- India’s mills are exporting sugar without a subsidy.

- We therefore think India will export 6.5m tonnes of sugar this season.

- This is 500k tonnes higher than the subsidised volume.

India Approaches its Sugar Export Target

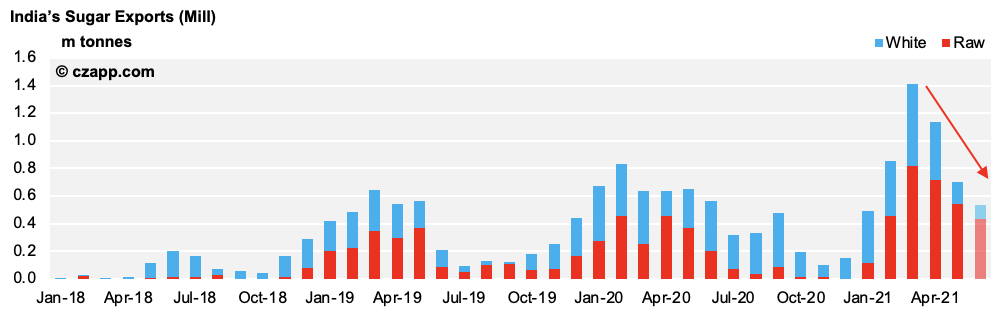

- 5.6m tonnes of Indian sugar has now been shipped (or nominated for shipment) this season.

- However, its pace of exports is beginning to slow.

- The mills supplied just 704k tonnes of sugar in May, down 434k tonnes month-on-month.

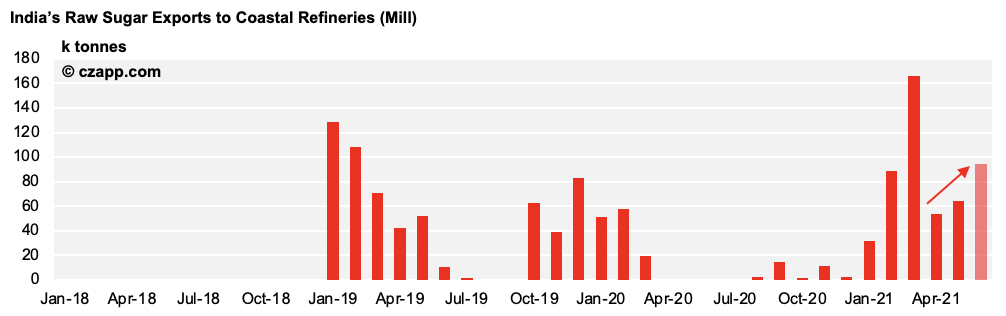

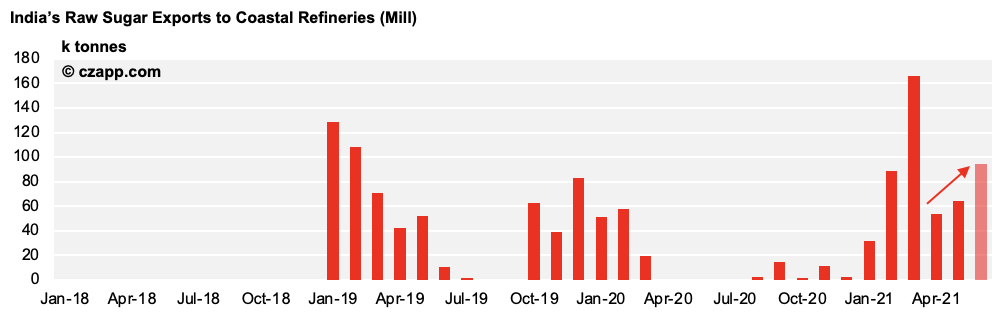

- As the Government has removed the export subsidy for uncontracted sugar, we think there’s about 200k tonnes of subsidised sugar left to ship.

- This means some mills are starting to sell raws without one.

- Most of this sugar should go to India’s coastal refineries as they enjoy cheaper freight, especially with today’s high bulk rates.

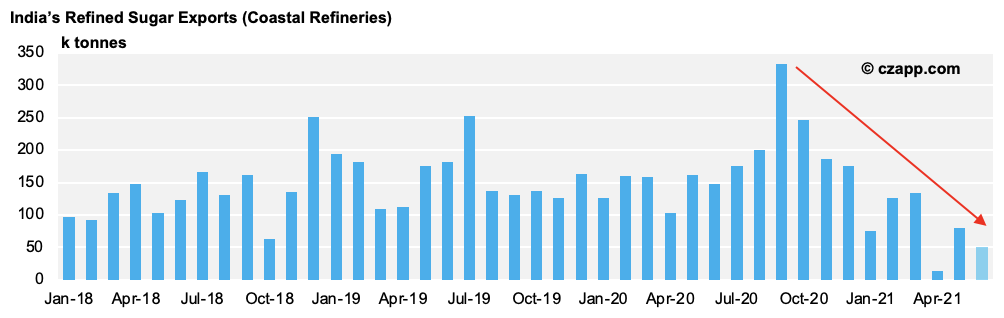

- So far this season, the coastal refineries have been slow to export, largely due to the global container shortage.

- They’ve also faced high prices and a backwardated raw sugar curve, which makes buying raws expensive.

- However, their pace should accelerate as they start to buy more Indian raws.

- So far this season, the coastal refineries have been slow to export, largely due to the global container shortage.

- They’ve also faced high prices and a backwardated raw sugar curve, which makes buying raws expensive.

- However, their pace should accelerate as they start to buy more Indian raws.

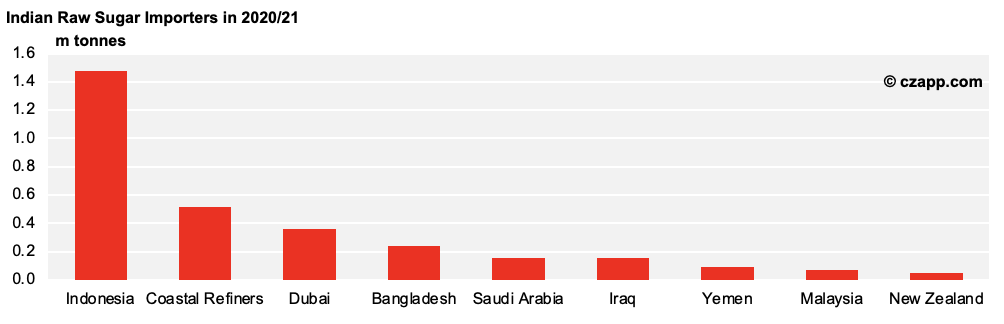

Where’s the Raw Sugar Going?

- Indonesia remains the largest buyer of Indian raws this season and has now imported 1.5m tonnes.

- Iran’s yet to import any Indian sugar, as talks between the two regarding their bilateral trade agreement (oil for sugar) continue.

- Last season, India exported 1.1m tonnes to Iran.

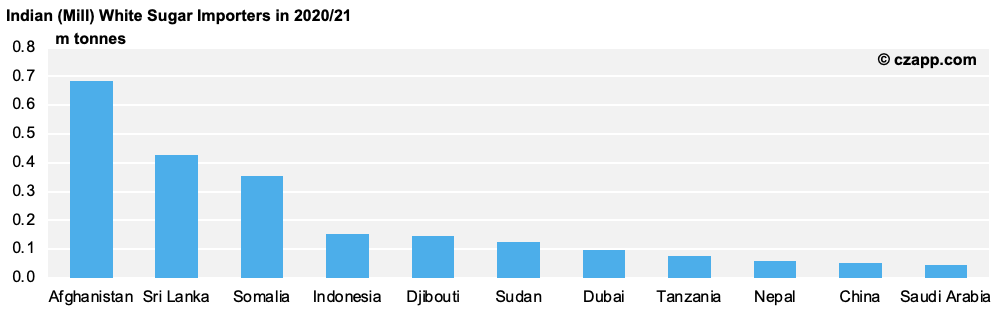

Where’s the White Sugar Going?

- Afghanistan (682k tonnes), Sri Lanka (427k tonnes) and Somalia (354k tonnes) remain the top buyers of Indian white sugar.

- Earlier in the season, these flows were disrupted by the container shortage, but we hope this issue is now diminishing.

Other Opinions You Might Be Interested In…

- Indonesia: The World’s Largest Raw Sugar Importer in 2021?

- Lowest Thai Refined Availability Since 2010/11

Explainers You Might Be Interested In…