Insight Focus

Global container volumes grew 6% in 2024. North America saw a 12% increase in imports, while the Far East accounted for 61% of global exports. Despite growth, geopolitical tensions and trade uncertainties continue to be a challenge.

Exports to India Subcontinent Surge

According to the CTS Annual Report, the container exports from Australasia and Oceania to the Indian Sub-Continent and Middle East saw remarkable growth in 2024. The specific trade lane skyrocketed by 34% compared to 2023 and 58% compared to 2022 with the majority of this growth being attributed to India, where imports have more than doubled from 2022 to 2024.

It is always intriguing to witness the rise of a new shipping powerhouse, and this is the narrative India aspires to shape in the coming years.

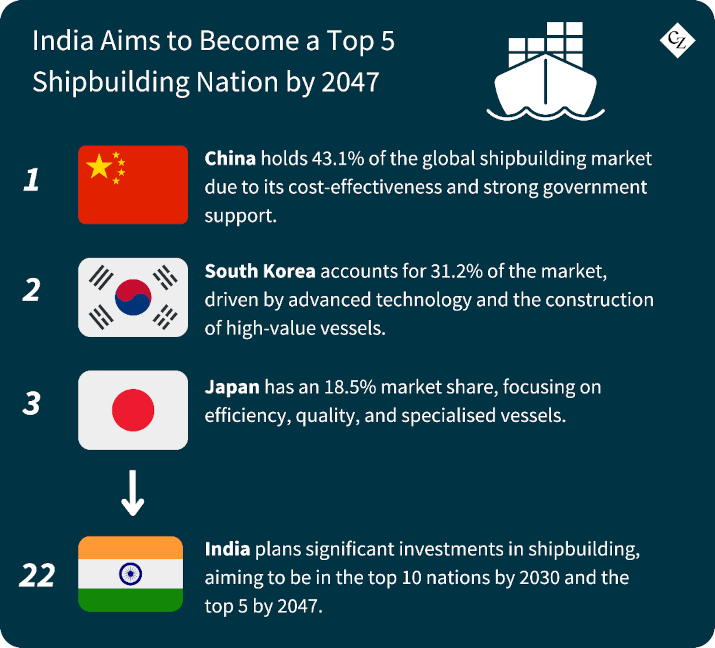

With an ambitious maritime plan, India aims to establish itself as a major player in global shipping by enhancing its shipping capabilities through the creation of a national container shipping line, enhancing control over international ports and terminals with a national operator for overseas facilities and significantly investing in its shipbuilding sector.

India is making strategic efforts to strengthen ties with global shipping players, such as Greek shipowners, openly inviting them to trust its shipyards and contribute to building the nation’s shipping profile. The country has set high ambitions — targeting a position among the top 10 shipbuilding nations by 2030 and the top five by 2047.

While India possesses all the essential prerequisites to become a prominent force in the shipping industry, achieving this vision will require patience, persistence, relationship-building, network development and consistent, robust investments.

Germany Misses Out on Global Growth

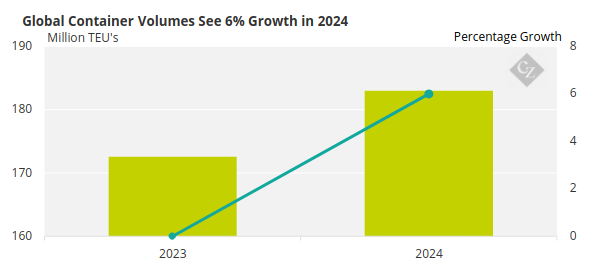

Elsewhere, global container volumes experienced a notable 6% growth in 2024 compared to the previous year, reaching over 183 million TEUs, according to Container Trade Statistics (CTS). A total of 183.2 million TEUs were lifted, with May, August and December each exceeding 16 million TEUs – the first time in history that three months in a single year hit this milestone.

The record-breaking performance of 2024 contrasts sharply with the more subdued volumes of 2023, which remained influenced by the post-Covid rush and stockpiling in 2022.

Source: CTS

Despite the overall positive outlook, not all countries experienced growth in 2024. Germany’s exports recorded the sharpest decline, dropping by 4% – a continuation of the negative trend from 2023, when exports fell by 3% compared to 2022. The decline was largely driven by reduced volumes to China.

However, this trend does not entirely align with the performance of Germany’s largest container port, the Port of Hamburg. The third busiest European container hub reported a modest 0.9% increase in overall container volumes and a 0.7% rise in box trade with China. While these results do not indicate a strong growth trend, they suggest a stabilisation rather than a downturn.

Far East, North America Outperform

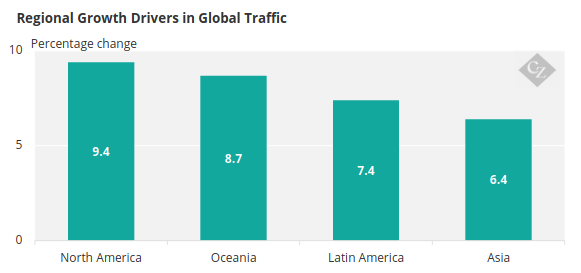

Generally, Far East exports were the highest-performing sector of the previous year, rising 8% compared to 2023 and 10% versus 2022. The region accounted for an impressive 61% of the global export mix, up from 59% the previous year.

Although the dry sector was the main driver of this performance, reefer volumes also posted strong results. In particular, Far East was the second largest reefer exporter after South and Central America, which continues to dominate the refrigerated cargo market.

As mentioned, the Far East’s dominant export growth to North America persisted, while shipments to Europe and the Indian Sub-Continent & Middle East also registered notable increases. Exports to Europe climbed 9% year-on-year, while those to the Indian Sub-Continent & Middle East surged 12% compared to 2023 and 35% from 2022.

Source: CTS

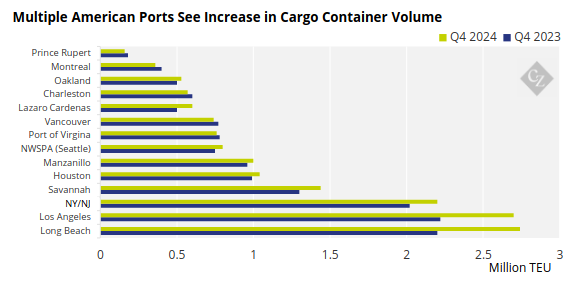

North America recorded the most substantial increase in the container import sector in 2024. With a growth of 12% year-on-year, North America, including the US and Canada, is rapidly narrowing the gap with Europe, while remaining third-largest regional importer globally.

Exports from the Far East to North America rose by 14%, with the ports of Los Angeles and Long Beach maintaining their critical role in facilitating these trade flows.

However, recent statements by Donald Trump regarding potential new tariffs on Chinese goods could impact Far East–US container traffic, posing fresh challenges for shipping stakeholders in the near future.

Source: CBRE

Uncertain Horizons Despite Record Volumes

In conclusion, 2024 was a highly successful year for global container volumes, driven by strong performances from two key regions in global trade – North America and the Far East. However, despite the impressive volume figures, the shipping industry continues to navigate a turbulent environment where uncertainty and unpredictability have become the new “normal”.

Geopolitical tensions, unstable global economy, tariff impositions and renewed trade war threats create a complex shipping landscape, requiring stakeholders to strike a delicate balance in finding the most efficient ways to conduct business. Adding to the industry’s uncertainty, February 2025 saw the long-anticipated restructuring of container shipping alliances after several years.

The new alliance formations are expected to generate significant interest, as the market closely watches their schedules, operational performance, and potential impact on both regional and global trade dynamics.