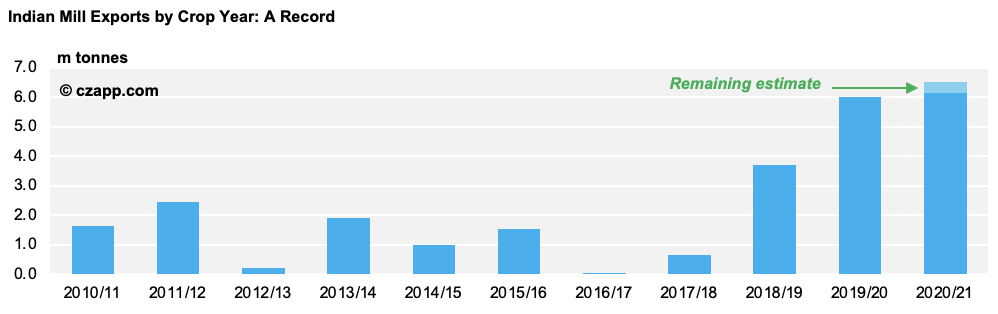

- India’s mills have exported 6.15m tonnes of sugar so far this season.

- We think the mills will export 6.5m tonnes in total, a new record.

- This is because high sugar prices mean it’s viable to export without a subsidy.

India’s Mills Continue to Export Without a Subsidy

- Indian mills have now exported 6.15m tonnes of sugar this season.

- This is more than they have ever exported in one season previously.

- About 350k tonnes of unsubsidised exports have now been nominated or shipped.

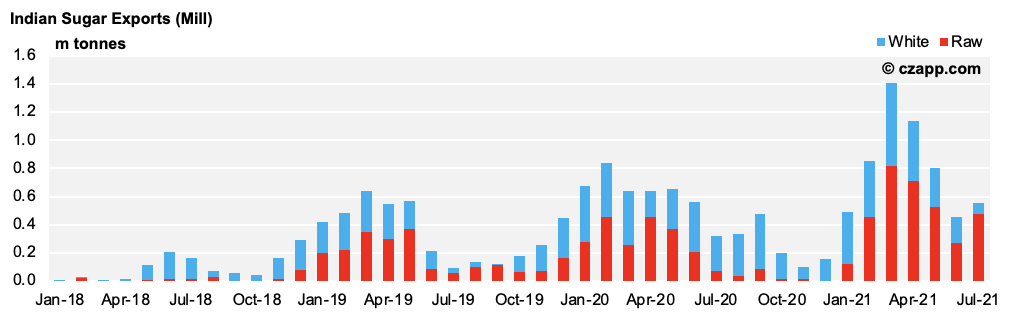

- India’s mills should export 475k tonnes of raw sugar in July, up 207k tonnes month-on-month.

- They should also export 80k tonnes of white sugar, down 105k tonnes month-on-month.

White Sugar Demand is Fading

- White sugar demand is fading, perhaps as COVID measures in places like Thailand, Malaysia and Indonesia have started to have a small on impact consumption.

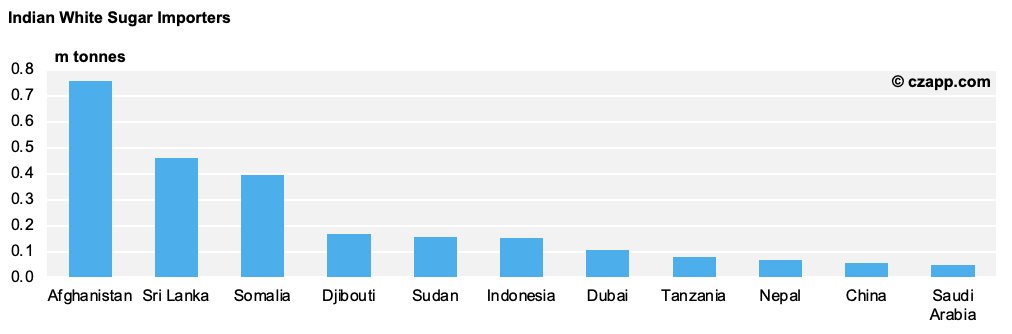

- Also, Somalia and Djibouti, two of India’s key destinations, have high stocks as they’ve already taken a lot of white sugar this year.

- Nevertheless, Somalia remains one of the top importers of Indian whites this season (393kmt), alongside Afghanistan (756kmt) and Sri Lanka (460kmt).

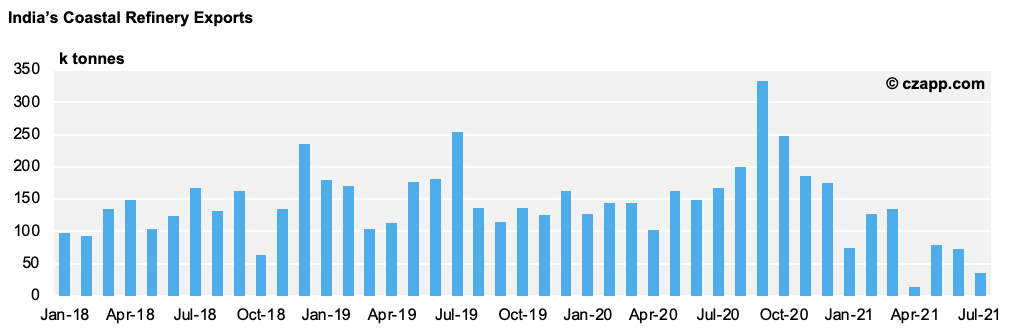

Coastal Refinery Buying Continues, But Exports Slow

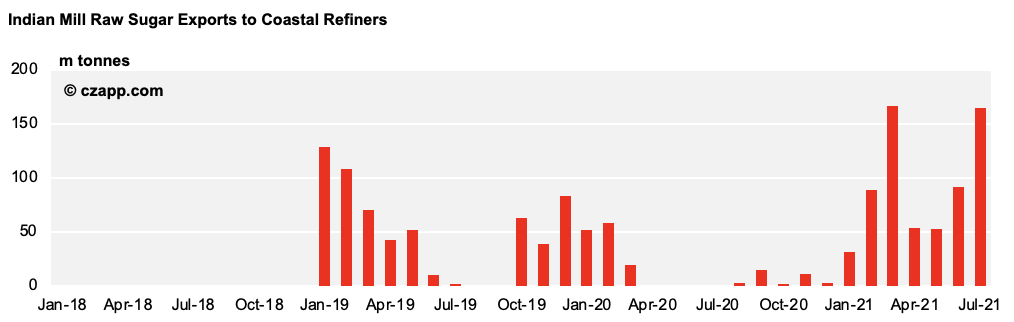

- 165k tonnes of Indian raws shipments to the coastal refineries have been nominated already far this month, marking their second strongest month on record.

- High freight costs mean Indian raws have a significant freight advantage over Brazilian supply.

- However, the coastal refineries’ export pace has been slow since April.

- This is largely due to the container shortage.

- Also, though, the re-export refiners have had to deal with tricky market conditions this year.

- The backwardated raws spreads earlier this year made raw sugar expensive, and today’s weakness in the white premium means refiners now have very little margin.

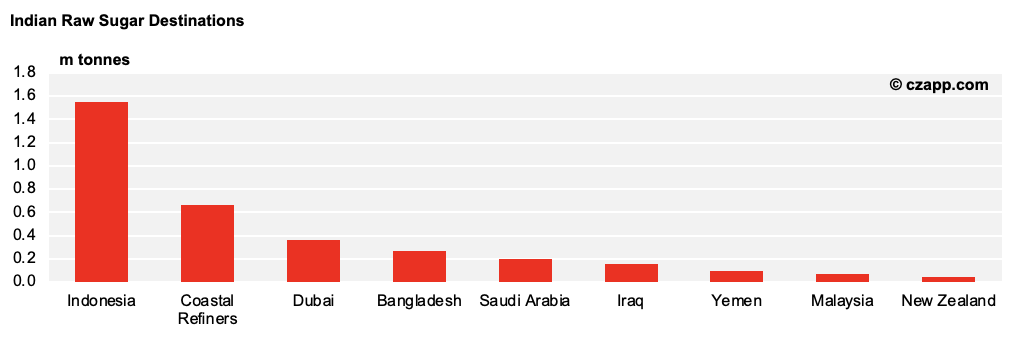

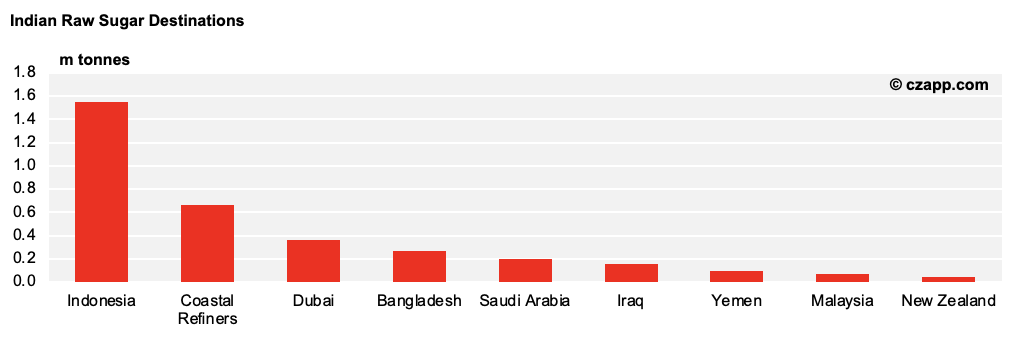

Where Are the World Market Buyers?

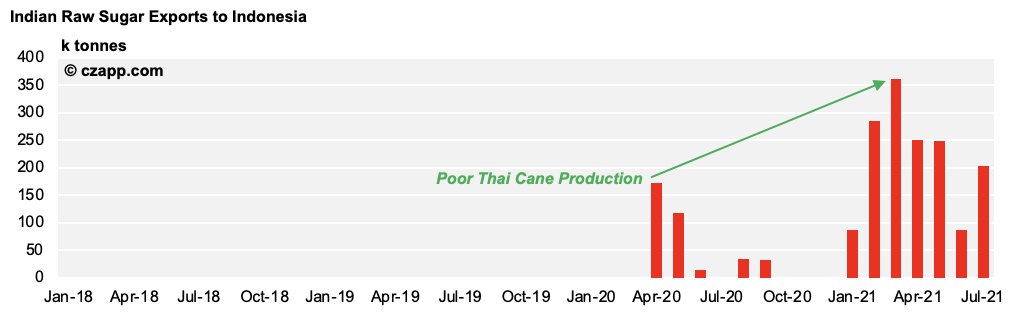

- Indonesia is still a key buyer of Indian raw sugar, with 203k tonnes already nominated for shipment this month.

- Indonesian demand has been so good this season as Thailand’s raws supply is at a 16-year low following two seasons of poor production.

- Indonesian demand has been so good this season as Thailand’s raws supply is at a 16-year low following two seasons of poor production.

- If the Thai cane crop rebounds next year, some of Indonesia’s demand should shift back towards Thailand.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…

- Czapp Explains: The Sugar Industry in Uttar Pradesh

- Czapp Explains: The Sugar Industry in Maharashtra and Karnataka

- Czapp Explains: Thailand’s Raw Sugar Industry