Insight Focus

In 2024, several maritime chokepoints emerged for the shipping industry. Going into 2025, key hotspots will continue to impact global shipping routes due to geopolitical risks and economic factors. Shipping companies must adopt flexible strategies, enhanced security and technology to manage disruptions.

As we are into the first month of 2025, identifying the pivotal maritime trade “hotspots” that will influence the shipping industry this year is crucial. These regions, where geopolitical risks intersect with economic forces, are poised to reshape global shipping routes, redefine major trade lanes and set the tone for the global supply chains industry.

Stakeholders, such as shipping companies, port operators, and governments, must address these risks by adopting enhanced security measures, engaging in diplomatic negotiations and fostering regional cooperation. Effectively managing these challenges is essential for preserving the efficiency and stability of global trade.

Each of these critical areas presents distinct challenges that can affect shipping routes, trade flows and maritime security. To navigate these complexities, shipping companies must implement robust strategies that enhance resilience and operational flexibility. These might include regularly tracking developments in key hotspots, maintaining flexibility when it comes to vessel routing and even investing in a presence in alternative ports and hubs.

Red Sea and Suez Canal

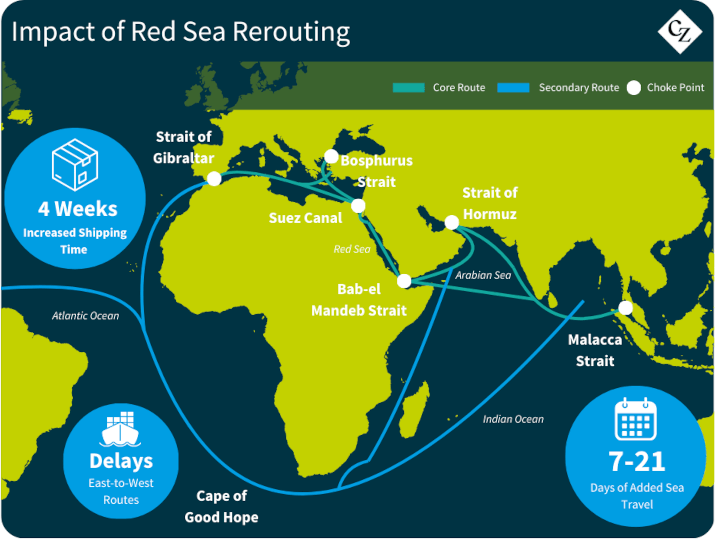

Unsurprisingly, the Red Sea is once again expected to be at the epicentre of the shipping industry. The region remains volatile, with continued Houthi attacks targeting commercial vessels. This ongoing unrest has led to the Red Sea, including the Suez Canal, being classified as “restricted zones” by many shipping companies.

As a result, ports along the alternative route via the Cape of Good Hope are absorbing increased vessel traffic. This shift significantly impacts global trade, causing longer delivery times, delays, elevated costs and increased freight rates. With no resolution in sight, these challenges are expected to persist, adding complexity to global supply chains and maritime operations.

While a ceasefire has now been declared in Gaza, tensions continue to simmer across the broader Middle East and Red Sea region, involving countries like Iran and Yemen, which further exacerbates regional instability.

Taiwan Strait

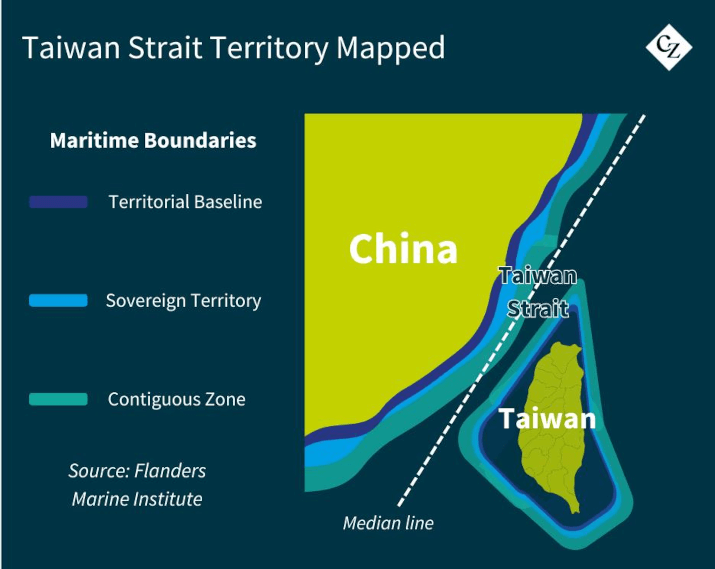

The Taiwan Strait remains a focal point in the strained relationship between China and Taiwan, with far-reaching implications for international shipping.

As a major global shipping artery, any escalation in military tensions or conflict in this region could disrupt one of the world’s busiest trade routes, destabilising supply chains and increasing costs due to rerouting and heightened security measures.

Research from thinktank Center for Strategic and International Studies shows that around $2.45 trillion in goods transited the strait in 2022, accounting for 20% of all maritime trade. The impact of conflict in this small strait cannot be underestimated.

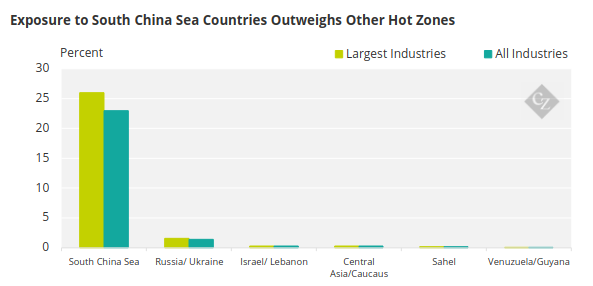

South China Sea

With over USD 3 trillion worth of trade passing through annually, the South China Sea is a cornerstone of global maritime commerce. However, territorial disputes involving nations such as China, the Philippines, Vietnam and Malaysia, along with China’s militarisation of key islands, create a volatile environment.

Source: Dow Jones

These tensions challenge freedom of navigation and raise concerns about potential conflicts, threatening to disrupt crucial shipping lanes and trigger international confrontations.

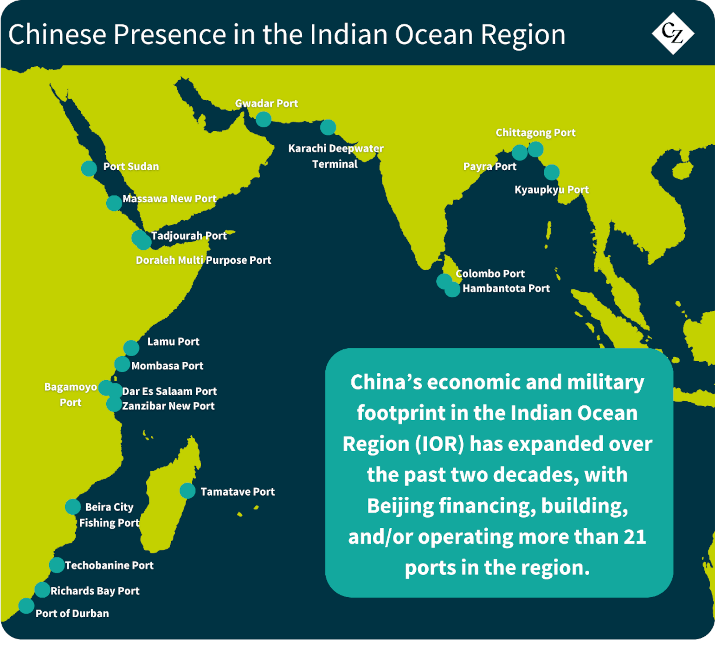

China’s Dual-Use Ports

China’s strategic development of dual-use ports—such as those in Djibouti, Gwadar in Pakistan and Hainan—adds a layer of complexity to global maritime trade. While these ports facilitate commercial activity, they also serve military objectives, enabling China to project power along vital trade routes.

This dual functionality heightens concerns among nations wary of China’s growing maritime influence and introduces additional risks to regional stability.

Gulf of Guinea

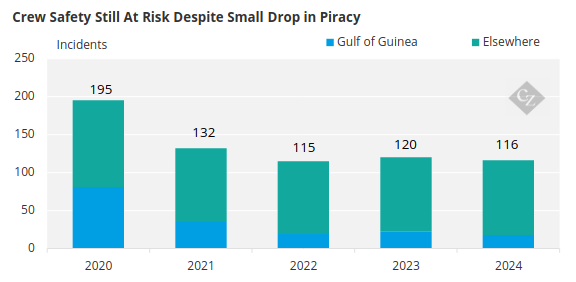

Piracy and maritime crimes continue to plague the Gulf of Guinea, significantly affecting trade security.

Weak maritime governance in the region contributes to cargo theft, kidnapping, and smuggling. These persistent threats drive up insurance premiums, demand higher security investments and may compel ships to take longer, alternative routes to avoid high-risk areas.

Source: ICC

Panama Canal

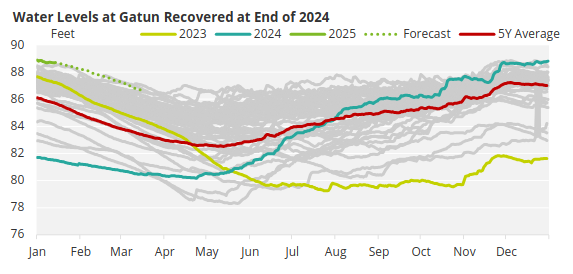

Recurring droughts have created operational challenges for the Panama Canal, reducing water levels and imposing draft restrictions that limit shiploads.

Source: Panama Canal Authority

While water levels have recovered at the end of 2024 as El Nino subsided and La Nina emerged, the Panama Canal now faces heightened geopolitical tensions. Recent remarks by US President Donald Trump have added complexity to the region.

Trump stated that he would not rule out military measures to regain control of the canal, citing concerns over Chinese influence on this strategic waterway. These developments further strain one of the main arteries of global trade, intensifying challenges for stakeholders and raising fears of potential disruptions.

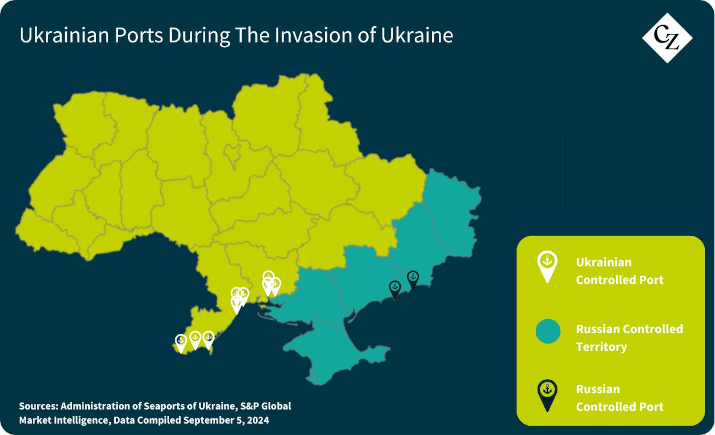

Black Sea

Geopolitical instability in the Black Sea, fuelled by Russian activities in Crimea and Eastern Ukraine, has significant implications for maritime trade. Tensions in this region threaten shipping routes, oil and gas transport and the broader security framework of Eastern Europe, making it a key area of concern for global trade.

Bab-el-Mandeb and Strait of Hormuz

The Bab-el-Mandeb and Strait of Hormuz are two of the world’s most critical chokepoints for energy supplies and trade. The ongoing conflict in Yemen poses threats to the Bab-el-Mandeb, including potential missile and drone attacks on shipping.

Meanwhile, geopolitical tensions involving Iran in the Strait of Hormuz could disrupt oil flows, triggering severe global economic consequences. Oil price fluctuations famously have huge impacts on economic growth, given that it accounts for 3% of global GDP.