This Insight was published on the 11th March in Portuguese.

- After almost two months withholding the increase in gasoline, Petrobras partially passed on the rise of international prices to the refineries.

- Gasoline prices at the refinery will be increased by 18.7%, reaching to R$3.86/litre.

- What does this mean for ethanol parity and sugar prices?

Close to International Parity

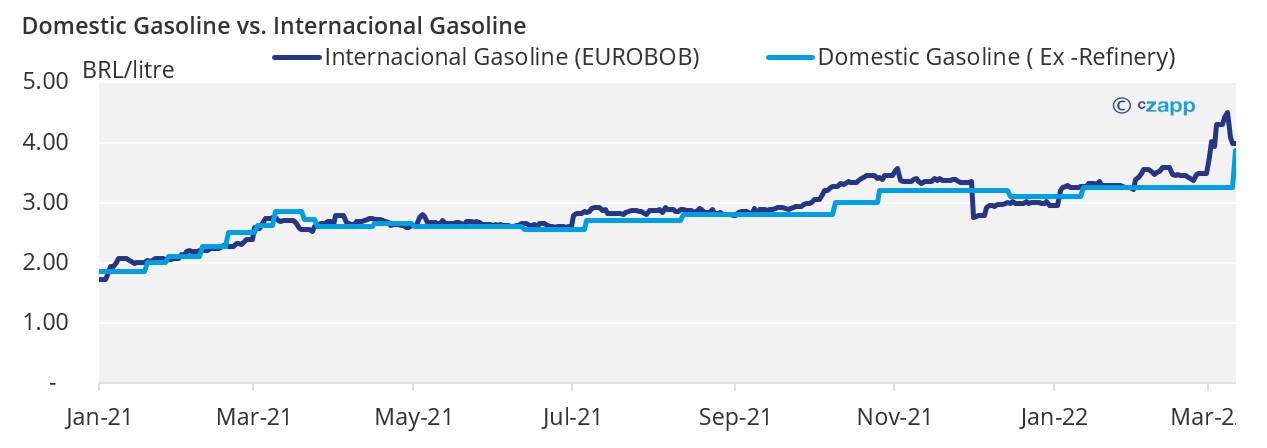

- In January, when Brent was at 85 USD/bbl, Petrobras made a full adjustment in gasoline prices.

- 57 days later, and with Brent oil 30% higher, the company made a new fuel price readjustment – but this time partially.

- As of the 11th March, the price of gasoline at the refineries will increase by 18.7% to R$3.86/liter.

- With this, the gap between the domestic and international gasoline prices reduces to less than 5%.

- Petrobras made the adjustment after seeking government authorisation and warning about a possible risk of fuel shortages – according to sources, there was a risk of running out of diesel as early as April.

- The company seeking government authorisation signals a reduction in decision-making autonomy amid high prices.

The Effects on Ethanol Prices

- The price increase at the refinery will be passed onto consumers at gas stations, giving space for ethanol to rise without losing competitiveness.

- This means ethanol (ex-mill) prices have potential to increase.

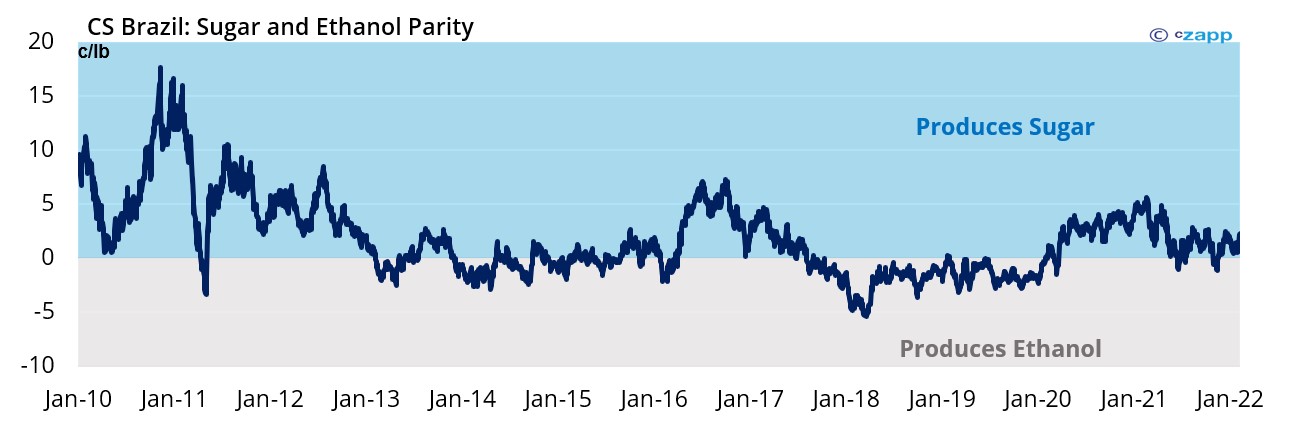

- Today, the ethanol parity is at 17.87 c/lb, since the price of ethanol (ex-mill) is around BRL 2.9/liter.

- With this revision, ethanol has the potential to reach a theoretical parity of 21/clb (No. 11 bases). – considering FX rate of 5.01 BRL/USD

But Why Theoretical Parity?

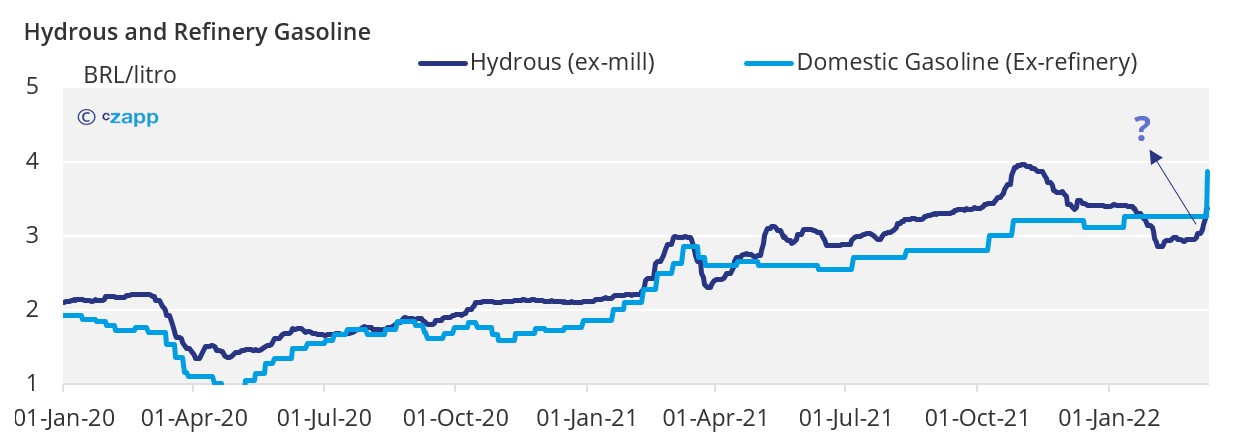

- Remember that for this to happen, hydrous prices must reach 3.45 BRL/litre.

- Today, the price is 2.92 BRL/liter (ex-mill) so an 18% increase is required.

- The last time Petrobras readjusted prices in January, ethanol at the mills didn’t move.

- On the contrary, even during the off-season and without fresh supply, biofuel prices fell in the following weeks.

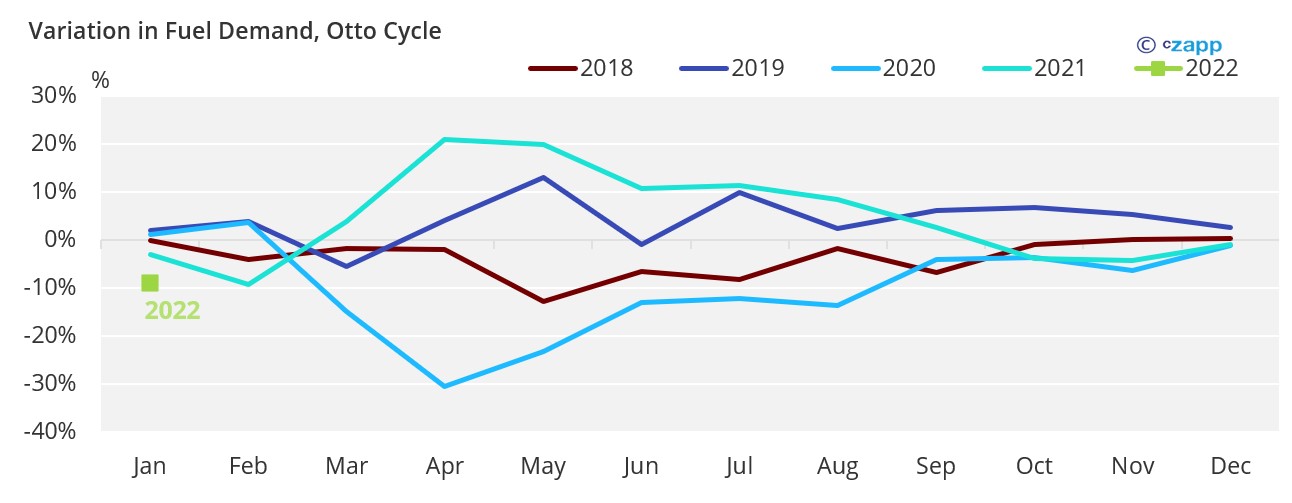

- Hydrous prices are a reflection of the drop in demand and the high parity at pumps, which has averaged 73% since January.

- In January alone, there was a 9% retraction in fuel demand.

- In addition, the hydrous market share dropped to 21%, the lowest level since June 2017.

- But not everything is negative.

- With the rise in gasoline prices being passed on faster to the pumps, the parity has already dropped below 70% (average SP), which should start to encourage consumer migration back to ethanol.

- The movement of the Paulínia hydrous ethanol daily index was also positive, rising 4% to indicate that there should be an increase in the price asked by producers.

- But still, demand for hydrous needs to recover significantly for the theoretical parity to reach 21c, considering an FX rate at 5.01 BRL/USD.

The Political Risk Has Not Disappeared

- On the 10th March, the Gasoline Price Stabilization Account (CEP) was approved by the Senate, which changes Petrobras’ price policy in practice.

- The CEP seeks to reduce price fluctuations at gas stations.

- For the proposal to be implemented, it must still be approved by the house of representatives.

- The idea behind the CEP is to establish a price band which gasoline can vary – a maximum price and a minimum price will be defined.

- In short, it’s a mechanism to reduce the impact of price fluctuations that surges in the international market to be passed on to the national market.

- This means that if the proposal is approved, a hike in the international prices will not be fully reflected domestically.

- We therefore see a limit on the upside for ethanol prices.

Concluding Thoughts

- For now, the gasoline price readjustment will be passed onto the consumer.

- And this is positive for the ethanol market, as it allows the price to rise without impacting parity at the pumps.

- However, we need to be aware of other variables that may affect the reaction of biofuel prices.

- The 2022/23 crop starts now in April, bringing a fresh supply to the market.

- Also, how will demand behave? Will it rise enough to be a price catalyst in the upcoming months?

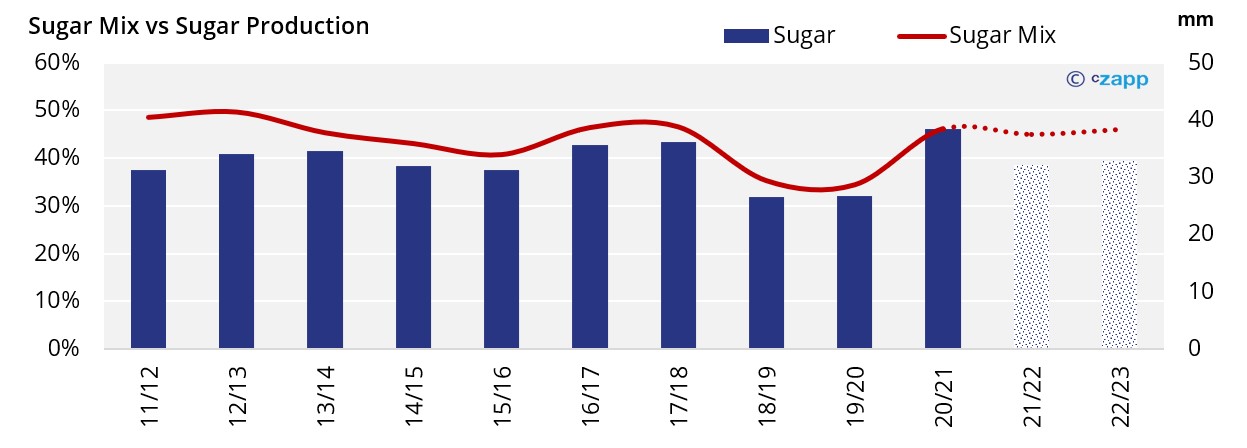

- If ethanol reaches the theoretical parity of 21c, the No.11 would have to be above this level to prevent a production mix switch in the mills.

Other Insights That May Be of Interest…

Other Insights That May Be of Interest…