- At first glance, the global wheat futures markets can be quite confusing.

- Within one market, there are premiums between some months, and discounts between others. Why does one wheat futures market go up while another is going down?

- Understanding why things are the way they are is paramount to anyone involved, or starting out, in wheat.

The Futures Markets

We’ve previously discussed the different futures markets, but in short, they represent the various types of wheat grown in different regions.

Each market has its own quality specifications relevant to the individual wheats traded.

The prices will be based on a point of delivery, such as stores in-land, or ports used for export. Prices are quoted in currencies relevant to the local trade, as are the contract volumes (i.e., metric tonnes or bushels).

The contracts can be either cash settled in advance or converted to physical grain at the relevant delivery month. Some markets don’t allow for physical delivery and as such must be cash settled in advance.

How the Harvests Shape Price Dynamics

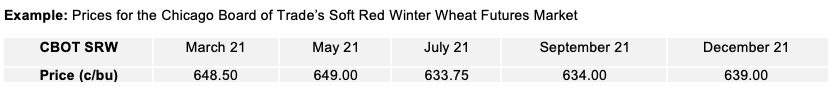

Futures prices are quoted based upon various months of delivery throughout the year.

Harvest takes place during the summer months. Quoted prices will generally be lowest for these months and have small premiums thereafter (until the next harvest). This allows a higher price to the producer/farmer to cover storage and other costs if the wheat is sold for a later collection period.

The ‘new crop’ harvest will often lead to discounts for these months, below the prices of the last ‘old crop’ prices. This will depend on factors such as harvest expectations and carryover stocks still available.

The example below shows how there is a premium from March to May, as these are both ‘old crop’ months. With the harvest beginning between May and July, prices show a discount from May (old crop) to July (new crop).

The ‘One Up and One Down’ Concept

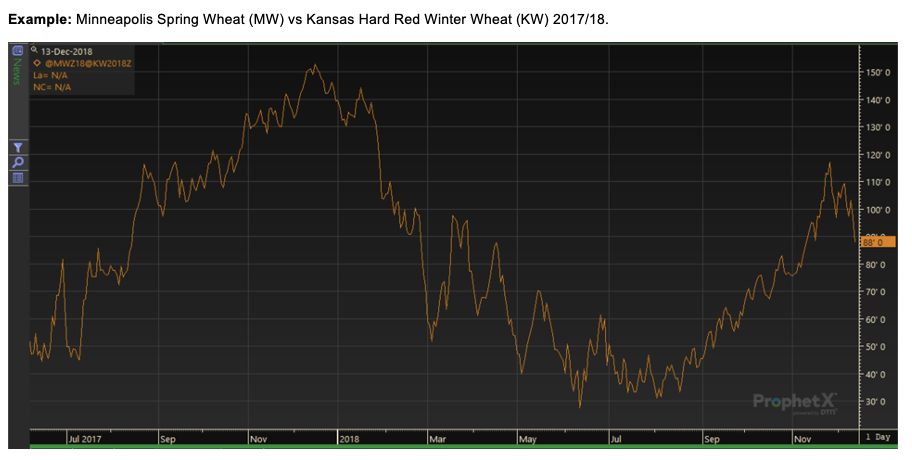

Different wheat futures markets don’t always move in the same direction at the same time. Many things influence why an individual market moves in an opposing direction to another. It’s usually general supply and demand factors, sometimes related to quality, which do not necessarily impact both markets equally.

Source: DTN Prophet X

Minneapolis Wheat (MW) is higher quality than Kansas Hard Red Winter Wheat winter wheat (KW).

Poor weather can have disastrous consequences for the high-quality requirements of the MW. This can support the price of premium quality MW, as harvest sees a reduced supply of high specification wheat.

Meanwhile, a proportion of the harvest will be downgraded and increase the supply of lower specification wheat.

In turn, the lower quality KW is impacted with a greater supply of similar quality competing wheat, pressuring prices.

The chart above showed how prices fluctuate to give varied premiums of MW over KW. They are both wheat but will have periods where one goes up and the other goes down.

The More You Know, the More You’ll Grow

Greater understanding of why the wheat markets do what they do allows us to better assess our own individual business needs within the marketplace.

Regardless of your role within the wheat chain, the wider your understanding of how it all interacts is, the more confident you’ll feel about the decisions you make.

Other Opinions You Might Be Interested In…