Opinion Focus

In 2022/23, Brazilian corn exports surpassed those of the U.S. by 32.5%. This was driven by large Chinese purchases. Can Brazil retain its market share in the future?

Brazil Achieved 1st place in Corn Exports

Last season (22/23) Brazil surpassed U.S. corn exports by 32.5% – 13.7 million tonnes. According to SECEX (Secretariat of Foreign Trade), 55.9 million tonnes left Brazilian ports between January and December last year, compared to 42.2 million tonnes sent abroad by U.S. terminals, as pointed out in a report by the US Department of Agriculture in its April report.

In addition to competitive prices, a record Brazilian harvest of 131.9 million tonnes and even the trade fight between the U.S. and China, the excellent performance of Brazilian shipments was mainly possible due to the reconfiguration of the global trade framework since the Russian invasion of Ukraine in February 2022.

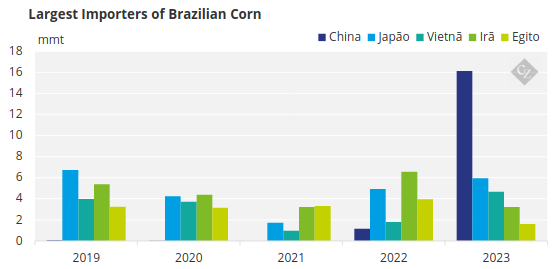

Source: Comexstat

China, the main buyer of other Brazilian agricultural products, has always purchased insignificant quantities of Brazilian corn. For many years market participants have been dealing with rumours about a possible return of Chinese buying.

But What Caused China to Return so Suddenly?

We know that China has always been a major buyer of U.S. corn, and for reasons of price and logistics, Ukraine also supplied 8.23 million tonnes from the Black Sea region in 2021, the year before the conflict with the Russians.

With the beginning of production problems, and mainly logistics in the Black Sea caused by the war, Ukrainian exports to China fell in 2022 to 5.26 million tonnes, with a small improvement in 2023, to 5.51 million tonnes. tons.

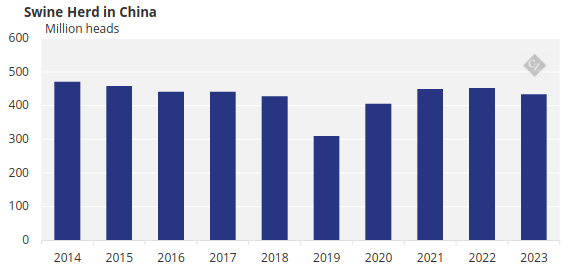

The problem quickly forced the Chinese to look for alternative options for their strong demand at the time, as they were at the end of the process of recovering their pig herd after a 30% drop in 2019, which, despite not seeming alarming, had a strong impact internally, given that China is a deficit country in relation to swine production/consumption. In view of this, Brazil emerged as a good option, meaning that the phytosanitary obstacles, that until then prevented any type of negotiation, were resolved at the end of 2022, meaning that 1.1 million tonnes would leave Brazilian ports towards China in December of that year.

Source: USDA

In the following year, Brazil exported a total of 16.1 million tonnes of corn to China, 28.8% of its export share, and well above the 2nd largest buyer, Japan, with 5.9 million tonnes.

This movement was possible thanks not only to Ukraine, but also to the U.S., which after a trade war with the Chinese during Donald Trump’s government, saw its sales to China fall from 19.83 million tonnes in 2021, to 7. 14 million tonnes last year.

Will Brazil be Able to Maintain its Position?

In 2024, the Chinese remain active in the Brazilian market, having purchased 0.9 million tonnes of corn until March, doubling the amount imported year on year (0.47 million tonnes in March 2023). Despite this, Ukraine is slowly getting back into the game, having sold 1.53 million tonnes to the Chinese by March.

Although the production number for the 23/24 harvest is still very controversial, with projections that vary between 111 and 124 million tonnes, from CONAB, and the USDA respectively, Brazilian production will certainly be much lower than the observed in the last harvest, naturally reducing its export capacity.

However, the return of corn supplies from the Black Sea, coupled with Donald Trump’s possible victory in the U.S. elections in November this year (who would likely try a trade deal with China to regain its corn export volumes, in exchange for easing another tariff), should not facilitate our exports.

Although Brazil, as the largest global supplier of corn, is a sure origin, we certainly still have a long way to go before this becomes common.