Insight Focus

- The USA depends on sugar imports to ensure supply each year.

- Two of its largest suppliers are struggling to supply in 2022/23.

- The USDA may have to reallocate raw sugar quota to those who can perform.

What is the TRQ?

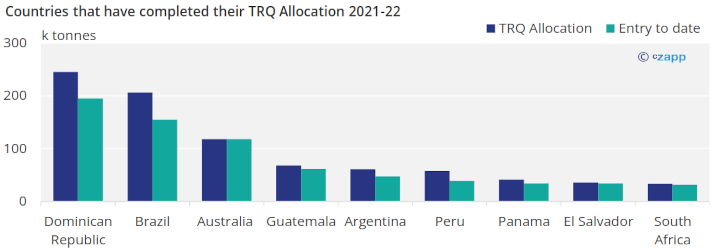

The US Department of Agriculture (USDA) has predicted in its latest World Agricultural Supply and Demand Estimates (WASDE) that around 1.2 million metric tonnes of raw sugar will enter the United States under the 2021/22 TRQ program. At the end of November, only 1.045m tonnes of sugar had entered the United States.

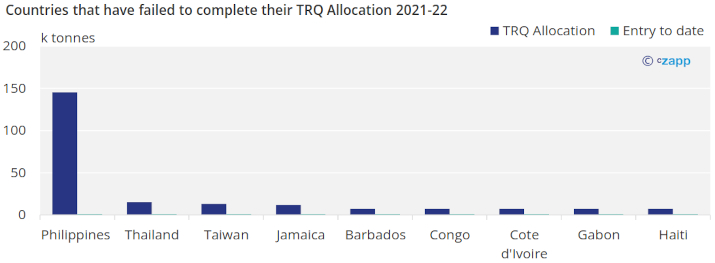

This raises the risk that the US will be under-supplied in 2023. The USDA will, therefore, probably reallocate around 230k tonnes of raw sugar import quota from countries that haven’t shipped to those that have, perhaps as early as February 2023.

Current Complexities for US Raw Sugar Supply

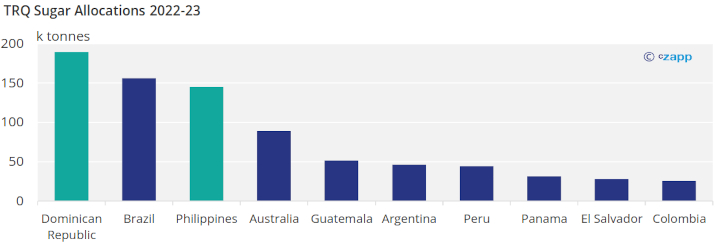

Compounding the USDA’s challenge are problems for two of the biggest participants in the US TRQ program; The Philippines and The Dominican Republic, both of whom comprise 334,578 tonnes out of the 2022/23 TRQ total supply.

The Philippines US TRQ Entries for 2021/2022 Are Minimal

The Philippines, which has the third largest TRQ allocation at 145k tonnes, will most likely fail to fulfill its 2021/22 quota, with no sugar having been reported as entered to date.

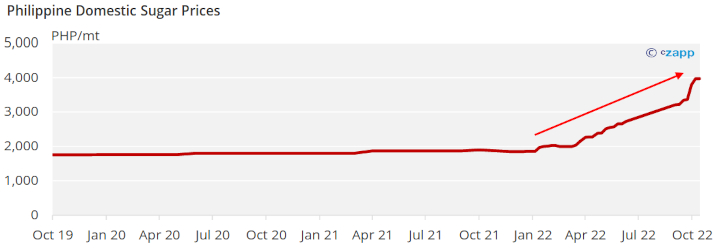

The Philippines doesn’t produce enough sugar to meet domestic needs each year, so it must import sugar to cover the deficit and ship to the USA. This year a political row has erupted over the quantity of sugar imports needed, slowing their arrival. Domestic prices have more than doubled, making exports to the US uncompetitive.

What is Happening in the Dominican Republic?

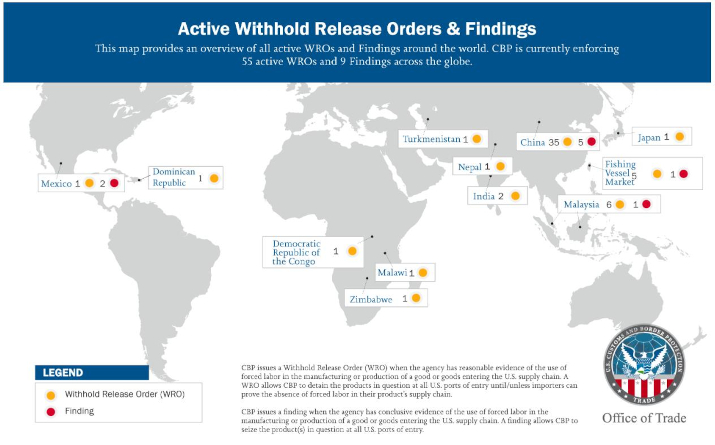

At the end of November, the US Customs and Border Protection (CBP) issued what is known as a “Withhold Release Order” (WRO) on Central Romana, the largest mill in the Dominican Republic and the most prominent exporter into the US TRQ.

The order means that CBP personnel at all U.S. ports of entry will detain raw sugar and sugar-based products produced by Central Romana while the order is in place. CBP has historically implemented these orders while investigating the labor standards and practices of the origin producer. There are currently 55 ongoing orders across the globe, with nine subsequent findings.

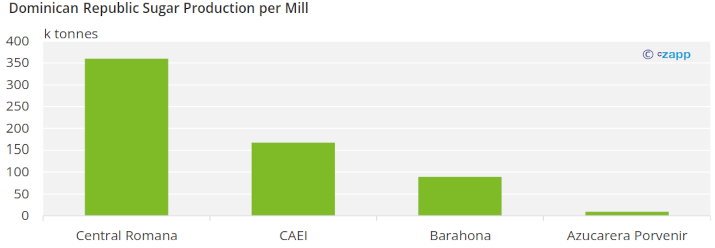

Central Romana is the largest sugar producer in the Dominican Republic and is the principal shipper of the country’s TRQ volume. However, even with the order in place, it is likely that the country will fulfil its commitments to the US. Central Romana will probably take over the country’s domestic allocation, leaving CAEI (Vicini) and Barahona to meet the US quota.

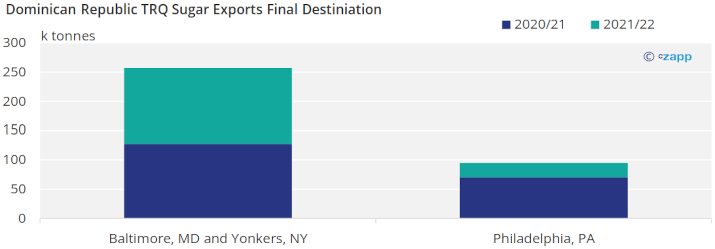

With a TRQ reallocation expected, it will be interesting to see where any additional reallocated Dominican raws ultimately get delivered. Historically, ASR’s Baltimore and Yonkers refineries have received most of the Dominican TRQ. However, with new participants involved in the marketing and exporting of the quota while the WRO is in place, this may pave the way for some alternative recipients and ports of entry for the country’s raws.

Who would benefit from a TRQ reallocation?

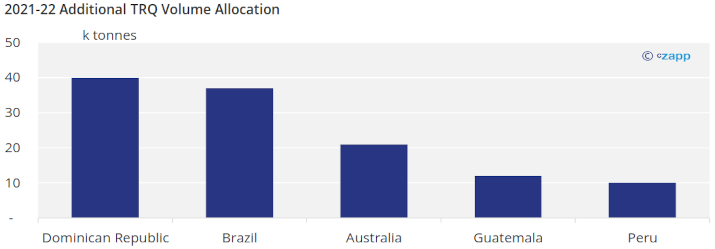

The countries that would benefit from a TRQ allocation this year are the same countries that completed their quota consistently in the past few years and received a reallocation last year. The countries that received additional allocation last year were Dominican Republic, Brazil, Australia, Guatemala, and Peru.