushel. The average price since September 1 is running at USD 4.54/bushel.

Corn Sinks on Higher US Acreage

Chicago opened on a negative tone last week on the back of favourable weather for US crops and guesses of higher corn acreage to be published in last Friday’s acreage and quarterly stock report.

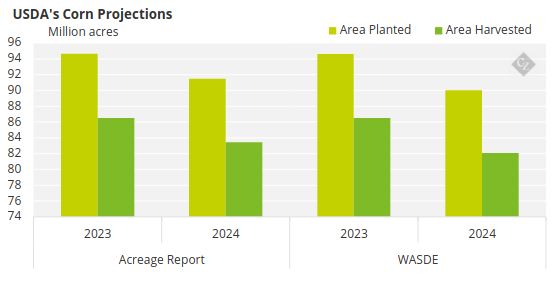

Source: WASDE, Acreage Report

The USDA surprised the market by projecting planted area of 91.48 million acres and harvested area of 83.44 million acres — still below last year but well above the latest WASDE report. In this, the USDA predicted 90 million acres and 82.1 million acres, respectively. The average estimate was 90.35 million acres, hence the selloff after the publication.

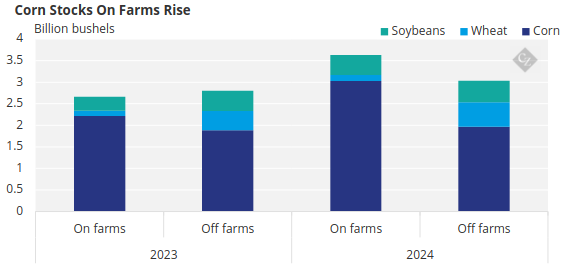

On top of this sizable increase in corn production, corn stocks as of June 1 were pegged at 4.99 billion bushels – a 21.7% increase year-on-year and the bulk of it were on farm stocks. These rose by a sizable 36.5% year-on-year versus off-farm stocks, which were up by just 4.3%. This is the highest level of June 1 stocks of the last four years.

Source: USDA

US corn condition fell three points to 69% good or excellent versus 50% last year. Areas under drought conditions increased to 6%. Argentinian corn is 54.9% harvested.

The new estimates for planted and harvested area for US corn plugged into the supply and demand estimates from the June WASDE (leaving all other data unchanged) takes the stock-to-use ratio to 15.8% by August 31 next year. This is higher than the 14.2% recorded previously and would be the highest stock-to-use of the last 20 years.

Wheat Progresses Well in US, Russia

Wheat was pulled lower by corn but also due to the strong progress of the US and Russian harvests. By mid-week hot and dry weather was reported in Russian growing regions, giving some support to the market and resulting in positive days on Wednesday and Thursday. But after quarterly US stocks were published with higher stocks than expected, the market fell again.

US winter wheat is 40% harvested, ahead of 21% last year and the 25% five-year average. Condition was 52% good or excellent, up three points week-on-week and compared with 40% last year. Areas under drought conditions increased by 4 points week-on-week to 21%. Argentinian wheat is 81% planted, slightly ahead of 72% last year and 98.5% is in good or excellent condition.

Russia has started harvesting earlier than normal. Although only 1% has been harvested, yields are 61% higher than last year in the southern region of Russia which was not impacted by the frost and later heat. Ukrainian wheat is also 1% harvested and the first yield readings are also higher year-on-year. This is not yet indicative for both Russia and Ukraine but is a positive first signal.

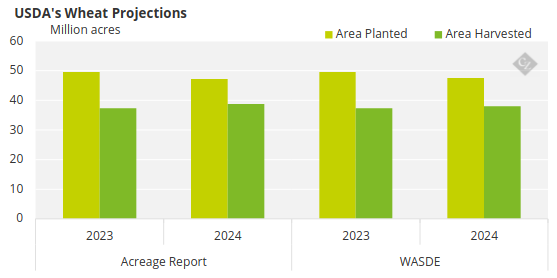

The USDA projected 47.2 million acres of wheat would be planted, lower than the 47.66 million acres expected by the market and the 47.5 million acres estimated in the latest WASDE report.

Source: WASDE, Acreage Report

Besides the acreage, wheat stocks as of June 1 were 702 million bushels — or a sizable 23.3% higher year on year, which is the highest number of the last three years. The market was expecting 684 million bushels.

The US had variable weather with a heatwave two weeks ago followed by ample rains last week to the point that some areas were flooded. Dry weather is forecast for this week, which should alleviate those areas saturated by excess rains.

Brazil is expected to remain dry in most of the centre south region, but the southeast will be cold. Hot temperatures are expected in Europe but there will also be rains, especially in France and Germany. Rains are expected in the Black Sea region.