Insight Focus

Trade disputes between the EU and US have intensified. Potential tariffs could disrupt supply chains and raise costs. This uncertainty complicates long-term planning for PET producers and may reduce competitiveness and profitability.

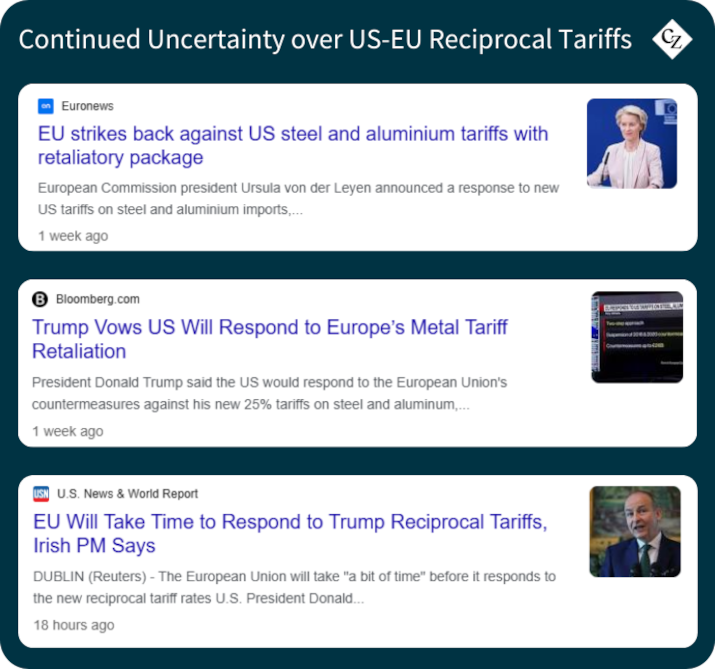

It won’t come as news to you that there are rumblings of trade disputes between the EU and the US, with PET exporters on both sides of the Atlantic looking for positive, solid facts to hold on to.

As various reciprocal tariffs on steel, aluminium and other industrial plastics remain unclear, the potential consequences for PET producers and converters who export in either direction are significant. In the absence of clear decisions, we can at least look at potential issues and hypothetical solutions.

How Tariffs Could Disrupt PET Converters’ Supply Chains

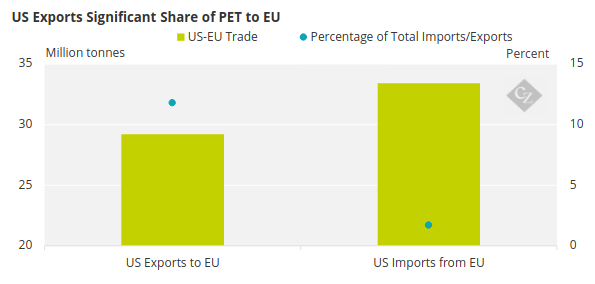

According to data from the Office of Economic Complexity, the EU is quite a significant market for US PET exports – although it exports relatively little. The North American country exported PET worth USD 29.2 million to European countries in 2023 – about 11.8% of its total PET exports. The US’ PET imports from the EU, on the other hand, totalled just USD 33.4 million – about 1.7% of the total USD 1.93 billion in imports.

The US is relatively unimportant for EU PET trade, according to the data. It accounts for less than 1% of both exports and imports in terms of value. The EU’s PET trade is mainly intra-EU, making up about USD 1.93 billion of the total USD 2 billion in exports and USD 2.4 billion of the total USD 3.68 billion in imports in 2023.

For PET converters exporting to the US, the introduction of tariffs may force companies to shift sourcing strategies, which could lead to delays or increased costs in obtaining the necessary raw materials and equipment. This would, in turn, affect production schedules and profitability.

Production costs could also rise for converters that rely on US-manufactured equipment or components made from affected materials, including steel and aluminium, which could also reduce competitiveness or at least squeeze tight margins.

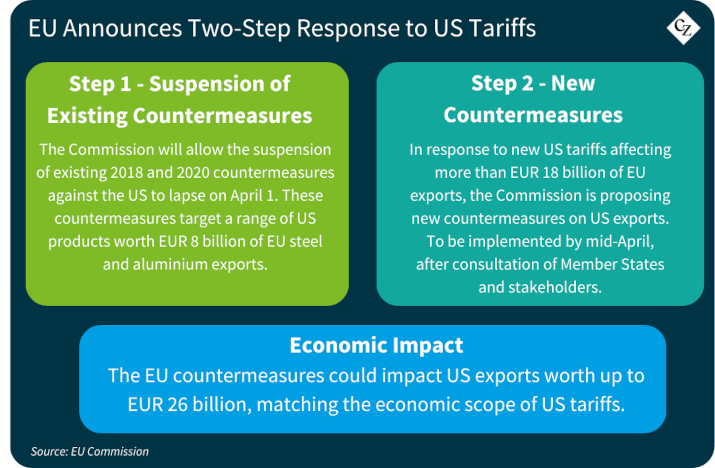

For PET producers and converters in the US that export to customers in Europe, the challenges are different but equally frustrating. Possible retaliatory measures could result in counter-tariffs on US goods, making US exports less competitive in the European market, especially if there is also a lack of confidence in the market or concerns about additional issues that have yet to be announced, further complicating an already frustrating process.

Continued Market Uncertainty

Any high tariffs would likely lead US PET producers to seek alternative markets for their products. While this could be a potential solution, it would also disrupt established relationships that may be difficult to rebuild once the volatility calms.

Any impact on competitiveness could negatively influence profitability, so combined with trading difficulties, the introduction and escalation of tariffs could lead to an economic downturn, which nobody wants.

Economic uncertainties are compounded by regulatory uncertainties, with any disruption adding fuel to the fire. This unpredictability makes it difficult for PET producers on both sides of the Atlantic to make long-term plans, especially if demand for consumer packaging declines due to these political decisions.

It’s fair to say that the current tariff tensions between the EU and the US present a challenge for PET producers and converters wherever they stand. It would be wise to stay open-minded about alternative sourcing strategies while hoping that the volatility will decrease.