- India has already exported a record 7.5m tonnes of sugar so far this year.

- This is a 25% higher than the previous record, held in 2019, where it exported 6m tonnes of sugar.

- Most of this has gone to Iran, Afghanistan and East Africa (Sudan, Somalia, and Ethiopia).

India’s Yearly Sugar Exports Hit Record High

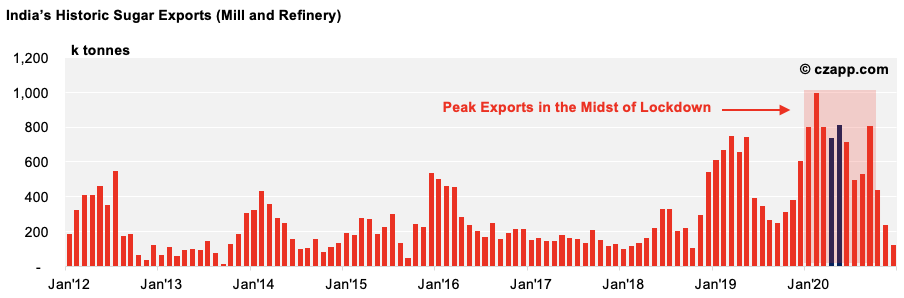

- India exported a record 7.5m tonnes of sugar this year, despite COVID lockdowns between March and May which restricted the movement of people and goods.

- During this period, India’s ports were put to the test but successfully exported close to 1m tonnes of sugar each month.

- All in all, India has exported 1.5m tonnes more sugar than it managed to in 2019, when no such restrictions existed.

Record Mill Exports

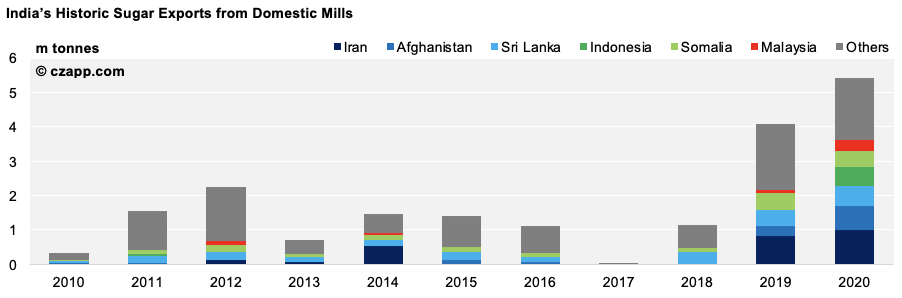

- The 2020 sugar export quota enabled Indian mills to export 5.4m tonnes this year.

- This meant Indian mills exported their surplus production and trumped last season’s exports by 1.4m tonnes.

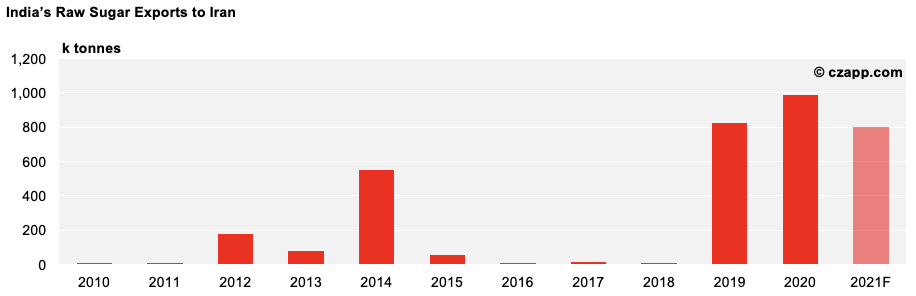

- Iran has been the main receiver through its bilateral trade deal with India (Iranian oil for Indian sugar).

- It has imported 987k tonnes of Indian raws, up 20% from last year, where it imported 823k tonnes.

- However, as we have written previously, this trade deal may not continue in 2021.

- Afghanistan has also imported a lot of Indian sugar this year; 705k tonnes in total (up 400k tonnes year-on-year).

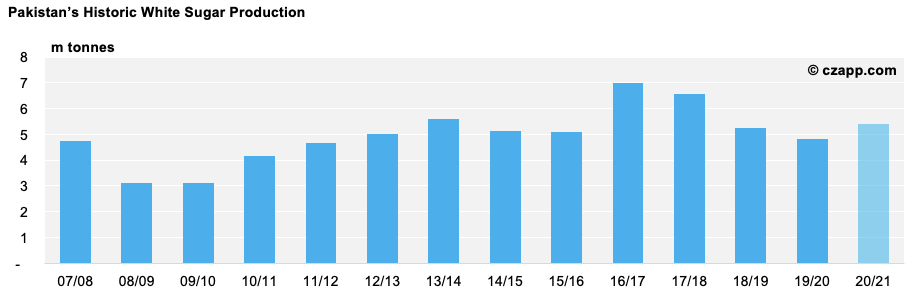

- This is because Pakistan, its usual supplier, suffered a sugar production shortfall.

- However, we think Pakistan will produce 5.4m tonnes of white and refined sugar this season, up from 4.8m tonnes in 2019/20.

- This is firstly because Pakistan was graced with the ideal amount of rain for cane development this year, but also because attractive cane prices meant cotton farmers switched to plant cane once again.

- With this, Afghanistan may turn back to Pakistan for its sugar supply in 2020/21, as it’s the cheaper of the two origins.

Largest Coastal Refinery Exports Since 2016

- Turning away from the mills, India’s coastal refineries have exported 2.03m tonnes of sugar so far this year, up 23k tonnes from last year’s total.

- The main offtaker has been Sudan, which has imported 806k tonnes alone.

- Other significant importers include Ethiopia, Somalia, and Indonesia, which have taken 200k tonnes, 109k tonnes and 100k tonnes respectively.

- We think this East African demand will continue next season, given Thailand’s limited export availability.

Other Opinions You Might Be Interested In…

- Thai Sugar Production Won’t Increase, Despite Larger Cane Crush

- Indonesia Reduces Raws Colour Requirements

- Pakistan: Cotton Farmers Plant Sugar Cane

- Market Talk: India-Iran Oil/Sugar Trade in Trouble?

- India Finally Confirms Sugar Export Subsidy