Insight Focus

China is the world’s largest sugar importer. How it buys its sugar often moves the market. But its domestic sugar production is increasing, which might be important in the future.

Production Gap For the 2024/25 Season

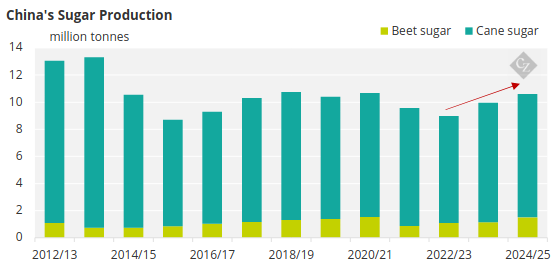

China’s sugar production in 2023/24 has reached 9.96 million tonnes, an increase of 11% year-on-year. China is not stopping there; we expect sugar production to increase again to 10.6m tonnes in 2024/25.

However, this growth is still not enough to fully meet domestic demand. We estimate China’s sugar consumption at 15.5 million tonnes and 16 million tonnes, which means that there is still a sugar supply gap of about 5 million tonnes.

A Glance at 2024/25 Sugar Crop Planting

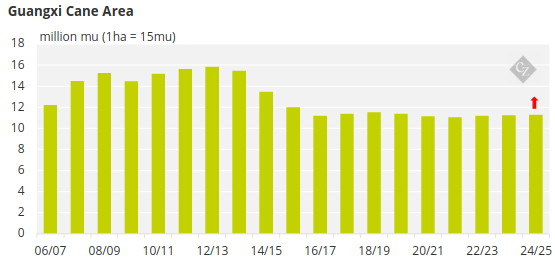

Spurred on by the sugar bull market in the past few years, cane and beet cultivation in China has finally begun to grow. For the 2024/25 season, a major sugar group with the fourth largest sugar production in the country has reported an expansion of 240,000 mu (16,000 ha) of sugarcane area to 1.84 million mu (122,700 ha) by the end of May.

Although only a negligible increase has been publicly reported in the sugarcane area in Guangxi, the sugar production in a good year can reach 6.3 million tonnes, an increase of 120,000 tonnes over the 2023/24 season.

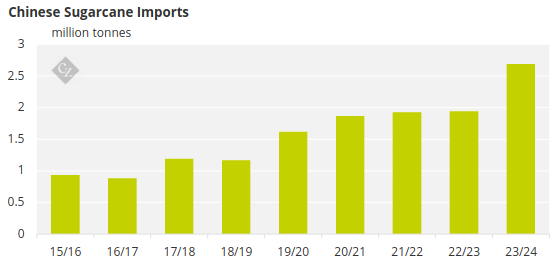

Cross-border sugarcane imports are also on the rise. Yunnan has been plagued by dry weather in recent years, so the local sugarcane production in Yunnan has not been satisfactory. However, the amount of imported sugarcane has increased significantly. The sugarcane is mainly transported from Laos and Vietnam to sugar mills in Yunnan for crushing.

As of the end of May, a total of 2.69 million tonnes of sugarcane were imported for the 2023/24 season, an increase of 38% over the previous season. Once the weather returns to normal, Yunnan (the second-largest producing region) could produce more than 2.032 million tonnes of sugar. This will be coupled with strong sugarcane imports.

Beet planting in Xinjiang and Inner Mongolia should also increase due to weakness in competitor crops such as corn, soy and potato. We think beet sugar output in 2024/25 could be around 1.5 million tonnes, 31% higher than this season.

Stock Levels Have Improved

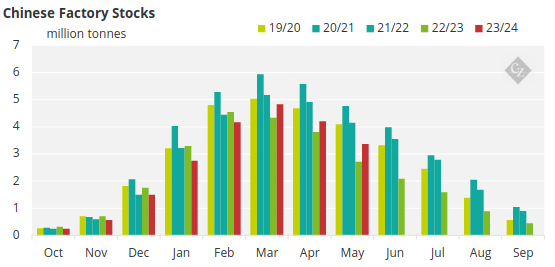

China’s sugar stocks in the 2023/24 season have improved compared to last year’s, but they remain historically tight. We will leave the national sugar reserves out of the discussion here, as these sugars are not freely circulated in the market.

At the end of May, China’s sugar mill industrial inventory stood at 3.37 million tonnes, 650,000 tonnes higher than the same period last year but 450,000 tonnes below the five-year average. This means that there is not much room on the stock side for China to significantly delay its imports.

China Will Continue to Be a Major Sugar Importer

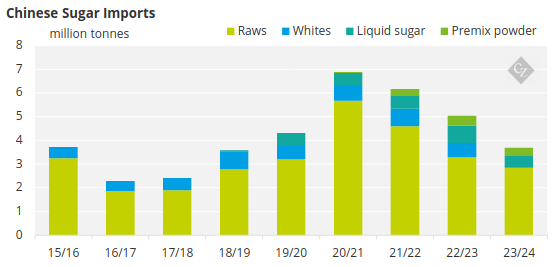

In the 2024/25 season, we think China will be the world’s leading sugar importer. At present, China’s imports of sugar products (including raw sugar, white sugar, pre-mix powder and liquid sugar) mainly come from Brazil and Thailand.

However, uncertainties in the international and domestic markets, particularly factors such as climate change, policy adjustments and market volatility, may have an impact on the way China imports sugar.

Source: China Customs, CZ App

Note: 2023/24 data is updated until end of May with value converted to sugar equivalent