Insight Focus

- We expect Brazil’s 2022-23 soybean planting to set new records for area and production.

- A big crop will be more than welcome, but it is also a concern due to demand uncertainties.

- If production reaches about 150m tonnes, exports will have to surpass 93m – a difficult goal to achieve.

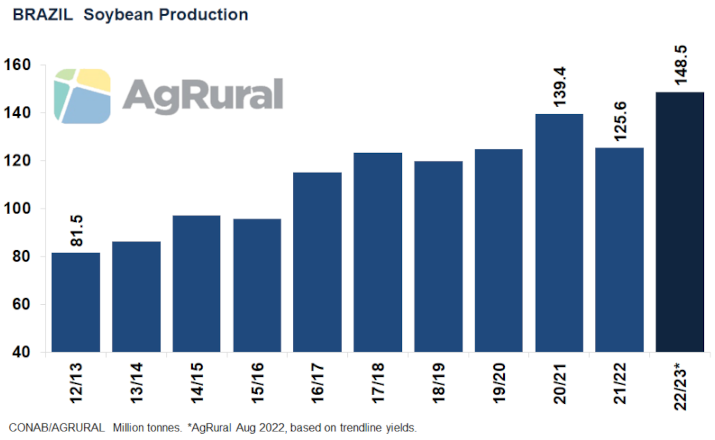

The 2022-23 soybean planting has started in Brazil and the expectation is that the country will establish new records even in a season marked by a steep increase in production costs and prices not as alluring as those seen in early 2022. AgRural estimates that the planted area will reach 42.7m hectares, 2.5% up from last year. Combined with trendline yields, that area results in a production of 148.5m tonnes – 18% above the production harvested in the 2021-22 season, when hot, dry conditions took a toll on southern producing areas.

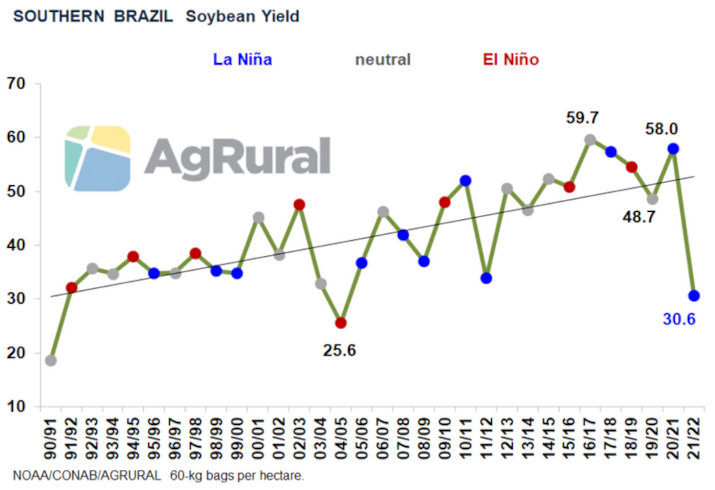

For such a recovery to take place, weather conditions, of course, will have to cooperate. Right now, one of the Brazilian farmers’ main concerns is the possibility of a third consecutive La Niña. The phenomenon does not automatically mean a crop failure, but it often deepens hot, dry periods that usually hit southern South America in December and January, when many soybean areas are filling pods and defining yields.

Fearing That Everything Goes Well

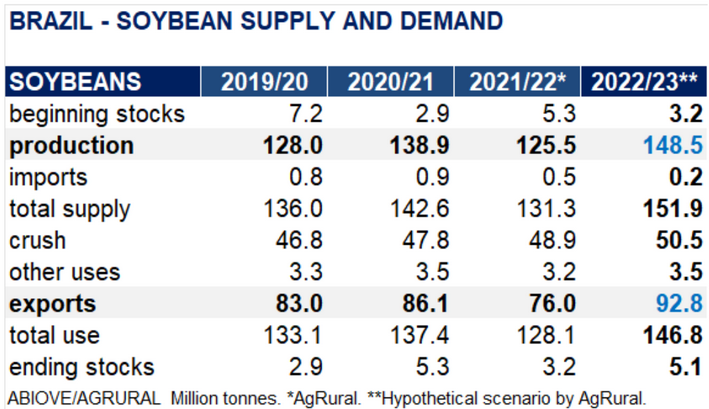

But, in addition to the traditional apprehension about the weather, Brazilian producers have an extra concern in the 2022-23 season: the possibility that everything goes well, prompting the new crop production to a massive record and putting extra pressure on prices if demand falters. Considering a production of 148.5m tonnes (some estimates put it above 150m), ending stocks around 5m tonnes (in line with the five-year average) and an increase in domestic consumption also similar to what happened over the past five years, exports would have to reach 93m tonnes, well above the range of 75m to 77m estimated by AgRural for 2022 and the record 86.1m tonnes made in 2021.

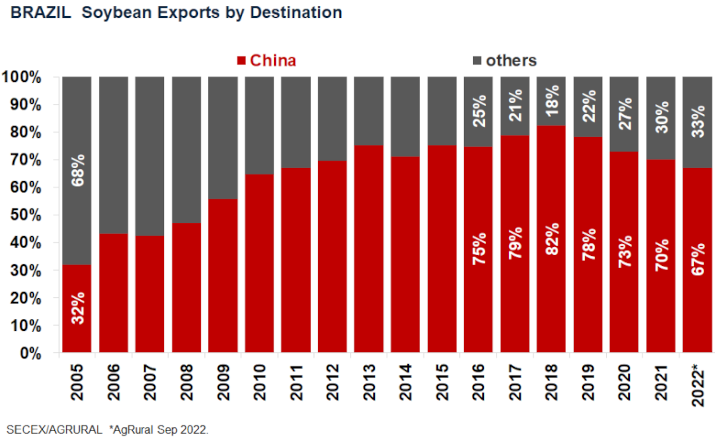

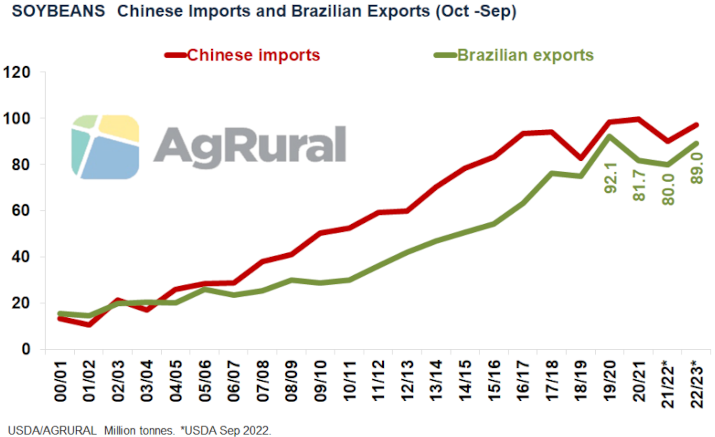

The problem is that Brazilian soybean exports are very concentrated. From 2017 to 2021, China was the destination of 76% of all soybeans shipped from Brazil. The percentage dropped after the end of the trade war between China and the US, reaching 70% in 2021 and heading for a little less than that in 2022. If we consider a share of 70% for 2023, and taking into account the hypothetical supply and demand scenario described above, the Chinese will have to import 65m tonnes of Brazilian soybeans in 2023 – 14m up from what they are likely to buy in 2022, according to AgRural’s projection.

Chinese Recovery

It is hard to believe, however, that Chinese soybean purchases from Brazil will be that big. On Sep 12, the USDA reduced its estimate for China’s 2022-23 imports (October 2022 to September 2023) from 98m to 97m tonnes. The Chinese government, in turn, works with 95m tonnes. Both numbers are higher than the 90m tonnes estimated for the 2021-22 marketing year, but not high enough to suggest such a big jump in Brazilian exports.

The USDA itself, which estimates Brazilian exports not for the calendar year, as we do here, but for the October-September season, projects Brazil’s 2022-23 shipments at 89m tonnes – 9m up from 2021-22, but still below the record 92.1m tonnes exported in 2019-20, when production reached 128.5m tonnes.

Tight Supplies in the US

One fact that favours Brazil is that the US 2022-23 production is smaller than initially estimated. On Sep 12, the USDA reduced the projected production from 123.3m to 119.2m tonnes. With fewer soybeans coming from the fields, the agency also lowered the export expectation, which now stands at 56.7m tonnes, 1.6m less than the estimate for 2021-22.

There was no increase in Brazil’s export projection for 2022-23 in the report released on Sep 12, but tight supplies and strong domestic consumption tend to make US soybean prices uncompetitive as soon as the harvest pressure has passed, and that could lead to lower exports than those forecasted by the USDA and, at the same time, to more shipments from Brazil, especially from Feb 2023 onwards.

Sluggish Farmer Selling

Even so, if Brazil really harvests a bumper crop in 2023, the country will need to diversify, increasing exports not only of soybeans, but also of soybean meal and oil, to other destinations. The lower prices that are likely to result from a huge production Brazil could help attract more demand. Lower prices, however, are not good news for Brazilian producers. Despite being aware that there may be a production surplus, farmers had sold only 15% of the 2022-23 potential production by the end of August, according to AgRural. It is the lowest forward selling pace since 2014-15.