- India could receive a 7m tonne export subsidy next season.

- This should ensure there are enough exports to reduce India’s large domestic sugar stocks.

- Additionally, the minimum domestic selling price will increase from INR 31/kg (USD 424/mt) to INR 33/kg (USD 450/mt).

India Could Receive a 7m Tonne Export Subsidy

- India could receive a 7m tonne export subsidy next season.

- This is significantly larger than the market expected and will help reduce India’s high domestic sugar stocks.

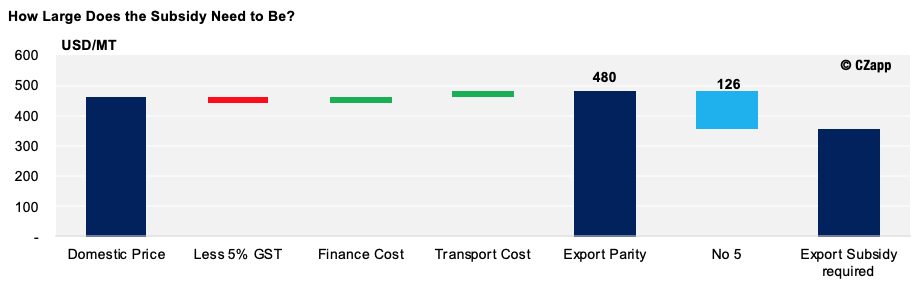

- India’s exporters require a subsidy between $106/mt (INR 7,900) to $126/mt (INR 9,390), otherwise domestic sales will be more profitable than world market exports.

- This is substantially lower than the INR 10,448 ($141) subsidy offered for 6m tonnes of exports over the 2019/20 season.

- A larger export subsidy will help India’s mills shift more of their sugar for much-needed cash after coronavirus devastated domestic consumption.

- We previously assumed that India would export 4.5m tonnes of sugar, but will now look to revise this higher, so long as the export subsidy is large enough.

India’s Sugar Stocks are High After Lockdown

- India suffered consumption losses of around 2m tonnes during lockdown due to the stark drop in out-of-home eating and drinking.

- During this period, India’s sugar stocks were left to build up, which weakened its domestic prices.

- India’s domestic prices will stay low until stocks reduce.

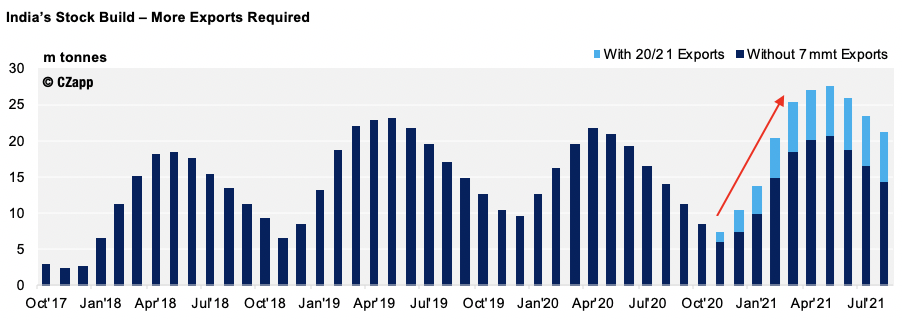

- Without a large export programme, India will carry a great deal of sugar into next year, meaning the repeated 4m tonne buffer stock target will be exceeded and depress domestic prices further.

- However, financing a large buffer stock is costly, especially now as India’s economy has been badly bruised by the pandemic.

- But with stocks currently over 25m tonnes, a 7m tonne export programme will help reduce domestic stocks and keep the buffer stock target at 4m tonnes.

What Does This Mean for the Wider Sugar Market?

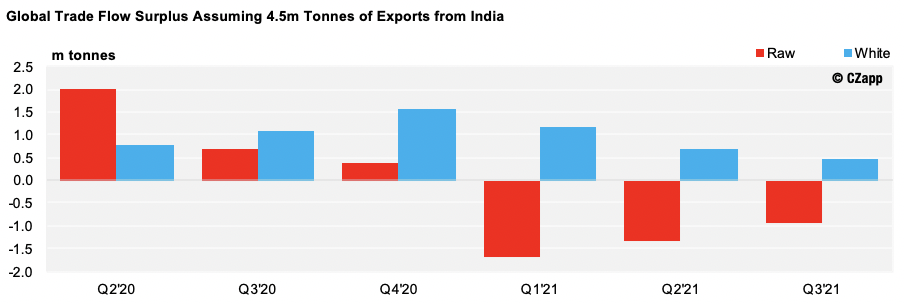

- Both the raw and white sugar markets are already oversupplied into next year, assuming India exports 4.5m tonnes of sugar.

- If a large enough subsidy is granted, this will push the sugar market into an even larger surplus.

- This will be especially significant for the whites, as Indian low-quality whites make up a large amount of the surplus.

Other Opinions You May Be Interested In…