Insight Focus

- Global demand for sesame is rising but sesame yields have suffered globally.

- China is a major sesame importer, but it sources most production from African nations.

- Could Red Sea issues allow Brazil to step in and plug a supply gap?

Appetite for Sesame Grows

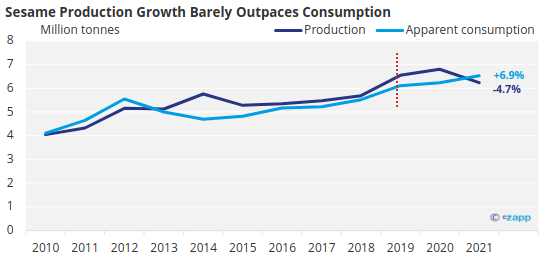

Global sesame production has expanded significantly in the past 15 years, but consumption has also been growing. In the past few years, production growth has faltered, while apparent consumption has continued to rise.

Source: FAOSTAT

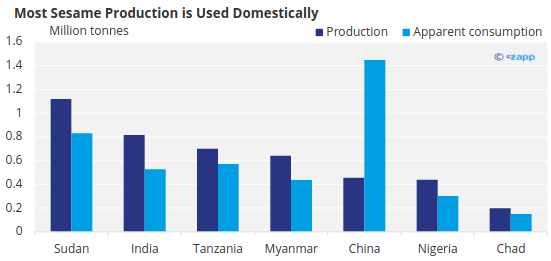

About 60 to 65 countries produce these seeds out of which Asian and African countries are the key producers. The main producing country is Sudan, followed by India, Myanmar, Tanzania, Nigeria, and China.

Most of the sesame harvested by the major producers is used domestically. In fact, China is highly dependent on sesame imports to satisfy domestic demand.

Source: FAOSTAT

Brazil Steps Up

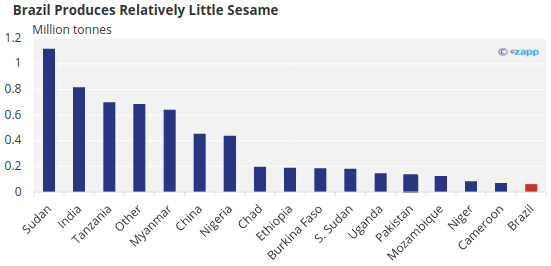

Brazil, with its recognized agricultural productivity, has become a global supplier but is still considered a small producer.

Source: FAOSTAT

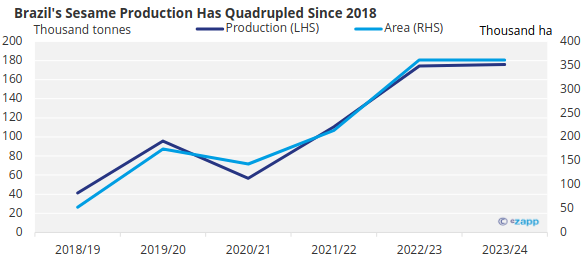

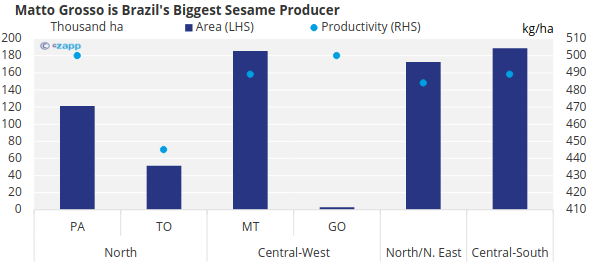

However, Brazil’s National Supply Company (Conab) expects production of 175,800 tonnes in 2023/24 – an increase of 184% on 2021 levels. Production is heavily concentrated in Mato Grosso state.

Source: Conab

Conab estimates that Mato Grosso will produce 90,700 tonnes of sesame, with 185,500 hectares (ha) allocated to grain. Para is the second largest producer, with 60,600 tonnes, followed by Tocantins at 23,000 tonnes. Goias is expected to produce 1,500 tonnes. These regions make up the majority of Brazil’s Cerrado – the largest savanna region in South America.

Reports suggest that most of the 2024 crop volume has already been sold internationally, but in future, Brazil is forecasted to increase its planted area.

Source: Conab

Corn Area Up for Grabs

Sesame plantations are relatively simple to cultivate because they only require basic agricultural techniques. The value of sesame seed and oil also generates more value than other crops, meaning they are a great option for small and medium-sized farmers. Another advantage is that the seed uses less soil correction and can be produced in between 90 and 130 days.

The price that farmers can obtain for sesame depends on whether the plantation is devoted or in rotation, as well as the area in which it is situated.

In Brazil, sesame has now gained popularity as a replacement for corn during the soybean off-season due to its lower production costs. These range from BRL 1,000/ha (USD 202/ha) to BRL 1,500/ha (303/ha) as opposed to higher costs of BRL 5,000/ha (USD 1,011/ha) for corn.

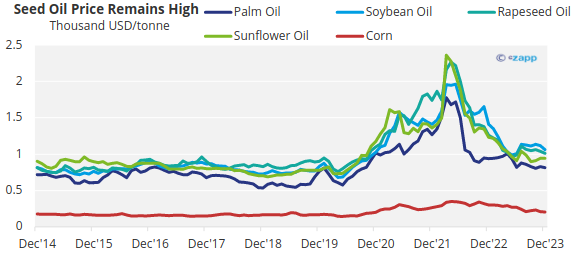

The profitability of the crop also contributes to the appeal of this oilseed. On average, the producer harvests 1,400kg/ha at BRL 5.50/kg, making BRL 7,700/ha in profit. The price of seed oils has risen exponentially in recent years due partly to the war in Ukraine.

Source: World Bank

In Brazil, there has been a devaluation in the corn culture due to high production levels and storage issues, which have caused prices to fall. This could create more opportunity for greater sesame cultivation areas across areas outside of the Cerrado, which sprawls across a wide band of central, northern, and eastern states.

Conab estimates that Brazil’s corn output will reach 117.6 million tons, a 10.9% or 14.3-million-tonne decrease from the last crop. It also predicts a 5.6% decrease in the planted area and productivity.

While this creates opportunities for greater sesame planted area, it is unlikely that this will threaten corn supply given that Brazilian sesame output is less than 1% of corn output.

Yield Issues to Be Addressed

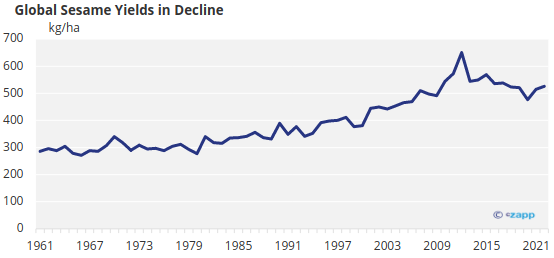

Sesame production around the world has suffered primarily due to declining yields.

Source: FAOSTAT

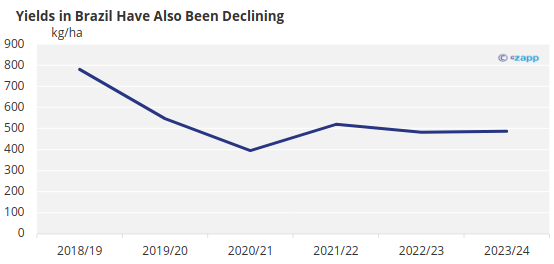

Brazil is no exception. Despite increasing production and an increase in area planted, sesame yields have dipped by about 37% since the 2018/19 season.

Source: Conab

Sesame plantation is not demanding on water, and favours areas of full sun and good drainage. Sesame development thrives in hot and dry climates, with ideal temperatures between 25°C and 30°C. Brazil’s meteorological agency INMET predicts that almost the whole nation will see temperatures above the climatological average throughout the quarter.

But the agency predicts that water levels in the soil will be high in the South region – where much of sesame growth is concentrated — for the foreseeable future. This is significant for the sesame crop because excessive moisture can harm sesame growth, promote fungal diseases, cause plant lodging and even flower falling.

9999

Sesame does grow across all five regions of Brazil: North, Northeast, Central-West, Southeast and South. In the North and Northeast regions, El Nino conditions will create below-average rainfall, which could be favourable for sesame growth.

According to the APEC Climate Centre (APCC), there is an 80–90% chance that these conditions will last until the quarter ending in May of 2024. The probability drops to a 60% possibility in the quarter of April, May, and June of 2024.

Opportunity to Fill Some Chinese Demand

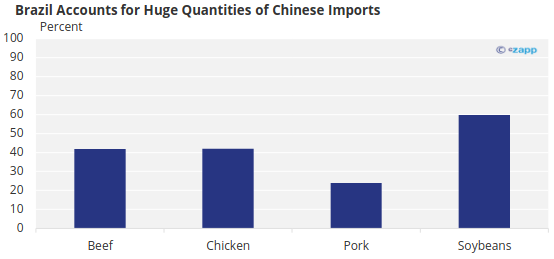

Brazil is already a major supplier to China across several agricultural commodities. In 2022, Brazil was China’s largest supplier of frozen beef, chicken soybeans, and was a major supplier of frozen pork.

Source: UN Comtrade

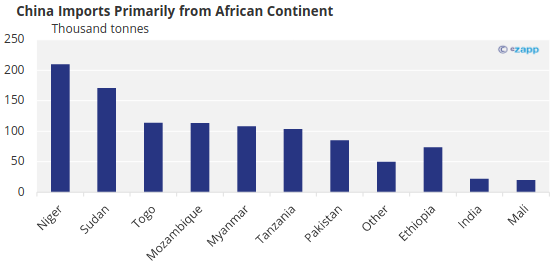

If it can solve its yield issues, Brazil has the opportunity to become a major supplier of another commodity to China. Currently, China sources most of its sesame from Africa.

Source: UN Comtrade

As we have seen previously, there are various production issues across African countries due to infrastructure challenges and conflicts. The Red Sea issues are also likely to cut off some African supply from Asia. Trade routes to Niger, Sudan and Togo – China’s three largest sesame suppliers – are likely to be impacted by ongoing Red Sea issues.

This leaves a substantial gap between supply and demand that could be snapped up by Brazil.

Concluding Thoughts

- Although Brazil is a relatively small sesame producer, production has been increasing in recent years.

- The increasing demand for seed oils is supporting sesame prices.

- But sesame yields need attention. Due to an increase in production area, productivity could be radically improved.

- El Nino has drastically different effects across Brazil. While excessive rainfall in some regions would be negative for crop development, warm, dry conditions elsewhere could aid yields.

- If yield issues are addressed, Brazil could capitalise on huge Chinese sesame demand spawning from Red Sea supply disruptions.