Insight Focus

- US milk production breaks a seven-month streak of lower output.

- Dairy commodity prices fall due to demand concerns later in the year.

- EU milk collections the lowest since December 2021.

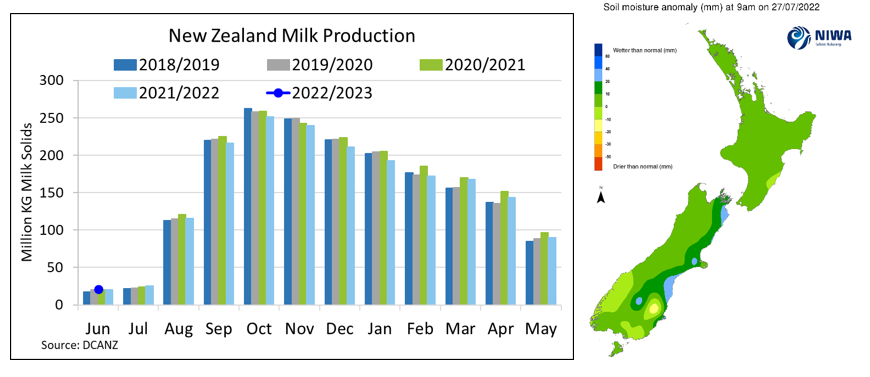

New Zealand:

It is winter in New Zealand, which means the locals are dealing with lots of wind and rain while pasture conditions are improving. In fact, most producers say they are dealing with torrential rains or snow as paddocks turn boggy in the North and creeks flood in Southland. Producers are likely feeding silage and trying to keep cows off the grass to keep pastures healthy ahead of spring. Milk production will not start to ramp up for another month, which will give the industry a better glimpse into the on-farm decisions being made due to expensive input costs. Despite a wet and stormy start to July, temperatures for most of the country remain above average for the time of year.

United States:

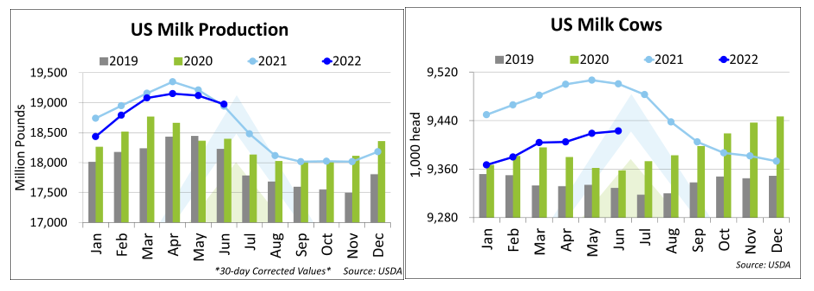

May cow numbers were revised higher, with June’s additional growth fueling the climb, US milk production broke a seven-month streak of lower output and showed growth versus prior year in June, driven higher by yield even as the total herd size remains weaker versus one year ago.

The return to growth came one month early versus HighGround expectations, which called for the shift to happen in July. While slight, the year over year gain shifts the industry mindset following several months of weakness that fueled price strength throughout the first half of this year as demand exceeded supply.

In recent weeks, most dairy commodities have seen prices fall, driven by both concerns about demand into the remainder of the year coupled with the working assumption that milk output would soon return to growth mode, loosening product availability and providing buyers with the upper hand in market negotiations yet again. This higher output validates that assumption and justifies some of the recent price declines as the market fell from this year’s highs.

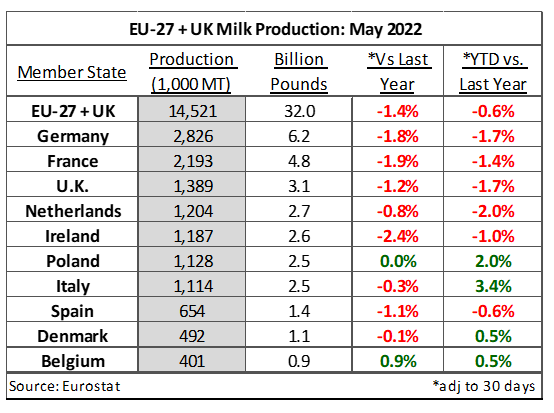

EU27+UK:

May is the peak milk production month for most nations within the EU, and milk collections were disappointing, reporting a loss of 1.4% from prior year, the weakest since December 2021.

Declines continue to be driven by Germany (-50,950MT YoY) and France (-42,980MT YoY) but were also notable from Ireland during May, DOWN 28,670MT from prior year. It is worth noting that Ireland’s 2021 production figures were a record high, which has made it difficult to reach in 2022 given the higher input costs and lack of feed availability.

Heatwaves are expected to have hampered milk production further throughout the Northern Hemisphere summer as wildfires continued to rage across continental Europe, with authorities battling to control blazes across France, Greece, Italy and elsewhere. In Spain and Portugal, more than 1,000 deaths have been attributed to their brutal, week-long heatwave.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial