Insight Focus

The union representing longshoremen at major US East Coast Ports has called off contract negotiations with port authorities in a dispute over electronic gates. If a contract is not agreed within 80 days, strike activity will go ahead, disrupting an already tenuous supply chain.

The likelihood of a strike at all Atlantic and Gulf Coast Ports is increasing, according to Harold J. Daggett, President of the International Longshoremen’s Association (ILA), as the current labour contract expires in 80 days, on September 30, and no agreement has been reached between the ILA and the US Maritime Alliance (USMX), the representative body of employers.

Dagget, who is also the union’s Chief Negotiator, noted that the employers are running out of time to negotiate a new Master Contract and avoid a coastwide strike on October 1.

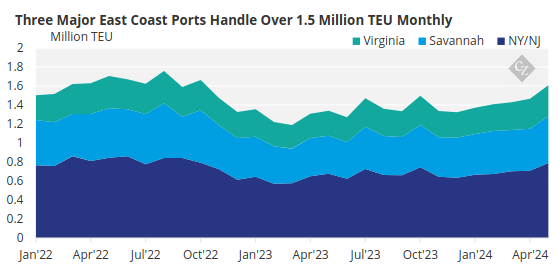

Source: Port of NY/NJ, Port of Savannah, Port of Virginia

The ILA, which represents 85,000 workers at 100 East and Gulf Coast ports, cancelled its Master Contract discussions with USMX after discovering that the global port operator APM Terminals and Danish ocean carrier Maersk Line were utilizing an Auto Gate system, which autonomously processes trucks without ILA labour.

This system, initially identified at the Port of Mobile in Alabama, is reportedly being used in other ports as well, according to the Association. On June 10, the ILA announced that it would not meet with USMX until the Auto Gate issue is resolved.

The USMX, on the other hand, said it is ready to continue talks with the union. “To avoid any further disruption to the cargo flow and/or damage to our nation’s economy, USMX remains ready, willing, and able to return to the bargaining table with the ILA to resume Master Contract negotiations and to reach a new Master Contract agreement,” stated the employers’ body.

Meanwhile, ILA is still awaiting the results of an audit on jobs created by new technology, a report it has anticipated for nearly two contract periods. The union has noted a growing number of Information Technology (IT) personnel at marine terminals and is concerned that APM Terminals and Maersk’s IT departments in Charlotte, North Carolina, are encroaching on its jurisdiction.

Concerns from Shipping Officials

Shipping stakeholders are cautiously monitoring the developments in contract negotiations between the ILA and the USMX. “The risks to global trade growth continue to increase,” said Hackett Associates founder Ben Hackett. “We are in a volatile situation with multiple pressures on the movement of goods, underpinned by continued inflationary pressures.”

Jonathan Gold, vice president for supply chain and customs policy of the National Retail Federation (NRF), said, “Lulls between supply chain challenges seldom last long, and importers are currently looking at issues including high shipping rates, unresolved port labour negotiations and continuing capacity and congestion issues from the ongoing disruptions in the Red Sea.”

July’s update of logistics metrics monitored by Descartes, a Canadian technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses, reinforces the strength of imports since the start of 2024.

“Despite strong US container imports, the risk of global supply chain disruptions remains high as the Middle East conflict and news of stalled labour negotiations at US South Atlantic and Gulf Coast ports threaten the stability of global trade,” said the company in a recent report.

Commenting on the ILA-USMX dispute, Chang Yen-yi, Chairman of Evergreen Marine Corporation, the seventh largest container line in the world, expressed concerns that if US East Coast port workers cannot resolve their differences with their employers, it could create more chaos in the container shipping industry.

Chang said: “I predict that the ILA will demand higher salaries as the Red Sea crisis has increased dockers’ workloads as shipping schedules are disrupted. If an agreement can’t be reached, the container shipping market will be more chaotic. It’s necessary to pay attention to the development in negotiations, as the recurrence of sabotage in the future will further affect the shipping market.”

US West Coast Gains Market Share

Meanwhile, the unstable condition on the East Coast has led to an upward trend in container volumes on the West Coast. “Worries over the lack of a new contract with East Coast/Gulf Coast dockworkers is shifting some cargo to West Coast ports,” confirms the Global Port Tracker report released by the National Retail Federation and Hackett Associates.

In particular, all the major container ports in California – Los Angeles, Long Beach and Oakland – have reported increased container throughputs in June.

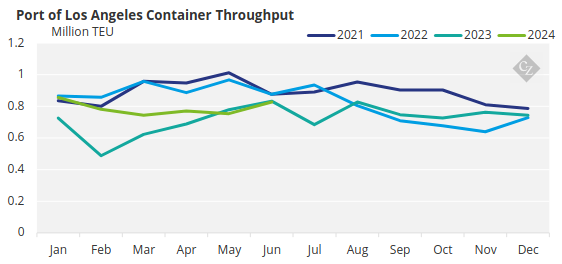

“June was a great month at the Port of Los Angeles, capping off of a stellar first half of the year,” said POLA Executive Director Gene Seroka. “The last six months have been steady and consistent, both in terms of cargo volume and, equally important, the efficiency on and around our terminal operations.” The Port of Los Angeles (POLA) handled 827,757 TEUs in the last month.

Source: Port of Los Angeles

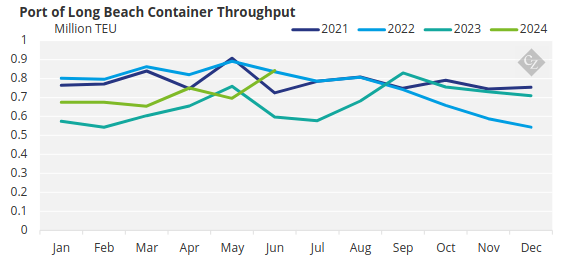

Additionally, the Port of Long Beach (POLB) experienced its busiest June on record with 842,446 TEUs, marking a significant 41.1% growth compared to the same month last year. This record has been “driven by vibrant consumer spending, potential tariff increases and ongoing labour contract negotiations at seaports on the East and Gulf coasts,” according to a port official.

Source: Port of Long Beach

POLB CEO Mario Cordero noted, “We are recapturing market share and consumer spending is driving cargo to our docks as we head into the peak shipping season.”

Moreover, the Port of Oakland moved 193,062 TEUs in June with the container volume increase showing a sign of return to pre-pandemic levels. “We are seeing promising signs from ocean carriers and importers, who are beginning to increase their inventories in preparation to meet holiday and year-end shopping demand,” stated Port of Oakland Maritime Director Bryan Brandes.