Main Points

- Like other markets, the fertilizer sector had a historic high since the beginning of the year;

- Result of delays in the supply chain, geopolitical issues and the scarcity of raw materials.

- The consequence is directly seen in the production costs of the agro sector.

No Surprises

- As we mentioned in the last cost of production report,we analyzed the cost inflation across the sugar and ethanol chain.

- The high sugar and ethanol values are increasing the cane price in Centre South Brazil.

- Additionally, because of the macro scenario, the high price of inputs and fuels (diesel in particular) affects even more costs of production.

- In this report we will take a closer look into one of the inputs that rose the most in the past year: fertilizers.

Why the climb?

- We had a three-factor combination that caused the rally in fertilizers prices: exchange rate (weakness of Brazilian Real), higher maritime freights and the supply crisis of some raw materials.

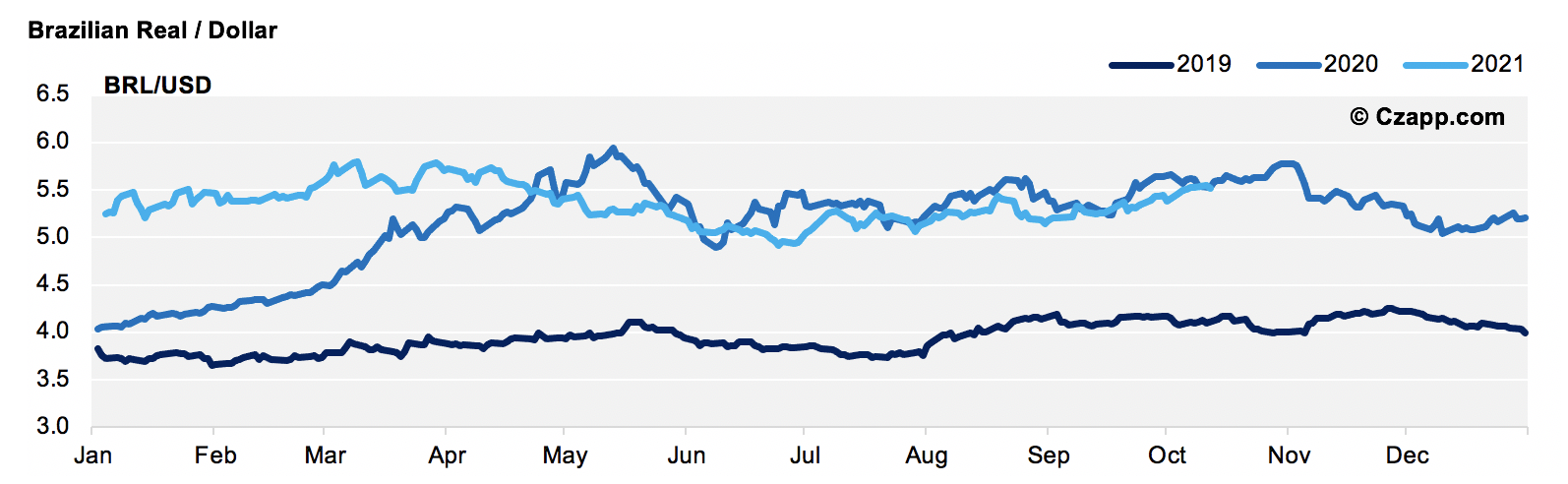

- Starting with the exchange:

- Real weakened 3.5% against the Dollar when compared to 2020, trading at an annual average of 5.35 BRL/USD.

- Since a great portion of the raw material for fertilizers is imported, the weak Real significantly affected the final price for producers.

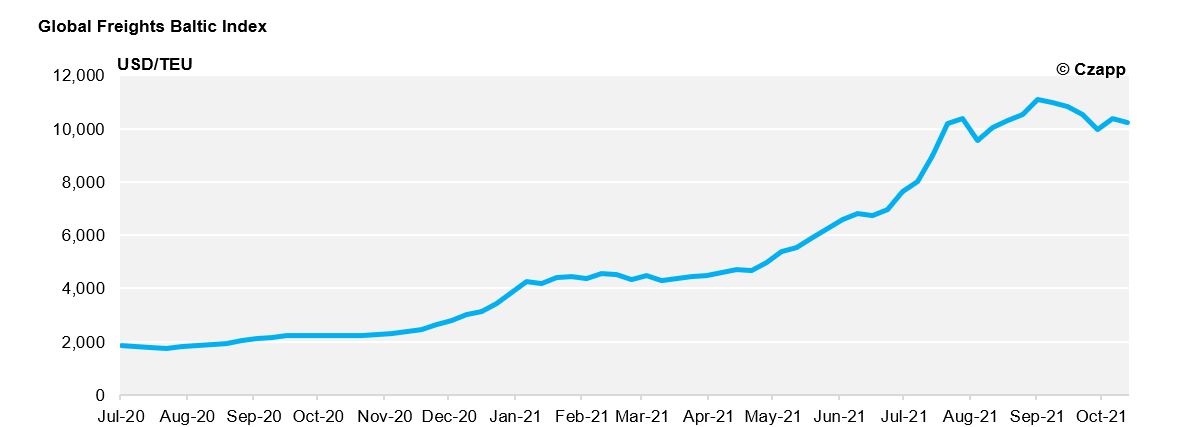

- On the logistical side, the maritime freight suffered a widespread high.

- For example, the pandemic saw countries racing in securing raw materials, leading to a shortage of containers.

- The container freight values climbed from 2k USD/TEU to more than 10k USD/TEU.

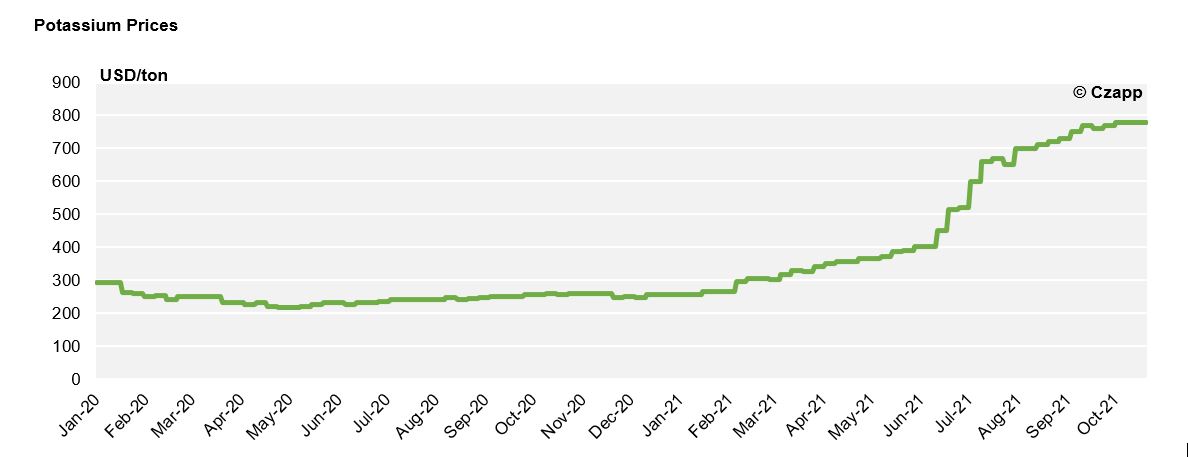

- Another factor was the potassium supply crisis.

- Different from what many imagine, it is not a problem of raw material shortages, but actually a geopolitical issue:

- The US blocked imports from Belarus, which is responsible for 1/4 share of the world’s production of potassium chloride

- And specifically, 30% percent of Brazil’s potassium imports are from Belarus.

- This created a problem of sourcing the material, that ultimately affected price.

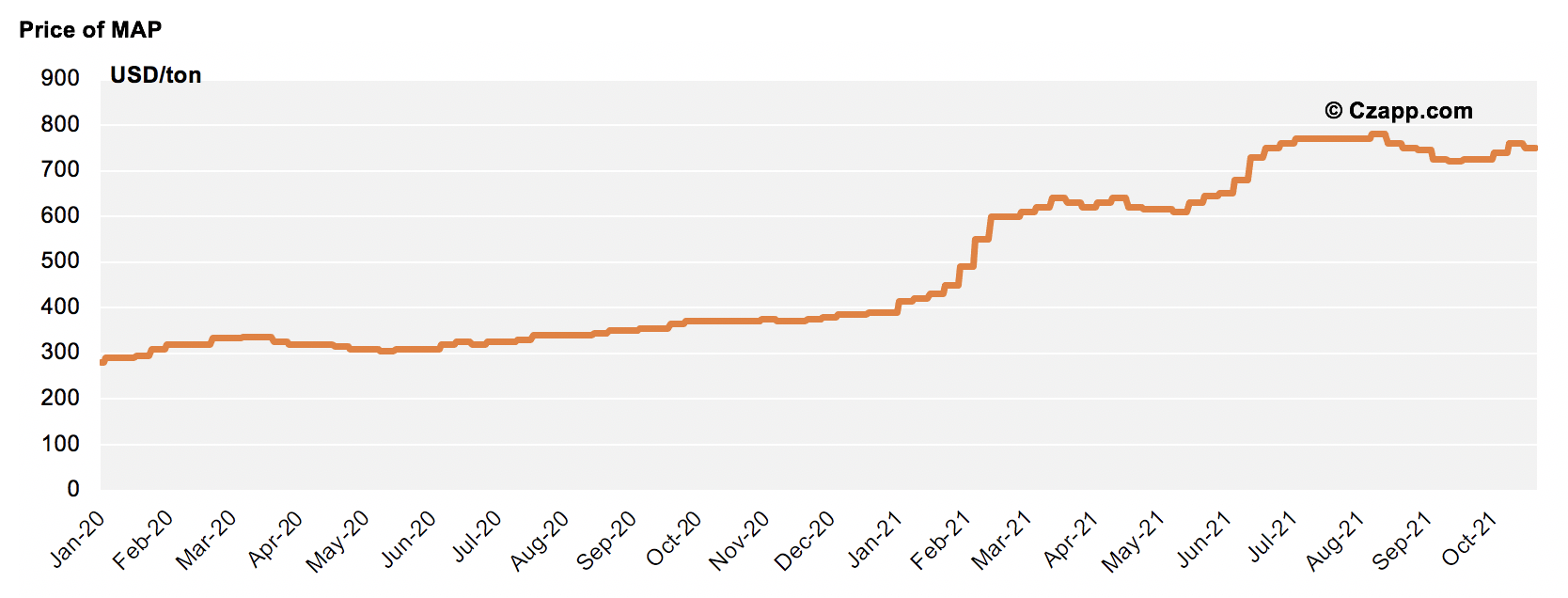

- And last but not least, nitrogen.

- This input was also affected by supply crisis.

- One of the reasons for its shortage is the Chinese energy crisis – for more information on this topic read this analysis.

- The price of natural gas (quoted in the English exchange), one of the major inputs for nitrogen production, has risen 5000% since May 2020

- And obviously the nitrogenated fertilizers in Brazil did not escape unscathed:

- The MAP, mineral fertilizer that contains phosphorus and nitrogen, rose 93% – going from 415 USD/ton at the beginning of the year for the current price of 750USD/ton.

How is Cane Affected?

- With prices at record levels, many producers are replacing and/or rationing some fertilizers.

- They are applying less nitrogenous fertilizers such as compost and replacing it with filter cake – an important residue from the sugar and alcohol industry.

- Still, neither farmers nor millers can manage to escape completely from the price hike.

- Agricultural costs correspond to approximately 62% of the total cost of sugar production

- But within the cost of the inputs used in the treatment of sugarcane, fertilizers have a weight of more than 50%.

- With the rise in cane price and inputs, and Real devaluation, the average cost of sugar production in Centre South Brazil rose about 20% yoy, reaching around R$1500 /ton.

- Talking to people close to the fertilizer sector, the feeling is that the scenario will not normalize in the short term.

- Many bet that the supply shock should last for the first quarter of 2022 – raising a red flag for the second corn crop, the largest in the country.

- Therefore, fertilizer prices are expected to remain high, resulting in operations costs to follow suit…

- The focus for a while will continue to be cost control.

- All that is left for us is to monitor how the cane fields will react in the 2022/23 crop, with this potential reduction in agricultural maintenance …

Reports that you might like……

Dashboards that you might like…